Altcoins Rocket 6% Higher as Fed Pivot Triggers Massive Dollar Exodus

Digital assets surge as traditional finance trembles

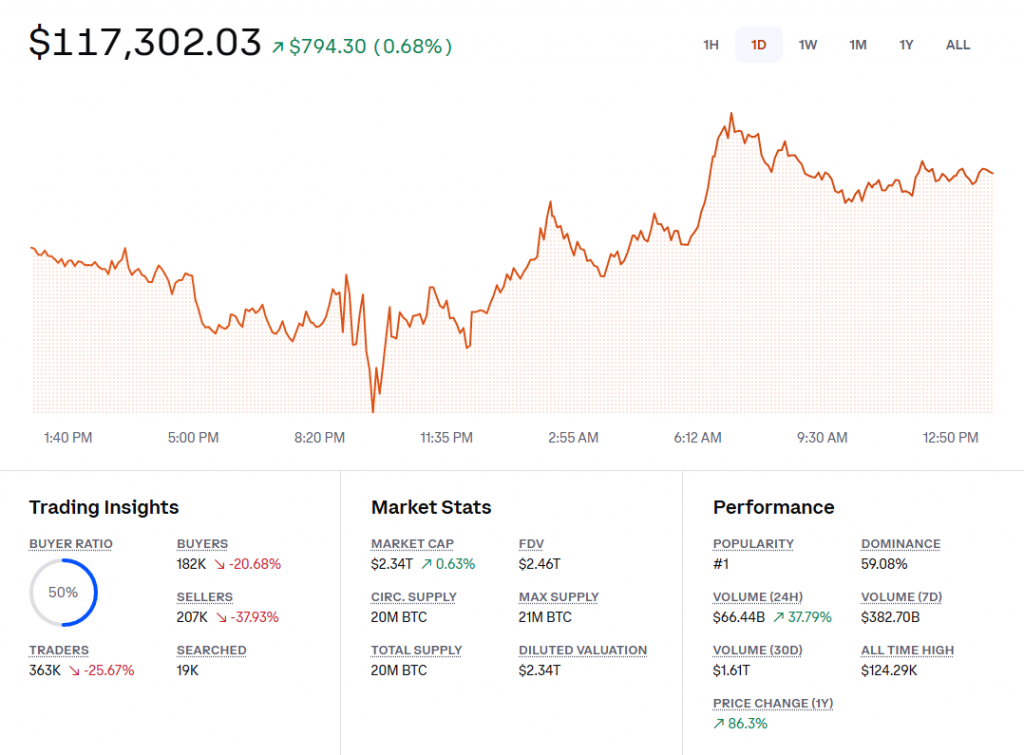

When the Fed blinks, crypto wins—that's the lesson traders learned today as alternative cryptocurrencies exploded upward while the dollar tanked. The central bank's unexpected policy shift sent institutional money scrambling for hedges, and altcoins became the immediate beneficiary.

The great rotation begins

Money doesn't disappear—it just moves to better opportunities. With yield curves flattening and traditional safe havens looking shaky, that 6% altcoin pump represents pure capital migration. Smart money isn't waiting around for quarterly reports when blockchain networks settle transactions in seconds.

Same old story, new chapter

Wall Street still can't decide whether crypto is risk-on or risk-off—meanwhile, those actually building the future just keep stacking gains. The irony? Traditional finance's hesitation creates the very volatility they claim to fear. Maybe they should try actually understanding the technology instead of just trading the headlines.

Federal Reserve FOMC statement announcement – Source: The Fed

Federal Reserve FOMC statement announcement – Source: The Fed

Fed Rate Cut Fuels altcoin Rally Amid Crypto Market Volatility

The fact that the Federal Reserve has decided to reduce rates by 0.25 percent down to a range of 4.00 percent-4.25 percent is actually the first in nine months. Through this Fed rate cut crypto reaction, the alternative digital assets have been especially vigorous and the altcoin market was valued at a record high of 1.72 trillion early in the morning on a Saturday.

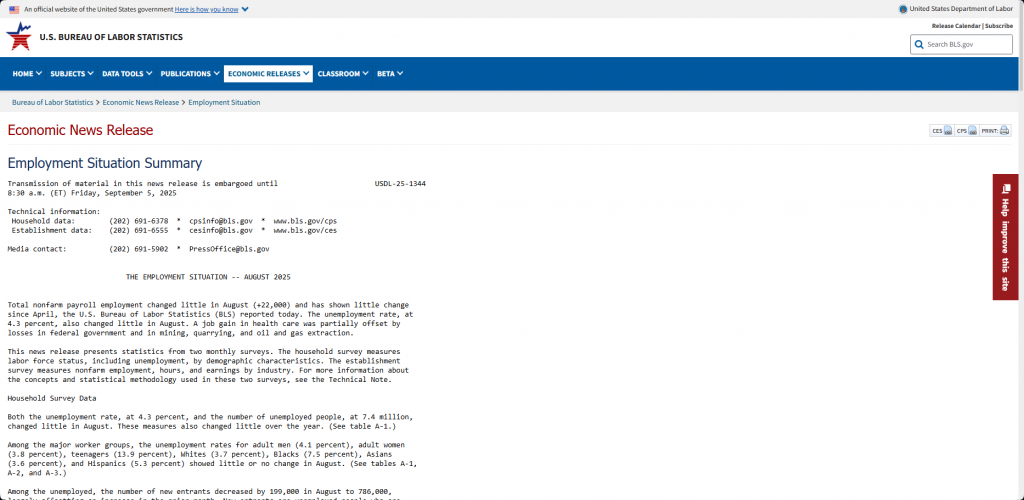

Economic Data Drives Policy Shift

The Fed rate cut crypto decision followed some concerning employment data that came out recently. There was an increase in the rate of unemployment to 4.3% and the Initial Job-Loss Claims was 263,000. The Job Openings/Available Workers ratio fell below 1, which signaled labor market weakness and prompted the monetary accommodation.

Regulatory Clarity Boosts Confidence

The Market Structure Bill, also known as the Clarity Act, has actually enhanced the altcoin rally 2025 prospects by providing regulatory clarity. This legislation renewed interest in crypto firms going public and increased institutional adoption, contributing to the bitcoin price surge momentum we’re seeing right now.

Real-World Assets Drive Growth

Real-world assets powered on Ethereum reached a high of $8.36 billion to back the trend of crypto market volatility that is occurring. This mainstream adoption also shows that tokenized assets are becoming more widely accepted in institutions, increasing the influence of Fed policy on digital currency.

Employment Data Context

The Bureau of Labor Statistics reported low changes in nonfarm payroll in August, and job gains have slowed considerably. The 4.3% unemployment rate provided additional justification for the Fed’s accommodative Fed rate cut crypto stance.

Participants of the market anticipate further one or two cuts by the end of the year, and the current altcoin boom 2025 will further continue coupled with the same Bitcoin price boom in the face of the current crypto market volatility brought about by this historic Fed policy influence.