Bitcoin Could Soar to $160,000 According to Top Crypto Analyst Willy Woo

Bitcoin's next parabolic move might just shock traditional finance.

Willy Woo's $160,000 prediction isn't just hopeful thinking—it's based on network fundamentals that Wall Street still ignores. The analyst's track record gives this forecast serious weight.

Why This Time Is Different

Unlike 2017's retail frenzy, this cycle sees institutional adoption actually happening. Real money flows through Bitcoin's veins now.

The Technical Backbone

On-chain metrics suggest accumulation patterns mirroring previous bull markets. Woo's models account for both price action and network health—something most analysts miss.

Traditional finance keeps waiting for Bitcoin to fail while it quietly builds momentum toward six figures. Maybe they're too busy counting their 2% bond yields to notice.

Whether Woo's prediction hits or misses, one thing's clear: dismissing Bitcoin at these levels could be the most expensive mistake of 2025.

TLDR

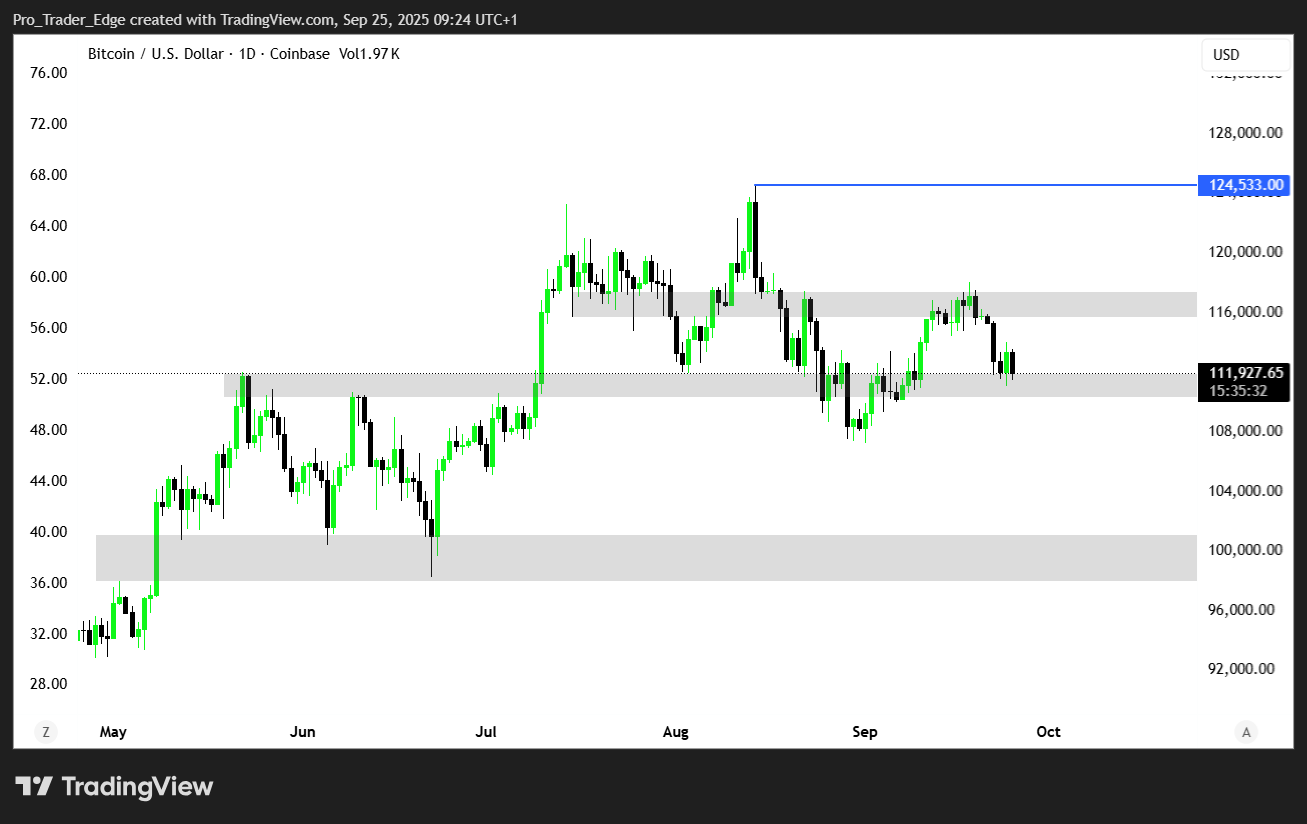

- Bitcoin analyst Willy Woo updates price target to $140,000-$160,000 after Bitcoin’s all-time high of $124,457 in August

