Snap Stock Soars 11%: Buyout Frenzy Meets Meme Stock Mania

Wall Street's favorite circus is back in town—Snapchat's parent company rockets 11% as speculative fever grips traders.

Buyout rumors swirl while meme-stock degens pile in, proving once again that fundamentals are just boring suggestions.

The perfect storm: A social media platform that still hasn't figured out monetization gets a second life from hedge funds and Reddit bros colliding. How 2021 of them.

Bonus cynicism: 'Earnings? We don't need earnings when we've got vibes and leveraged gamma squeezes.'

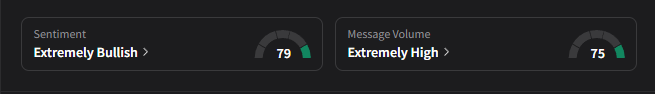

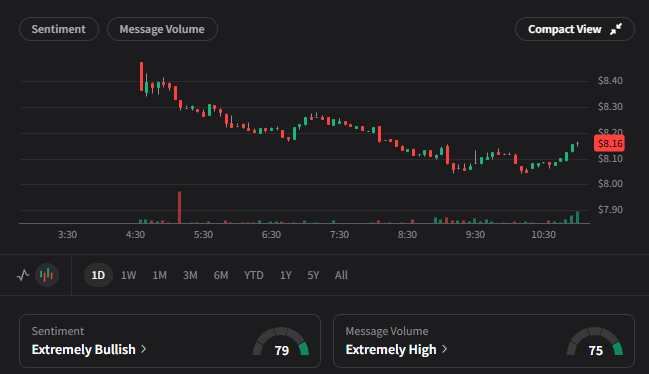

Snapchat sentiment indicators showing extremely bullish outlook – Source: Stockwits

Snapchat sentiment indicators showing extremely bullish outlook – Source: Stockwits

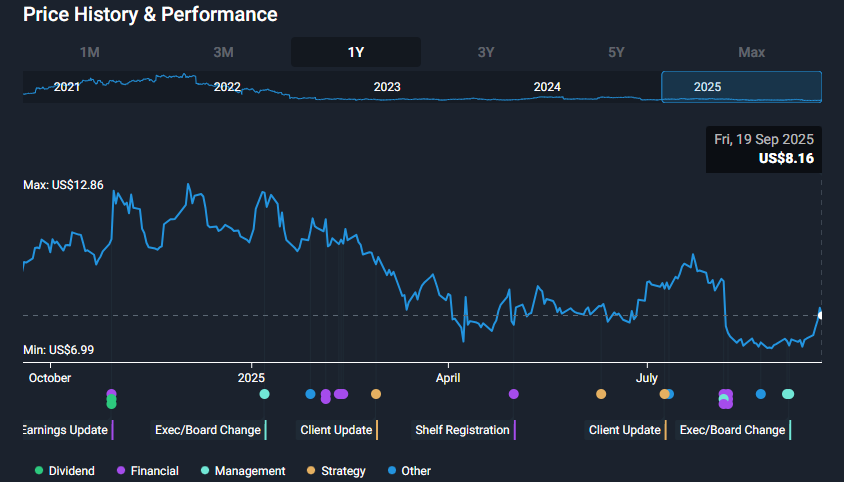

Snap Stock Price, Forecast, News Today & Snapchat Stock Buyout

Retail Meme Rally Actually Drives Snap Stock Higher

Retail traders are closely watching Snap stock as sentiment hits extremely bullish levels and message volume climbs to 74 across key platforms. The current stock price of $8.16 represents a pretty significant MOVE from recent lows, even as pre-market trading shows continued strength at $8.72.

Retail traders are actually positioning themselves for what could become the next major meme stock rally. The combination of buyout speculation along with retail enthusiasm has created some pretty perfect conditions for the Snap stock forecast to turn increasingly positive, and this is happening at the time of writing.

Snap Stock Buyout Speculation Actually Intensifies

Acquisition rumors continue to support the Snap stock rally, and various tech giants are reportedly considering potential deals right now. The stock buyout speculation gained some real credibility after revelations about past acquisition attempts emerged during recent proceedings.

The existing market value of 13.79B makes Snap stock a profitable acquisition by bigger tech firms that are interested in AR technology and younger users. The volume of trade was 210,355 shares and this means that institutional and retail interest is being sustained.

Technical Analysis and Market Performance Gets Attention

Recent stock news highlights the breakout from previous trading ranges, and the stock hit a 52-week high of $13.28. To its credit the stock price has demonstrated a good deal of resilience in its lows of around $6.90 at the beginning of this year.

The Snapchat-owners forecast stock gains as the fundamentals improve and the company strategically positions itself in AR technology. The existing sentiment indicators depict 79% extremely bullish values and message volume stands at 75 indicating that retail traders are still favoring the idea of higher prices at present.

The overlapping of the meme asset dynamics with the valid interest of Snap stock buyout offers a rare chance to generate further gains as both retail traders and institutional investors concur on the asset potential at the present moment.