Crypto Market Plunge 2025: 3 Top Coins to Dominate the Dip

Digital assets tumble as September volatility hits historic levels—traders scramble for defensive positions while smart money eyes entry points.

Bitcoin's 30% correction from its 2025 peak signals broader market stress, but seasoned investors recognize these bloodbaths as generational buying opportunities.

Ethereum's infrastructure dominance remains unshaken despite price fluctuations. The merge completion continues driving institutional adoption while defi protocols show unprecedented resilience.

BNB's ecosystem integration creates natural buy pressure during downturns. Exchange revenue models and chain utility provide fundamental support missing from pure speculative assets.

Remember: Wall Street still can't tell the difference between a blockchain and a bicycle chain—their panic is your profit window.

Why Is the Crypto Market Crashing This Week?

Looking at this week’s sell-off, several forces are ganging up to hammer crypto prices. First up: a massive leverage flush wiped out more than $1.7 billion in long positions on Monday. When you’ve got that many traders betting on higher prices at elevated levels, once the liquidations start, they don’t stop.

As a result, Bitcoin dropped to nearly $111,000 yesterday, ethereum briefly dipped below $4,000 today, and the rest of the market followed suit. Macro nerves aren’t making conditions any better. Traders are sweating the upcoming U.S. PCE inflation data and trying to predict if the Fed will continue cutting rates or not.

When macro uncertainty ramps up like this, liquidity just evaporates. Plus, spot ETF inflows have cooled off big time, removing that consistent buy pressure that helped fuel BTC and ETH’s rallies.

Then there’s derivatives positioning. Funding rates flipped negative across major exchanges, meaning shorts were the dominant force. That makes it challenging for the bulls to mount any real comeback until things rebalance.

Throw in U.S. political drama around a potential government shutdown weighing on the financial markets, and you’ve got a perfect storm of negative catalysts. That helps explain why crypto is getting hammered this week.

3 Best Coins to Buy as the Crypto Market Crashes

While most of the market is getting pummeled, a few projects are actually holding up well. Here are three of the best coins showing surprising strength that could beat this dip:

1. Bitcoin Hyper (HYPER)

Bitcoin Hyper (HYPER) is shaping up as one of the most ambitious Bitcoin scaling solutions we’ve seen in years. It’s the first ZK-rollup Layer-2 built specifically for Bitcoin – designed to transform it from a passive hold into a base for high-speed payments and smart contracts.

By integrating Solana’s Virtual Machine, bitcoin Hyper inherits that blazing speed and developer ecosystem while staying anchored to Bitcoin’s security. The result is tens of thousands of transactions per second, minimal fees, and full support for DeFi, NFTs, even meme coins – all backed by Bitcoin’s security.

The ongoing HYPER presale has already raised over $18.1 million, with staking rewards offering a 65% APY for early buyers. Weekly dev updates and external audits (from Coinsult and SpyWolf) have given it more credibility than most new launches typically receive.

Even big-name crypto YouTubers, like Borch Crypto, have begun to discuss Bitcoin Hyper. With October historically being crypto’s comeback month, now is the ideal time to add HYPER to your watchlist. Visit Bitcoin Hyper Presale.

2. MYX Finance (MYX)

MYX Finance (MYX) offers perpetual futures without the typical headaches associated with centralized platforms. Their “Matching Pool Mechanism” directly pairs longs and shorts, eliminating slippage and keeping leverage trades (up to 50x) smooth and efficient.

Built on Linea for speed and low costs, it’s fully permissionless and community-run – and even has backing from big names like Sequoia, Consensys, and Hack VC. That’s a key reason why MYX has been on such a solid run lately.

With a 1,000% rally in early September followed by another surge after the V2 upgrade, MYX has been one of the top-performing altcoins this month. Even though it has sold off in the past week, it’s still showing stronger resilience than most, making it another token to consider investing in.

3. Best Wallet Token (BEST)

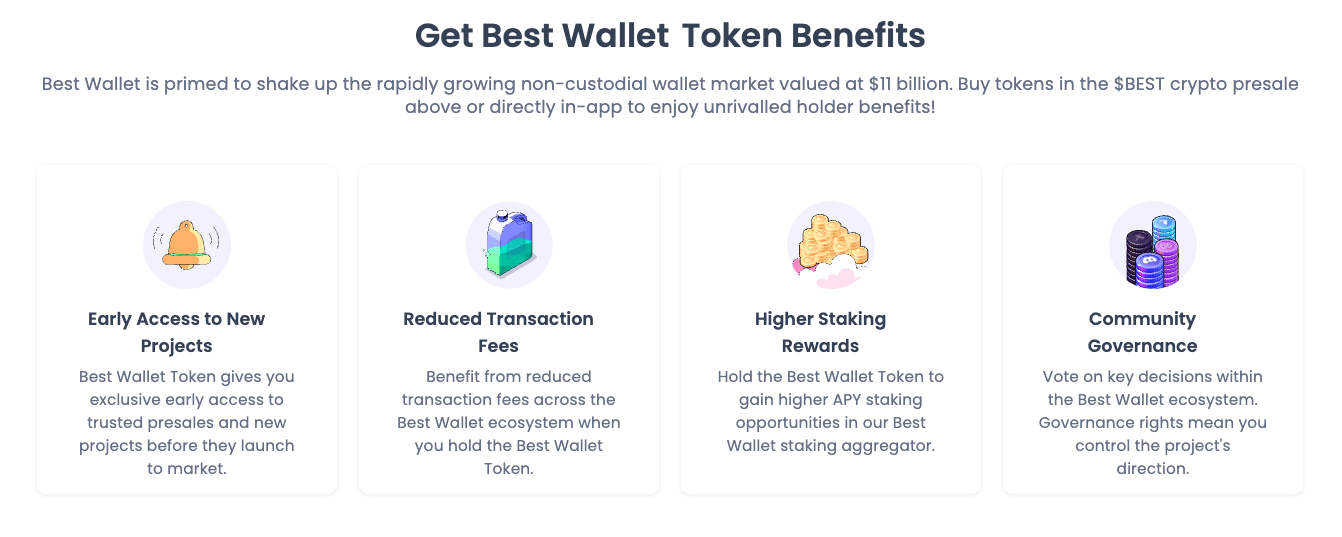

Best Wallet Token (BEST) powers one of the fastest-growing non-custodial wallets around, with over a million downloads already. It’s a multi-chain platform supporting 1,000+ assets across 60+ networks, complete with fiat on-ramps, cross-chain swaps, and advanced MPC security.

A native DEX is coming soon, pushing it toward that “super app” territory everyone talks about but few actually deliver. And since you don’t need to complete KYC checks to use Best Wallet, you get a completely private experience.

The BEST token sits at the center of everything. Holders get up to 50% fee discounts, staking yields estimated at 82% APY, governance rights, and exclusive access to vetted presales inside the Upcoming Tokens portal.

Best Wallet’s ongoing presale has already raised $16 million, with a DEX listing expected before the end of the year. So, with real utility, a live product, and solid fundraising momentum, BEST looks positioned to break out even while the broader market struggles.

Visit Best Wallet Token Presale.