- Bitcoin called “canary in the coal mine” due to high sensitivity to global liquidity conditions

- Current investor fundamentals in make-or-break zone with potential recovery if investors return within three weeks

- Altcoin season faces challenges from competition with crypto ETFs and treasury stocks on Wall Street

- FTX plans to pay $1.6 billion to creditors on September 30, potentially boosting altcoin market momentum

Popular on-chain analyst Willy Woo has revised his Bitcoin price predictions during a recent appearance on TheStreet Roundtable. The crypto expert shared updated forecasts and market insights after Bitcoin reached new heights earlier this year.

WATCH: In a conversation with Scott Melker, Willy Woo warns Bitcoin ( $BTC) looks weaker structurally, “canary in the coal mine."@scottmelker | @woonomic | #CryptoMarket | #Bitcoin pic.twitter.com/5RdqyH4UvA

— Roundtable Network (@RTB_io) September 24, 2025

Bitcoin hit an all-time high of $124,457.12 on August 14, marking a major milestone for the leading cryptocurrency. However, the digital asset has experienced a downturn since reaching this peak price level.

Woo described bitcoin as the “canary in the coal mine” among global macro assets. He explained that Bitcoin shows the highest sensitivity to liquidity changes in the broader financial system.

The analyst believes Bitcoin could climb to a range between $140,000 and $160,000 in the current cycle. However, he acknowledged uncertainty about the exact timing of such price movements.

Current market conditions present a critical juncture for Bitcoin investors. WOO stated that underlying investor fundamentals are now in a “make-or-break zone” that will determine future price direction.

Despite current challenges, Woo remains optimistic about potential recovery scenarios. He suggested the market could bounce back if investors return to Bitcoin within the next three weeks.

The analyst previously made bullish predictions for Bitcoin in 2021. Speaking at SALT Talks on April 29, 2021, Woo projected Bitcoin could reach $250,000 to $300,000 by the end of that cycle.

Whale Activity and Treasury Movement

Market dynamics have shifted as large holders adjust their positions. Some whales who sold Bitcoin around the $120,000 level may have moved funds into treasury companies and traditional stock markets.

Woo described this strategy as “playing chicken” with market timing. Capital continues flowing into Bitcoin, but volumes remain modest compared to previous bull market cycles.

The reduced capital inflows become apparent when comparing current market capitalization growth to historical patterns. This trend suggests institutional adoption may be proceeding at a slower pace than earlier cycles.

Altcoin Market Faces New Challenges

The current cycle has not produced a traditional altcoin season yet. Woo addressed questions about whether alternative cryptocurrencies will experience their typical surge period.

Altcoins now compete directly with crypto exchange-traded funds and treasury stocks available on Wall Street. This competition has limited the flow of capital into smaller digital assets.

Recent momentum has favored ethereum and Solana over the past month. However, Woo admitted this activity falls short of previous altcoin boom periods.

The presence of a solana ETF and crypto treasury stocks shows buyer demand exists. Yet most other coins remain stuck without clear upward momentum.

FTX plans to distribute $1.6 billion to creditors on September 30. This liquidity injection could potentially trigger renewed interest in alternative cryptocurrencies.

The payout represents $300 million less than initial projections. Market participants will monitor whether this reduced amount affects potential altcoin season timing.

Current Altcoin Season Index readings show 74 out of 100, indicating favorable conditions for altcoin gains. However, reduced payment amounts may limit the expected market impact.