Ethereum (ETH) Price Alert: Supply Crunch Intensifies as Whales Go on Buying Spree

Ethereum's supply dynamics just hit critical mass—whales are accumulating while available coins vanish from exchanges.

The Great ETH Drain

Exchange reserves plummet as institutional buyers and crypto whales snap up Ethereum at an unprecedented pace. The supply shock mirrors Bitcoin's 2020 trajectory but accelerates faster thanks to DeFi's insatiable yield demands.

Whale Watching Season

On-chain data reveals wallet addresses holding 10,000+ ETH added another 2% to their stacks this month alone. They're betting big on Ethereum's protocol upgrades outpacing regulatory headaches—because nothing says 'calculated risk' like nine-figure crypto positions.

Market Mechanics Tighten

With staking locks swelling and Layer 2 solutions hoarding ETH for gas, circulating supply gets squeezed from multiple angles. Traditional finance analysts still call it volatility—crypto natives call it basic supply-demand mathematics.

The irony? Wall Street spent decades perfecting stock buybacks while crypto whales mastered the art in five years—just without the shareholder lawsuits.

TLDR

- Ethereum exchange supply drops 52% to nine-year low of 14.8 million ETH, tightening market liquidity

- Analyst identifies critical liquidation risk at $3,700-$3,800 price level that could trigger forced selling

- Whales accumulated $1.73 billion worth of ETH (431,018 tokens) from major exchanges between September 25-27

- Three key support zones identified: $3,515 (1.38M ETH), $3,020 (2.65M ETH), and $2,772 (2.64M ETH)

