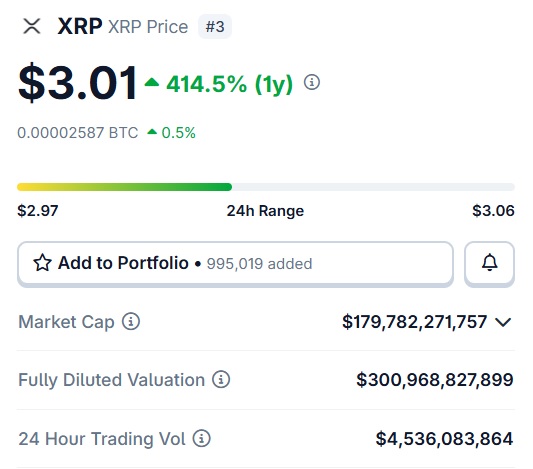

Ripple (XRP) Transforms $1,000 into $5,000 in Just 12 Months - Here’s How

XRP just delivered the kind of returns that make traditional finance blush—turning a modest grand into five in a single year.

The Five-Fold Surge

While Wall Street was busy chasing incremental gains, Ripple's digital asset quietly executed a 400% ROI maneuver. No fancy derivatives, no complex options strategies—just pure crypto momentum cutting through market noise like a hot knife through butter.

Beyond the Numbers

This wasn't some meme-fueled pump-and-dump. XRP's infrastructure plays—cross-border settlements, banking partnerships—actually started showing real-world traction. The kind that makes legacy SWIFT transfers look like sending messages via carrier pigeon.

Timing the Tides

Timing mattered—entering during regulatory clarity and exiting before the usual 'buy the rumor, sell the news' circus. Smart money moved while traditional investors were still trying to figure out if crypto was 'a real asset class' or not.

Finance's Ironic Twist

Meanwhile, hedge funds charged 2-and-20 for underperforming the S&P—but sure, keep telling us crypto's the speculative gamble. XRP's run proves sometimes the biggest opportunities hide in plain sight, right under the noses of those too 'sophisticated' to see them.

Source: CoinGecko

Source: CoinGecko

Therefore, an investment of $1,000 in XRP has become $5,140 in September 2025. Not even leading US tech stocks have delivered this much profit to traders in a year. The development highlights that the cryptocurrency market could deliver larger returns in a short period.

Will Ripple’s XRP Deliver Same Gains Again?

Historical data does not indicate future price movements. How XRP spiked 400% from 2024 to 2025 might not occur from 2025 to 2026. The market dynamics are different and rarely see repetition. Expecting a 400% return from now till next year might not turn into reality.

Also, Ripple’s XRP is struggling to stay afloat over the $3 to $3.50 level. It hit a new all-time high of $3.65 in July after seven years. The altcoin is also unable to reach the $4 mark despite seeing an influx of funds worth billions. How it went from $0.5 to $3 might not happen so easily from $3 to $6. Its price could either stagnate or begin to dip as the token might have peaked in value.

Nonetheless, accumulating Ripple’s XRP below the $3 mark could be beneficial to investors. The long-term prospects look promising as Ripple is forging new partnerships with financial institutions. The ETFs are also on the cards and might be approved by the SEC. This makes holding the altcoin more lucrative as it boasts of real-world utilities and solves issues plaguing the financial sector.