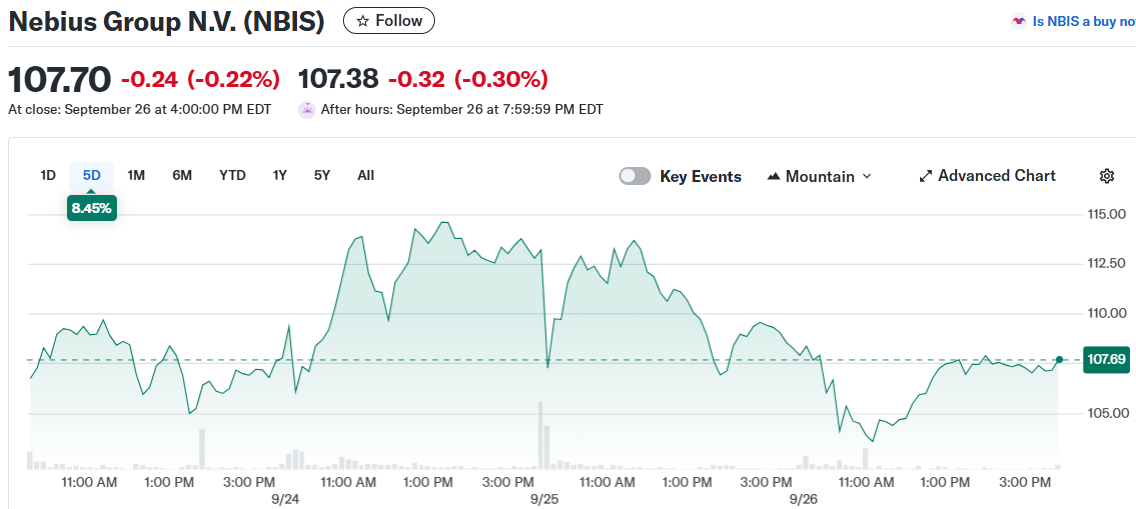

Nebius (NBIS) Skyrockets as Microsoft Partnership Ignites 168% Price Target Surge

Nebius stock explodes upward after sealing a transformative Microsoft deal that sent analysts scrambling to upgrade their projections.

The Cloud Computing Catalyst

Microsoft's strategic partnership with Nebius triggered an immediate market frenzy, pushing NBIS shares to unprecedented heights. Analysts across major firms simultaneously hiked price targets by 168%—one of the most aggressive upward revisions in recent tech memory.

Trading floors buzzed with activity as institutional investors piled into the suddenly-hot stock. The deal positions Nebius to leverage Microsoft's global cloud infrastructure, potentially disrupting the entire cloud services landscape.

Market analysts who'd previously dismissed Nebius as just another tech startup now call it 'the most compelling cloud play of the quarter.' Meanwhile, retail traders flooded social media platforms with celebratory posts and memes about their sudden paper gains.

Of course, Wall Street being Wall Street, the same analysts who missed this rally will now claim they saw it coming all along. The partnership represents a massive validation of Nebius's technology—and proves once again that in tech investing, sometimes the biggest opportunities emerge from deals nobody saw coming.

TLDR

- Nebius Group (NBIS) stock price target raised by Northland from $77 to $206, maintaining Outperform rating

- Company secured a deal with Microsoft, demonstrating competitive positioning in AI infrastructure market

- Nebius raised approximately $4.3 billion through Class A share offerings and convertible notes

- Revenue soared 625% year over year and 106% sequentially in Q2 2025

- Stock has surged nearly 470% over the past year, outpacing other AI companies

Nebius Group received a massive vote of confidence from analysts this week. Northland raised its price target on the AI cloud provider to $206 from $77. The firm maintained its Outperform rating on the stock.

The dramatic price increase comes after Nebius secured a contract with Microsoft. Northland credits the company’s cost advantages for winning the deal. The analyst firm sees this as proof of Nebius’ competitive position in the market.

JUST IN: $NBIS announces multi-billion dollar agreement with Microsoft for AI infrastructure. 🔥

Under this multi-year agreement, $NBIS will deliver dedicated capacity to Microsoft from its new data center in Vineland, New Jersey starting later this year.

Arkady Volozh, Founder… pic.twitter.com/VifW2fuReI

— M. V. Cunha (@mvcinvesting) September 8, 2025

Nebius operates primarily as an AI cloud platform provider. The company also runs two subsidiaries: autonomous vehicle technology developer Avride and education technology provider TripleTen. It holds stakes in database platform ClickHouse and AI data specialist Toloka.

CEO Arkady Volozh believes his company is one of only a few AI hyperscalers capable of meeting future infrastructure demands. The company is expanding rapidly to keep up with surging demand. Nebius plans to secure more than 1 gigawatt of power by the end of 2026.

Strong Financial Performance

The company’s financial results justify the analyst optimism. Revenue jumped 625% year over year in the second quarter. Sequential growth reached 106% from Q1 to Q2. These numbers far exceed the growth rates of competitors like Nvidia and CoreWeave.

Nebius has attracted several marquee customers beyond Microsoft. Cloudflare and Shopify use the company’s AI cloud services. The platform also serves emerging AI companies including HeyGen, Lightning.AI, and Photoroom.

The stock performance reflects this business momentum. Shares have surged nearly 470% over the past year. This outpaces the gains posted by Nvidia and other AI infrastructure companies.

Funding Secured for Expansion

Nebius recently completed a major fundraising effort. The company raised approximately $4.3 billion through multiple offerings. This included a public offering of 10.8 million Class A shares at $92.50 per share.

The company also closed a private offering of convertible senior notes. These notes mature in 2030 and 2032 with an aggregate principal of $3.16 billion. The convertible offering was upsized from an initial $2 billion to $2.75 billion.

These funds will support the company’s rapid expansion plans. Northland highlighted Nebius’ “world-class engineering capability” as a key strength. The analyst firm noted the company’s quick ramps and focus on virtualized infrastructure.

Northland increased its revenue projections for Nebius based on an expanded market outlook. The firm raised its AI-as-a-Service market estimate from $560 billion to $800 billion. It also increased Nebius’ projected market share from 3% to 9%.

The company currently trades at $26.9 billion in market value. Despite the high valuation, analysts see room for further growth. Northland named Nebius its top pick in the sector.

The Microsoft deal represents a validation of Nebius’ competitive advantages. The company’s cost structure and engineering capabilities helped secure the contract. This positions Nebius well for future deals with other major cloud customers.