Palantir (PLTR) Stock: Bank of America Raises Target to $215 After Record $1 Billion Quarter

Bank of America just dropped a bombshell on Palantir—hiking their price target to $215 after the data analytics firm smashed through the $1 billion quarterly revenue barrier.

The Big Money Bet

Wall Street's waking up to what crypto investors have known for years—data is the new oil, and Palantir's drilling at record pace. That $215 target represents serious institutional conviction, the kind that moves markets.

Breaking Down the Numbers

$1 billion in quarterly revenue isn't just a number—it's a statement. While traditional finance firms are still figuring out their digital transformation strategies, Palantir's executing at scale. The timing couldn't be more perfect as enterprises scramble for AI and data solutions.

What This Means for Tech

Palantir's success signals a broader shift—companies that leverage data effectively are pulling away from the pack. It's the same pattern we see in crypto: infrastructure plays outperforming during adoption phases.

The Cynical Take

Of course, Wall Street analysts are always late to the party—they're raising targets after the stock already ran. Typical finance herd mentality, always chasing rather than leading.

Bottom line: When traditional institutions start recognizing tech value at these levels, you know the transformation is real. Palantir's quarter just rewrote the rulebook for enterprise software valuations.

TLDR

- Palantir reported $1 billion quarterly revenue, beating estimates by $60 million with 48% year-over-year growth

- Operating income jumped 83% to $464 million while free cash flow more than tripled to $569 million

- Bank of America raised price target from $180 to $215, projecting commercial sales could hit $10 billion by 2030

- Company raised full-year guidance to $4.1-4.2 billion revenue from previous $3.9 billion forecast

- Stock trades at 240 times earnings with Boeing joining as newest Fortune 500 client

Palantir Technologies delivered another strong quarter that has analysts buzzing about the data analytics company’s AI-driven future. The Denver-based firm reported second-quarter revenue of $1 billion, easily beating analyst estimates of $940 million.

This represents a robust 48% jump compared to the same period last year. The company continues to capitalize on surging demand for artificial intelligence solutions across government and commercial sectors.

Operating metrics told an even more compelling story. Operating income surged 83% to $464 million from the previous year. Free cash FLOW performance was particularly impressive, more than tripling to $569 million during the quarter.

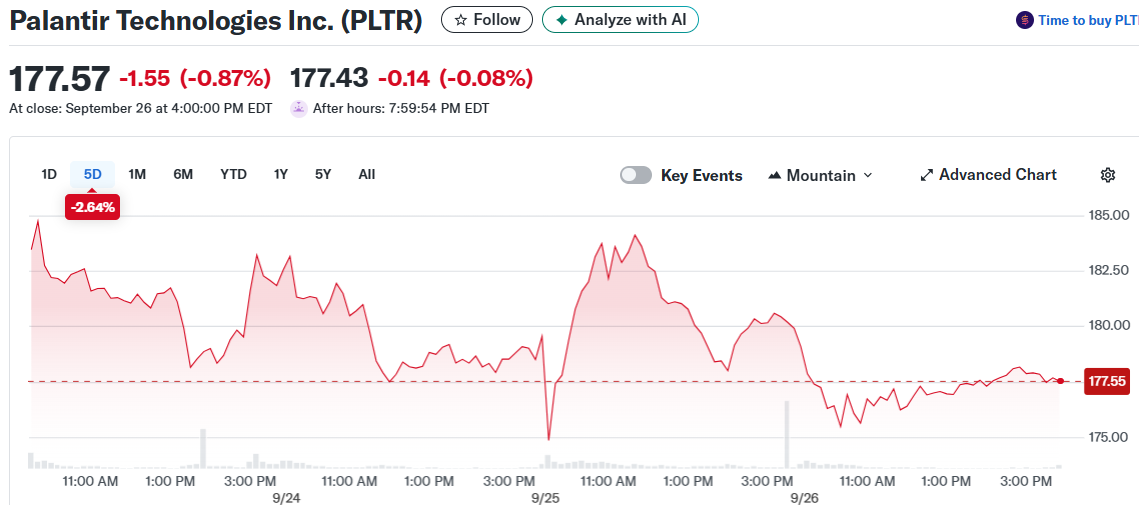

The strong results sent PLTR shares up 4.6% in after-hours trading. Palantir ended the period with $5.8 billion in net cash, providing substantial financial flexibility for future investments.

Management expressed growing confidence by raising expectations across multiple timeframes. For the upcoming quarter, Palantir projects revenue of $1.1 billion with operating income NEAR $495 million.

Revenue Guidance Gets Major Upgrade

The full-year outlook received a boost as well. Palantir now expects $4.1 to $4.2 billion in revenue for 2025, up from the previous guidance of $3.9 billion.

This marks the latest in a series of guidance increases. Demand for AI-powered analytics continues exceeding internal projections. The company’s ability to consistently raise forecasts has become a hallmark of its recent performance.

Palantir’s competitive advantage stems from its sophisticated technology stack. The company’s “ontology framework” connects fragmented data sources and makes them usable in real time.

Once organizations adopt Palantir’s systems, switching becomes extremely difficult. The data insights become too valuable to abandon, creating sticky revenue streams that benefit long-term growth.

Bank of America Sees Massive Commercial Potential

The investment bank expects commercial sales could exceed $10 billion by 2030. Revenue growth rates of 41% in 2026 and 39% in 2027 support this aggressive forecast.

Boeing recently joined Palantir’s growing commercial customer base, selecting Foundry for defense projects. The aerospace giant adds another Fortune 500 name to the company’s expanding portfolio.

The average spending by Palantir’s top 20 clients reached $75 million over the past 12 months. This represents a 30% increase from the previous year, demonstrating deepening customer relationships.

The company’s U.S. commercial business grew 93% year-over-year and 20% sequentially. U.S. government business grew 53% year-over-year and 14% sequentially, showing broad-based momentum across both key segments.