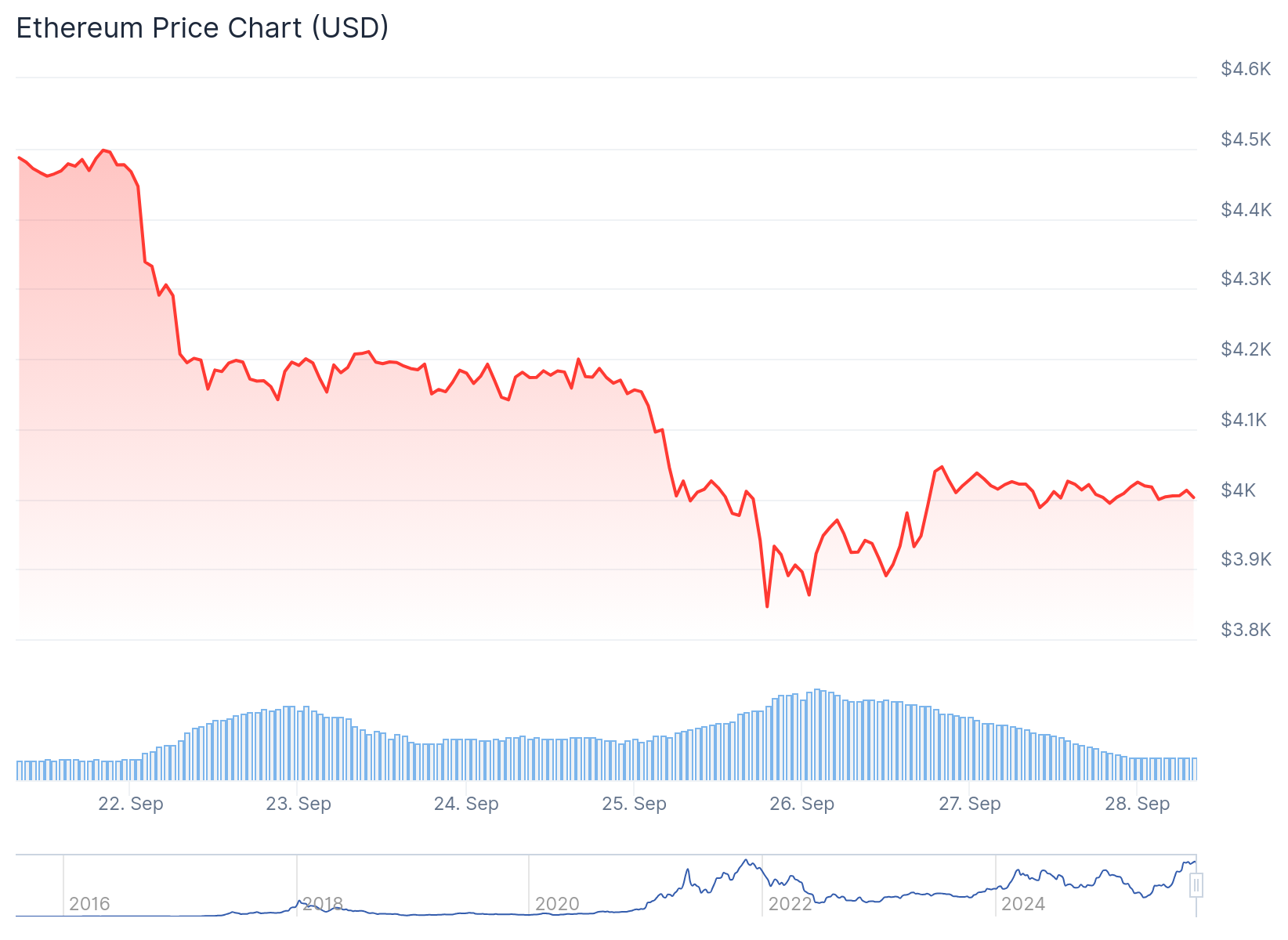

- ETH currently trades around $4,011, down 0.33% daily and 10% weekly

Ethereum exchange balances have dropped to their lowest level since 2016, falling 52% from peak levels to just 14.8 million ETH. This represents a decline from roughly 31 million ETH held on exchanges previously.

The supply reduction suggests investors are moving coins to staking contracts, cold wallets, and institutional custody solutions. The launch of ethereum staking ETFs has also increased demand for the cryptocurrency.

Data from Glassnode confirms these exchange balances are at nine-year lows. This tightening supply could make sudden price swings more likely when demand or selling pressure increases.

Liquidation Risks Mount at $3,700 Level

Crypto analyst Ted has identified growing liquidation risks around the $3,700 to $3,800 price zone. He warns this level could be tested again before Ethereum finds stability.

$ETH liquidity heatmap is showing decent long liquidations around the $3,700-$3,800 level.

This level could be revisited again before Ethereum shows any recovery. pic.twitter.com/SQTbfrujAa

— Ted (@TedPillows) September 27, 2025

If ETH drops below $3,700, large amounts of Leveraged positions may face liquidation. This could create a wave of forced selling pressure on the market.

The analyst’s liquidity heatmap shows decent long liquidations clustered around the $3,700-$3,800 range. This level represents a critical support that bulls need to defend.

According to TradingView data, ETH currently trades at $4,011. The price is down 0.33% in the past 24 hours and more than 10% over the past week.

The cryptocurrency briefly dipped below $3,980 during the session before recovering. However, it remains under its recent close of $4,034.

Major Accumulation Activity

Despite market volatility, whale activity shows strong institutional interest. Between September 25 and 27, sixteen wallets purchased 431,018 ETH worth $1.73 billion total.

Whales keep accumulating $ETH!

16 wallets have received 431,018 $ETH($1.73B) from #Kraken, #GalaxyDigital, #BitGo, #FalconX and #OKX in the past 3 days.https://t.co/0DPxgZMGN7 https://t.co/xtPLBKo9LZ pic.twitter.com/oEXZKIErmr

— Lookonchain (@lookonchain) September 27, 2025

These large purchases came from major exchanges including Kraken, Galaxy Digital, BitGo, FalconX, and OKX. The scale shows institutional buyers are positioning during the current pullback.

Earlier whale activity also saw $204 million worth of ETH accumulated by large holders. This pattern suggests deep-pocketed investors remain bullish despite price weakness.

The buying activity contrasts with potentially cautious retail sentiment. However, whale and institutional demand appears to remain strong.

Glassnode data analyzed by Ali reveals three critical support zones based on historical accumulation. The first level sits at $3,515, where over 1.38 million ETH changed hands.

Three support levels to watch for Ethereum $ETH: $3,515, $3,020, and $2,772. pic.twitter.com/M6UiTUGvjz

— Ali (@ali_charts) September 27, 2025

This represents the first line of defense for bulls and could provide a bounce if tested. The level shows short-term buying interest from traders.

The strongest support cluster appears at $3,020, where approximately 2.65 million ETH were transacted. This zone has the highest concentration of buyers and represents a make-or-break point.

If deeper selling occurs, the final support lies at $2,772. This level is backed by around 2.64 million ETH in historical accumulation data.

The support zones represent real trading activity where investors accumulated positions. This gives them significance as potential bounce levels during selloffs.

Holding above $3,500 could see ETH push toward $4,000 as confidence returns. Breaking below $3,515 WOULD likely lead to a test of the $3,020 critical zone.