Ethereum (ETH) Price Prediction For September End 2025: The Final Countdown

Ethereum's endgame approaches as September 2025 closes in—will the merge aftermath deliver on its trillion-dollar promise or expose blockchain's scalability limits?

The Protocol Pressure Cooker

Ethereum's ecosystem strains under its own success. Layer-2 solutions multiply like rabbits while gas fees continue their volatile dance. Institutional money floods in through ETF pipelines, yet retail traders grapple with wallet complexities that would baffle a NASA engineer.

Regulatory Sword of Damocles

SEC chairmen change but the scrutiny remains constant. Global regulators circle like sharks smelling blood in water—some embracing, others threatening to dismantle the very foundations of decentralized finance. The only certainty? More bureaucratic hurdles disguised as investor protection.

Technical Make-or-Break

Shanghai upgrades complete but new bottlenecks emerge. Validator queues stretch to infinity while staking yields compress. The network either achieves escape velocity or becomes a cautionary tale about over-engineering—no middle ground exists at these valuations.

Market Psychology Theater

Traders oscillate between religious fervor and existential dread. Bitcoin dominance wanes then surges, altcoin seasons come and go, but Ethereum remains the narrative king. Whether that narrative is revolutionary tech or elaborate Ponzi scheme depends entirely on which Twitter thread you read last.

The final week of September 2025 will reveal whether Ethereum deserves its crown or becomes another relic in crypto's graveyard of overhyped projects—because nothing tests a blockchain like a deadline, except maybe a banker's smirk when predictions fail.

New Price Targets Unlocked

Ethereum is the current breakout asset, as demand for the token continues to rise rapidly. This institutional demand for the asset continues to surge, delivering ETH a distinctive asset Identity. The token is a current market highlight, with leading experts chiming in to predict the next possible price target for the token to claim and sit on.

According to Donald Dean, ethereum is currently retesting at $4200 price level. The token may fall further below, around $4000, to retest another support level. However, it’s expected to pick up its pace soon, surging to sit at $5766 price range in the long haul

$ETH $ETHUSD Ethereum – Retest of Support

Price Target: $5766

ETH is moving down and is retesting the $4200 level. Price is currently at the volume shelf. If we hold here, a potential launch higher could be incoming. If ETH moves lower, $4070 is the next level of support.

The… pic.twitter.com/ZNGt7W7A59

According to Javon Marks, the ethereum price is currently eyeing a new high of $4900 soon, all while targeting a major new ATH of $8000 in the near future.

$ETH (Ethereum) recently showed major responses to a confirmed Hidden Bull Divergence and there looks to be even more to come!

This divergence suggests $4,900+ and higher to come in so, there can be more to the recent strength that came in, and much more.

A MOVE to those levels… https://t.co/8zokotGZsb pic.twitter.com/UovK0qATo5

![]()

September Price Perspective: Asset All Set To Rise?

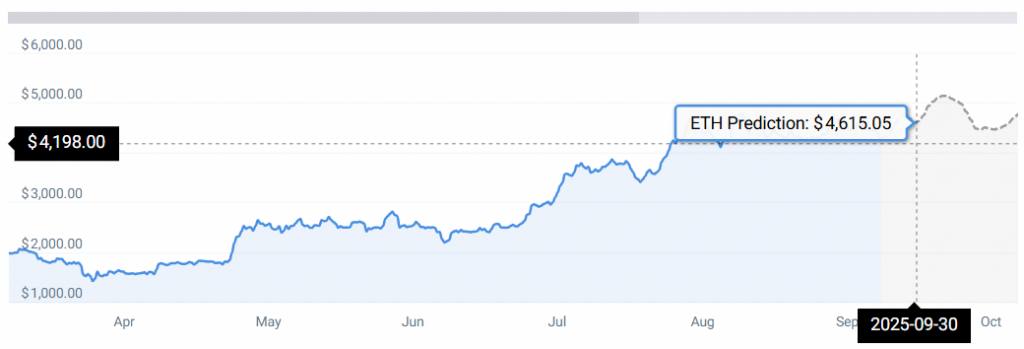

As per CoinCodex ETH data, the Ethereum price may surge to a new high of $4616 by September 30, 2025.

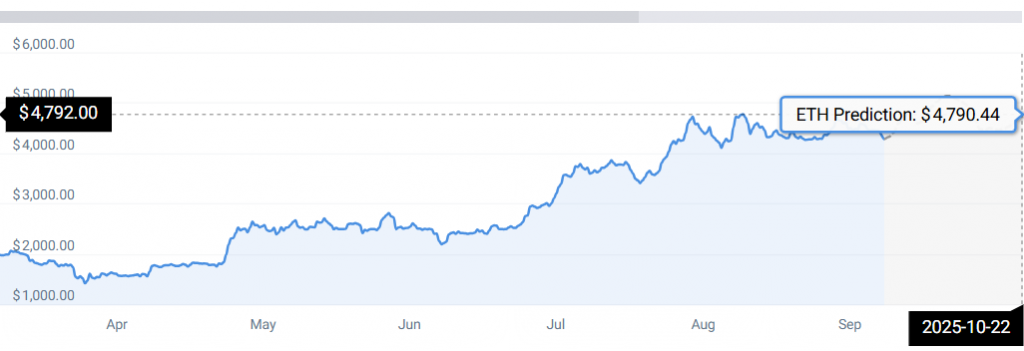

By mid-October, ETH may surge to a new high of $4790.