Solana (SOL) at $200: Smart Money Floods In - Will the Critical Support Level Hold?

Solana's $200 line becomes the crypto world's high-stakes poker table as institutional players place their bets.

WHALES ARE CIRCULING

Blockchain analytics reveal sophisticated investors accumulating SOL positions while retail traders watch nervously. The $200 support level isn't just technical analysis—it's becoming a psychological battleground for market sentiment.

THE PRESSURE COOKER

Trading volume patterns suggest institutional accumulation typically precedes major price movements. When smart money moves this conspicuously, they're either seeing something others miss or creating a narrative that serves their positions—because in traditional finance, they'd call this insider trading, but in crypto, it's just Tuesday.

MAKE OR BREAK MOMENT

All eyes remain locked on whether Solana can defend this crucial threshold. The next price swing could determine whether we're witnessing strategic accumulation before a breakout or the calm before a liquidation storm.

TLDR

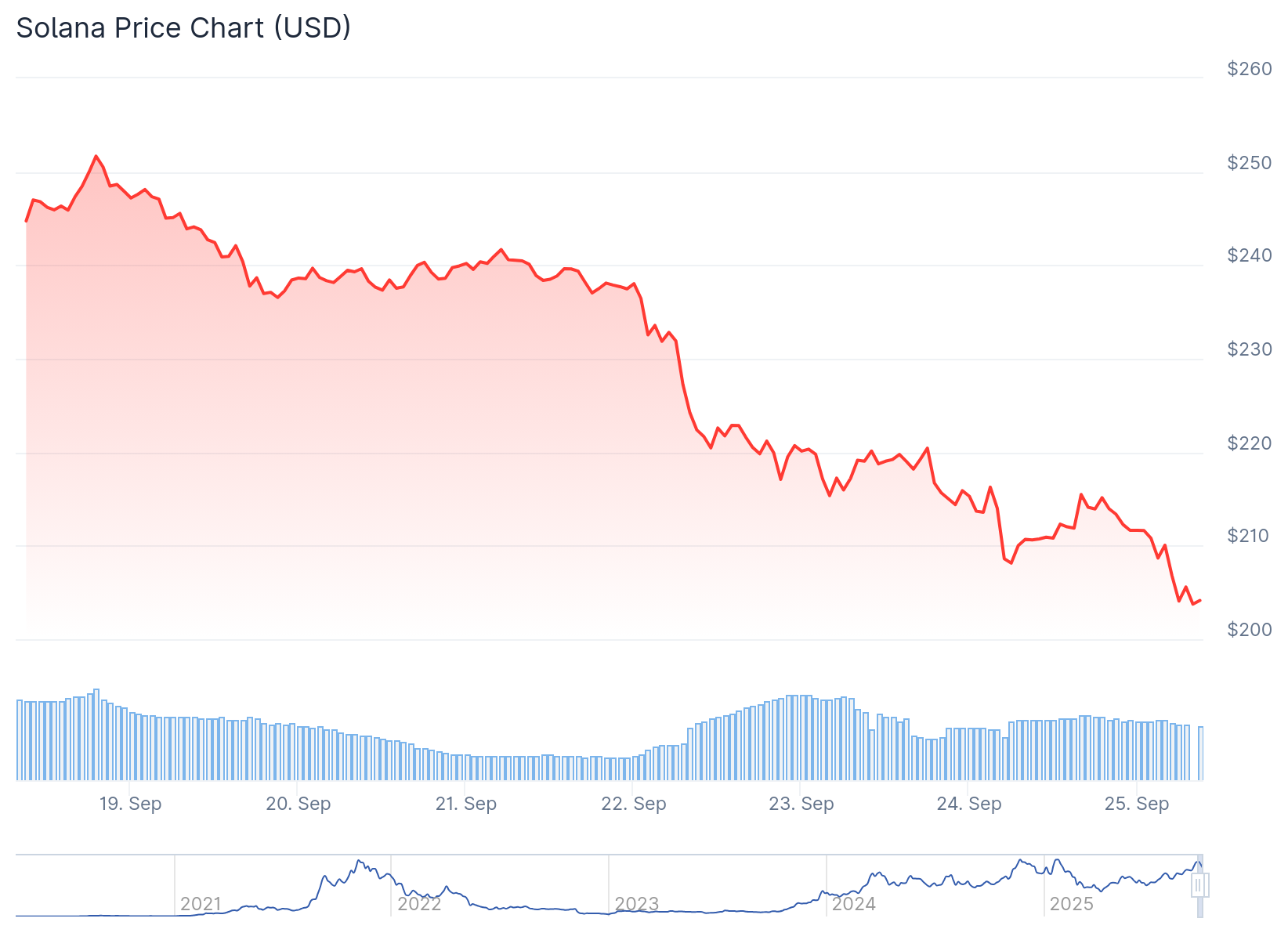

- Solana dropped over 10% this week, trading just above $210 with $200 as next crucial support level

- Technical analysis shows 50-day EMA at $206 as immediate support, with potential decline to $193 if broken

- Memecoin activity fell from 60% to under 30% of DEX volume, lowest since February 2024

- Stablecoin trading now represents 58% of DEX volume as network matures beyond speculation

- Institutional backing continues with major treasuries purchasing billions in SOL tokens

Solana has entered a sharp correction phase, dropping from recent highs to trade just above $210. The cryptocurrency fell over 10% this week and another 3% today, putting pressure on key support levels.

The $200 mark has emerged as the next crucial test for SOL. Market participants are bracing for further losses due to the speed of the decline, which increases the likelihood that this psychological level may not hold.

From a technical perspective, the 50-day exponential moving average at $206 represents the final immediate support. If solana fails to stabilize at this level, the decline could accelerate toward the 100-day EMA around $193.

This deeper support level corresponds with a wider retracement zone. A clear break below $193 could subject SOL to a lengthy correction, with potential targets in the $180 region.

