Crypto Tumbles: Unpacking Today’s Market Downturn

Digital assets face headwinds as market sentiment shifts abruptly.

Regulatory Pressure Mounts

Global financial watchdogs tighten scrutiny on cryptocurrency exchanges, triggering institutional sell-offs. The FSA's latest compliance demands ripple across Asian trading hubs.

Technical Breakdown Accelerates

Key support levels crumble as leveraged positions get liquidated. Bitcoin's failure to hold critical moving averages sparks domino-effect selling across altcoins.

Macroeconomic Shadows Loom

Traders pivot to safe-haven assets amid renewed inflation concerns. Traditional finance veterans couldn't resist tweeting 'I told you so' as correlation with tech stocks resurfaces.

Market Structure Shows Cracks

DeFi protocols see outflows while derivatives markets indicate heightened fear. The perpetual funding rate flip signals growing bearish positioning among whales.

This volatility underscores crypto's adolescent phase—old enough to attract Wall Street's attention, but still prone to throwing tantrums when macroeconomic curfews hit.

TLDR

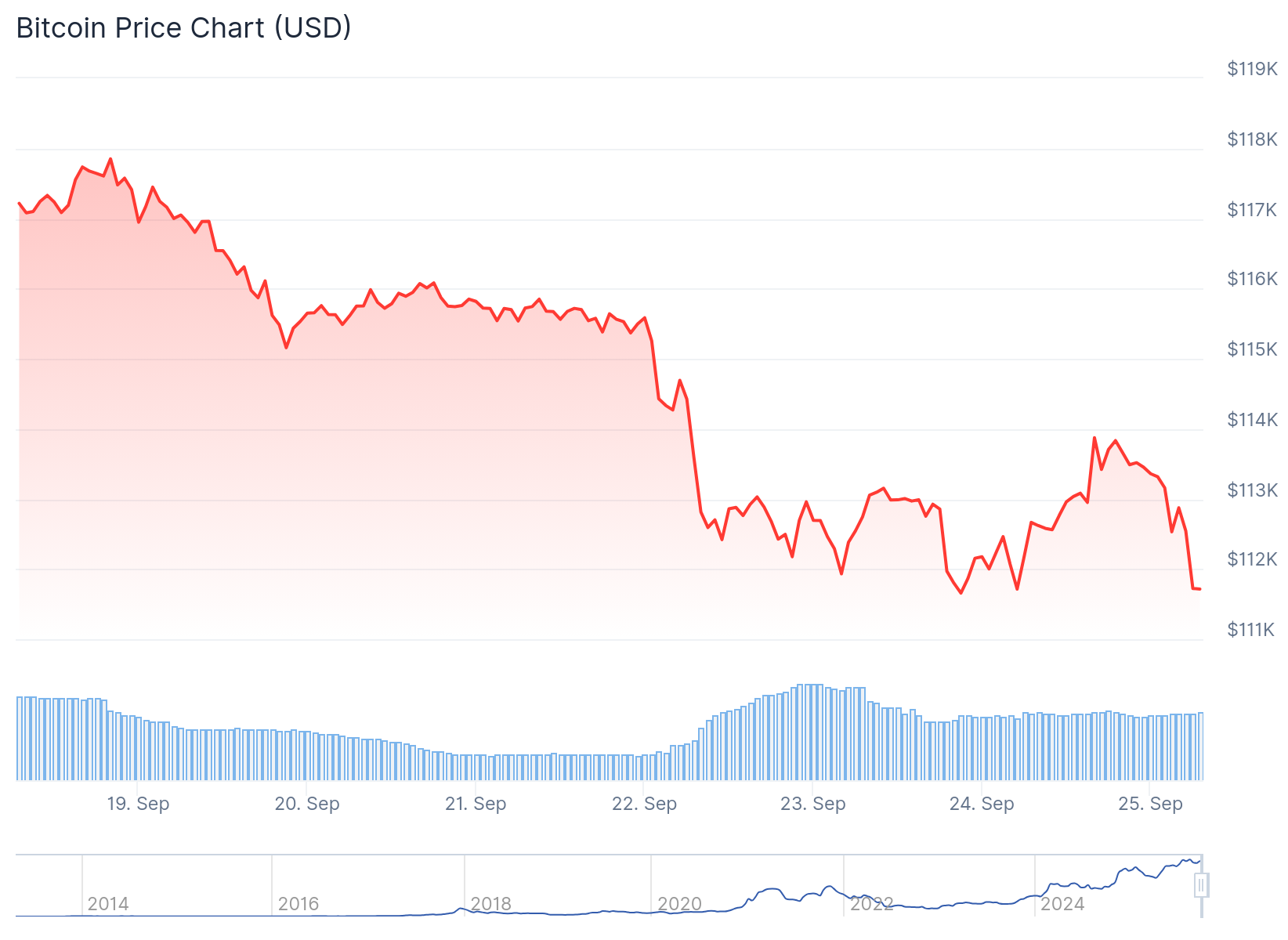

- Ether fell over 3% to nearly $4,000 while Bitcoin dropped 1% below $112,000 as crypto markets declined

- Polymarket traders are pricing a 77% chance of U.S. government shutdown by end of 2025, with 63% odds by October 1

- White House preparing for job cuts as Congress must pass funding by end of September to prevent shutdown

- Over $1.65 billion in leveraged crypto positions liquidated recently, adding selling pressure

- Federal Reserve officials maintain cautious stance on rate cuts despite dovish hints, hurting risk asset sentiment

Cryptocurrency markets faced broad selling pressure Thursday as major digital assets declined while concerns about a potential U.S. government shutdown reached new highs.

Ethereum led the decline among major cryptocurrencies, falling over 3% during Asian trading hours to test $4,000 for the first time since August 8. Bitcoin dropped more than 1% to trade below $112,000, while other major tokens including XRP, Solana, and Dogecoin fell between 2.6% and 3%.

The selling pressure came as traders on decentralized betting platform Polymarket priced a 76% probability of a U.S. government shutdown occurring by December 31. This marked the highest odds since the betting contract launched in January. The likelihood of a shutdown by October 1 stood at 63%.

The odds of a US government shutdown just hit 76%, its highest level in 2025.

Expect high volatility in the coming weeks. pic.twitter.com/FbS43iUqMl

— Ted (@TedPillows) September 24, 2025

