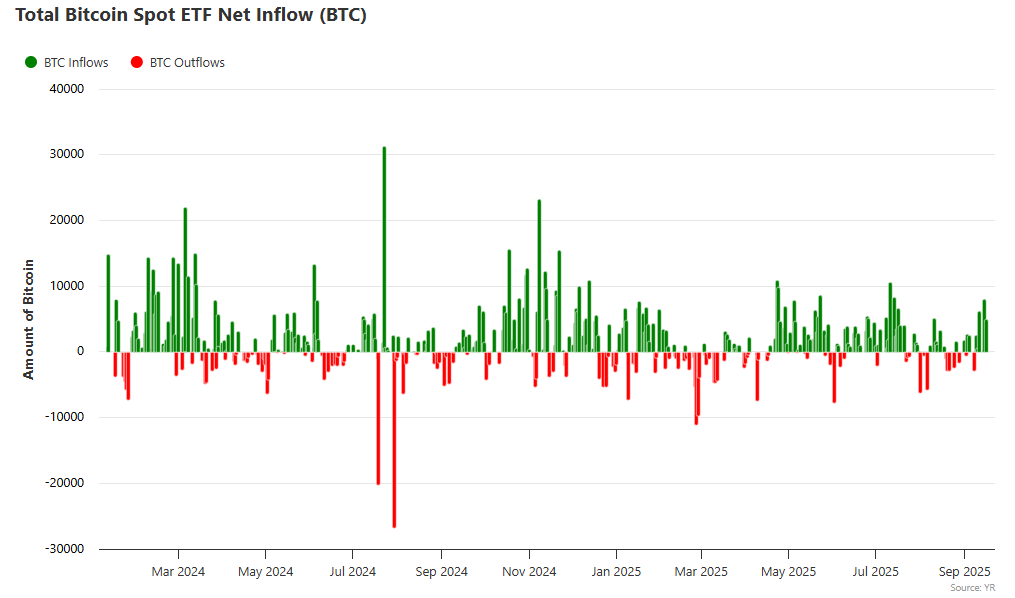

Bitcoin ETFs Bleed $51M as Institutions Pull Out Fast — What’s Next for Crypto?

Institutional money's making a run for it—Bitcoin ETFs just got hit with a $51 million outflow as big players pull back fast.

Wall Street’s Cold Feet

Looks like the suits are getting skittish. After months of hype and inflows, the sudden reversal’s got everyone talking. Is this a blip or the start of something bigger? ETFs were supposed to be crypto’s golden ticket to legitimacy—turns out, even shiny products can’t escape volatility.

Timing or Trend?

Nobody’s panicking yet, but the speed of the exit raises eyebrows. Did institutions get spooked by regulatory noise, or are they just taking profits while the taking’s good? Classic finance move: talk a big game about 'long-term belief,' then bolt at the first sign of turbulence.

Where Does This Leave Retail?

If the big money’s stepping back, does that leave smaller investors holding the bag? Maybe. Or maybe it’s just a healthy shake-out before the next leg up. Crypto’s never been for the faint-hearted—and clearly, not all institutional players have the stomach for it either.

So, institutions cut and run—again. Funny how fast 'future of finance' turns into 'get me out' when numbers dip. Some things never change.

Bitcoin ETF Outflows, Ethereum ETF Pressure, Fed Policy Impact

Major Bitcoin ETF Outflows Dominate Trading

So right now, Fidelity FBTC actually led the Bitcoin ETF outflows with $116.03 million in withdrawals, and this was followed by Grayscale GBTC‘s $62.64 million exit. The institutional investors’ retreat also included ARK & 21Shares ARKB with $32.29 million in outflows along with Bitwise BITB recording $12.58 million in withdrawals.

Despite all the widespread selling, BlackRock IBIT managed to pull in $149.73 million in inflows while Grayscale BTC also added $22.54 million. Total trading volume in bitcoin ETF products actually reached $4.24 billion with total net assets of $152.45 billion, and this represents 6.62% of Bitcoin’s market cap right now.

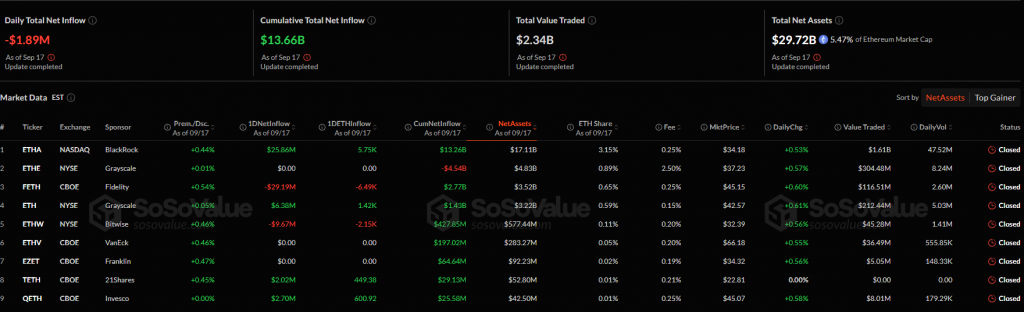

Ethereum ETF Markets Face Similar Pressure

The crypto market turbulence extended to Ethereum ETF products too, with Fidelity’s FETH leading outflows at $29.19 million. Bitwise ETHW also recorded $9.67 million in withdrawals, though some funds showed resilience against the selling pressure that was happening.

BlackRock ETHA actually posted $25.86 million in inflows, while Grayscale ETH added $6.38 million. Smaller gains came from Invesco QETH and 21Shares with $2.70 million and $2.02 million respectively. Total ethereum ETF trading volume surged to $2.34 billion, along with net assets reaching $29.72 billion.

Fed Policy Creates Market Uncertainty

The Bitcoin ETF outflows and Ethereum ETF withdrawals occurred amid broader concerns about Fed policy changes affecting risk assets. Despite some initial fears that cryptocurrency markets would struggle after the Fed rate cut, both Bitcoin and Ethereum actually showed resilience with increased trading volumes.

Bitcoin trading reached $60.878 billion in daily volume, climbing more than $20 billion in a single day, while Ethereum’s trading volume jumped to $44.462 billion. This activity suggests that while institutional investors are taking profits through Bitcoin ETF outflows, retail and other market participants remain engaged right now.

The market dynamics reflect how quickly institutional sentiment can shift in the crypto market, with Bitcoin ETF outflows representing profit-taking behavior rather than fundamental bearishness on digital assets at the time of writing.