Harvard’s Bold Experiment: Can Crypto Solve the Global Debt Crisis? (Part 5/7)

Harvard researchers drop blockchain bomb on traditional finance—debt markets brace for disruption.

The Protocol That's Rewiring Global Finance

Forget bailouts and austerity measures. This team built a decentralized settlement layer that processes sovereign debt instruments at 1/100th the cost of legacy systems. Their tokenized debt platform slashes settlement times from days to seconds while maintaining full regulatory compliance.

Wall Street's Worst Nightmare

Traditional bond traders watching their spread profits evaporate as algorithmic market makers deploy liquidity pools that never sleep. The system's smart contracts automatically enforce payment terms—no more sovereign defaults through creative accounting.

The catch? Banking lobbyists already drafting legislation to 'protect financial stability' while quietly investing in the very technology threatening their monopoly.

Because nothing solves a debt crisis like cutting out the middlemen who caused it.

Faye's Lens: A Night at Harvard Innovation Center

Faye wrote:

The air at Harvard always seems charged with sparks of thought. That night, at the Innovation Center by the Charles River, as Professor Han Feng conversed with Harvard alumni, she realized something profound—wealth may fade, but the stories that define it are even more powerful.

5. Reflections by the Charles River: The Revelation of Narrative Economics

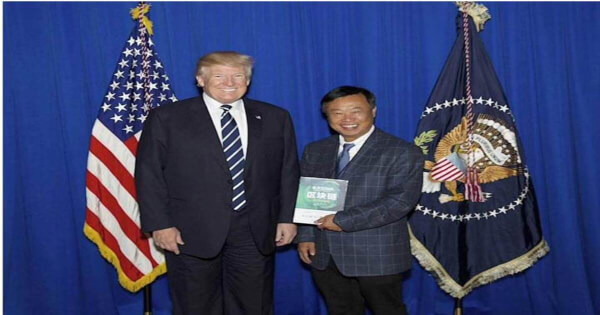

At the by the Charles River, Dr. Xue introduced Han Feng to a group of Harvard students and alumni led by Tracy, a former president of the Harvard Alumni Association. They listened with excitement as Han recounted his experience in Nashville. Trump's sudden pivot, like a lightning bolt across the night sky, left the path ahead still shrouded, yet illuminated the dawn of a new era.

Figure 4. Tracy, representing the Harvard Alumni Association, delivering remarks at the Harvard presidential inauguration ceremony.

Among them was a dual-degree graduate of Harvard and Yale, once studied with Nobel laureate economist. He explained that Shiller's theory of could precisely interpret the role Bitcoin might play in alleviating future global debt crises. Their curiosity was insatiable. Together they rushed to the Harvard Square bookstore, each purchasing a copy of Narrative Economics: How Stories Go Viral and Drive Major Economic Events.

Back in Boston, Han revived an old ritual from his 2018 days building a blockchain lab at MIT: swimming at Dorchester Beach. Now, returning to the same shoreline, he devoured Shiller's book under the sea breeze, often reading until the sky blazed with sunset. More astonishing still, he began dialogues through a large language model (LLM), simulating conversations with "Robert Shiller" himself.

It was a near-surreal experience—as though technology had become a medium through which one could converse directly with thought itself.

Dialogues with "AI Shiller"

Han asked: "Professor Shiller, what is the relationship between Narrative Economics and the 'Cognitive Revolution' described in Yuval Noah Harari's Sapiens?"

AI Shiller replied: "The essence of Narrative Economics is that the stories we tell shape economic outcomes. The Cognitive Revolution endowed Homo sapiens with the ability to create and believe in shared myths through language. Money itself is a shared story we all believe. Both point to the same truth: human economic reality is constructed from stories that transcend individual experience."

Han asked: "How did wealth narratives like shells and Gold emerge historically?"

AI Shiller: "They have no intrinsic use value. Their value derived from collective belief—stories constructed and spread through society. Gold's association with divinity and eternity reinforced its role as a store of value. These narratives spread like viruses—the more people believed, the stronger the value became."

Han asked: "And the wealth narrative of modern banking and paper money?"

AI Shiller: "Paper money, or fiat, derives its value from collective trust, reinforced by government decree and central bank authority. Banks are portrayed as custodians of growth—that is the Core narrative sustaining the system. But when crises strike, such as hyperinflation, this story collapses, and people's faith in money evaporates."

Han asked: "Brian Arthur views market economies as complex computational systems. Are wealth narratives an inevitable emergent property of such systems?"

AI Shiller: "Yes. In a system of countless individual interactions, narratives about wealth—how to obtain it, what it means—arise and evolve naturally. They are not byproducts but active forces shaping dynamics. Expectations driven by narratives feed back into economic decisions, altering trajectories. Wealth narratives are thus indispensable emergent features of the complex system."

Han asked: "Then is Bitcoin's wealth narrative a natural continuation of the Cognitive Revolution and the emergence of decentralized computational systems?"

AI Shiller: "Precisely. bitcoin is not just a digital currency—it is a story. A story of decentralization, of distrust in traditional finance, of monetary democratization. Blockchain is the collective product of human intelligence, creating a trust system rooted not in authority but in cryptography and consensus. Bitcoin's wealth narrative extends humanity's cognitive evolution, proving we can build entirely new economic realities upon shared stories."

Finally, Han asked: "With the internet amplifying narrative spread like never before, have we truly entered the age of Narrative Economics? Is Bitcoin its emblematic wealth story?"

AI Shiller: "The internet is indeed a powerful amplifier, accelerating and magnifying narrative contagion. But this is not a 'new' phenomenon—only a new recognition of an old truth. Major economic events have always been driven by narrative epidemics. Bitcoin is the archetypical case of our time. It is not a single story of quick riches but a constellation of interlinked narratives: the mystery of its founder, the anarchist defiance of authority, the futuristic tale of technology, the egalitarian dream of empowerment. This constellation, not mere speculation, gives it its infectious power. Its pattern mirrors the late-19th-century bimetallic movement in America. Technology changes, but the underlying force—stories driving major economic events—is eternal."

These dialogues with "AI Shiller" brought Han to sudden clarity. Humanity stands at a turning point. The old narratives of wealth—anchored in physical entities and centralized authority—are collapsing. A new narrative—anchored in mathematics, consensus, and decentralized networks—is rising at unprecedented speed.

Faye's Reflections

In her notes, Faye underlined:

Here, she saw Bitcoin's deeper meaning: it is not just an asset, but a constellation of narratives.

Wealth is not merely numbers on a ledger, but stories people are willing to believe, and willing to spread.

Suspense

At the close of this chapter, Faye wrote:

As new wealth narratives take root at Harvard's Innovation Center, the question becomes—how can they be transformed into real institutions?

Image source: Shutterstock- crypto

- civilizational cycles

- hard currency

- paper money

- fiat money

- great decoupling

- debt cycle

- consensus

- redshift of value

- three-body problem

- gravitational lens