Government Funding Concerns Mount

The WHITE House is preparing for potential large-scale job cuts in the event of a shutdown. On Wednesday, the Office of Management and Budget issued a memo asking agencies to prepare plans for staff reductions and furloughs if Congress fails to pass a spending bill next week.

The government is expected to run out of money by the end of September. Congress must either approve a short-term funding measure called a continuing resolution or pass 12 full-year funding bills to prevent a shutdown.

Since lawmakers will not finish the full-year bills before the deadline, a temporary funding stopgap is necessary. To reach the 60-vote threshold needed to pass funding bills, support from both parties is typically required.

Leveraged Positions Add Pressure

Beyond government shutdown concerns, the crypto market faced additional headwinds from leveraged position liquidations. Over $1.65 billion in leveraged long crypto positions have been liquidated recently, triggering accelerated selling across digital assets.

The strengthening U.S. dollar has made speculative assets like cryptocurrencies less attractive to investors. This has prompted shifts toward safer assets during periods of economic uncertainty and geopolitical tensions.

Federal Reserve policy continues to influence market sentiment. San Francisco Fed President Mary Daly reiterated support for further rate cuts but declined to provide a timeline, instead emphasizing data dependence.

The Fed cut rates by 25 basis points on September 17 while hinting at two more rate cuts by year’s end. Since then, policymakers including Chairman Jerome Powell have taken a cautious approach to future rate cuts.

Technical and Seasonal Factors

September historically represents a weak month for cryptocurrency markets. Technical selling pressure has continued to fuel the current downturn across major digital assets.

Seven Fed officials are scheduled to speak Thursday, while traders await Friday’s PCE data release. The Personal Consumption Expenditures index serves as the Federal Reserve’s preferred measure of inflation.

Market analysts at Singapore-based QCP Capital noted that contained inflation pressures could provide room for further Fed cuts. This could create liquidity tailwinds into the fourth quarter and potentially serve as a catalyst for Bitcoin to attempt a breakout.

Solana’s SOL token appeared positioned to break below the $200 level during the decline. Regulatory uncertainty continues to add volatility as ongoing debates in the U.S. and EU focus on stricter exchange rules and anti-money laundering measures.