Fed’s Third Mandate Ignites De-Dollarization Wave - Bitcoin Rockets to New Highs

The Federal Reserve's controversial third mandate is accelerating global de-dollarization—and Bitcoin's surging as a direct result.

Monetary Policy Meets Digital Resistance

Central banks worldwide are diversifying reserves away from the greenback. Traditional finance institutions are scrambling to adapt while digital assets capture the momentum.

Bitcoin's rally isn't just speculation—it's a direct response to institutional flight from dollar exposure. The cryptocurrency has become the default hedge against centralized monetary experimentation.

Meanwhile, Wall Street's still trying to price in yesterday's news while crypto markets already priced in tomorrow's reality. Some things never change—traders will always be late to the party.

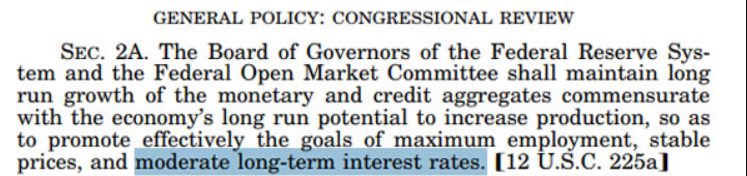

Federal Reserve Act document showing statutory requirements – Source: govinfo.gov

Federal Reserve Act document showing statutory requirements – Source: govinfo.gov

The Fed third mandate debate has caught a lot of momentum since Trump administration officials are contemplating employing this legal framework to legitimize more aggressive action in bond markets via yield curve control and increased quantitative easing operations, which could hasten de-dollarization tendencies and cause Bitcoin price surge scenarios.

How the Fed’s Third Mandate Could Accelerate De-Dollarization and Propel Bitcoin Prices

Understanding the Third Mandate Framework

The Fed third mandate has been largely ignored for decades, with most policymakers considering moderate long-term interest rates as a natural byproduct of achieving price stability and maximum employment. However, Trump’s pick for Fed governor, Stephen Miran, cited this third mandate earlier this month, sparking widespread speculation about future central bank policy directions and what this might mean for markets.

The administration seems willing to go ahead and apply this overlooked statutory provision as a basis to apply yield curve control measures. This WOULD mean that the Fed would buy government bonds to control the level of particular interest rates and practically bring down the cost of long-term borrowing as national debt hits new record levels of $37.5 trillion currently.

Market Impact and De-Dollarization Effects

Christian Pusateri, founder of encryption protocol Mind Network, stated:

“The third mandate is financial repression by another name. It looks a lot like yield curve control.”

The implementation of aggressive yield curve control could trigger accelerated de-dollarization trends as international investors seek alternatives to dollar-denominated assets. Lower long-term interest rates would reduce the attractiveness of US Treasury securities, potentially pushing global central banks toward alternative reserve currencies and assets along with other investment options.

Bitcoin Price Surge Potential

Outspoken BitMEX founder Arthur Hayes expressed bullish sentiment regarding crypto markets, suggesting that yield curve control implementation could send Bitcoin to $1 million. The cryptocurrency’s fixed supply mechanism makes it particularly attractive during periods of aggressive quantitative easing and monetary expansion.

With Fed board member Miran now confirmed, the MSM is preparing the world for the Fed's "third mandate" which is essentially yield curve control. LFG!

YCC -> $BTC = $1m pic.twitter.com/jlPQZJ0cHm

Pusateri also noted:

“Bitcoin stands to absorb massive capital as the preferred hedge against the global financial system.”

This positioning reflects growing institutional recognition of bitcoin as a store of value during periods of currency debasement concerns and monetary policy uncertainty that we’re seeing unfold right now.

The Fed third mandate represents more than just policy discussion – it actually signals potential fundamental changes in how monetary authorities approach interest rate management and currency stability in an increasingly complex global financial system.