Market sentiment remains mixed based on volume profiles. Selling activity has dominated recent sessions but has not yet reached capitulation levels.

Memecoin Activity Declines Sharply

The network is experiencing a major shift in trading patterns. Memecoin activity, which once represented over 60% of Solana’s DEX volume in late 2024 and early 2025, has dropped to under 30%.

This marks the lowest share since February 2024. The decline followed the launch of OFFICIAL TRUMP and Melania memecoins, which preceded a series of rug pulls and project collapses.

Daily DEX users have fallen from a peak of 4.8 million in January to below 800,000 by September. This retreat in speculative activity has coincided with Solana’s current price struggles.

Stablecoins Fill the Gap

Stablecoin trading has stepped in to replace memecoin speculation. Swaps between SOL and stablecoins now represent nearly 58% of DEX volume, the highest level since November 2023.

Solana’s stablecoin ecosystem has grown to more than $12 billion, up from $5 billion at the start of the year. This growth indicates the network is maturing beyond its memecoin boom phase.

The shift toward stablecoins reflects increased institutional adoption. Traders are using these assets for hedging, payments, and institutional strategies rather than pure speculation.

Pantera Capital recently purchased billions of SOL tokens at high average prices, setting a new floor on the chart. These institutional moves have provided some support despite the recent decline.

Solana’s total value locked grew 0.30% over the past month while Ethereum’s TVL dropped more than 7%. The network continues to average more than $5 billion in daily DEX and on-chain volume.

The RSI indicator sits at 44, showing cooling momentum without reaching oversold conditions. The MACD is tilting slightly bearish, reflecting the current downward pressure.

Bulls need to reclaim the $221 level to turn the trend back in their favor. Until then, the prevailing outlook remains bearish with the path of least resistance pointing lower.

If SOL holds the $200-$210 support zone, analysts see potential for a MOVE toward $295. A breakout from that level could target the $400 range that some analysts have projected.