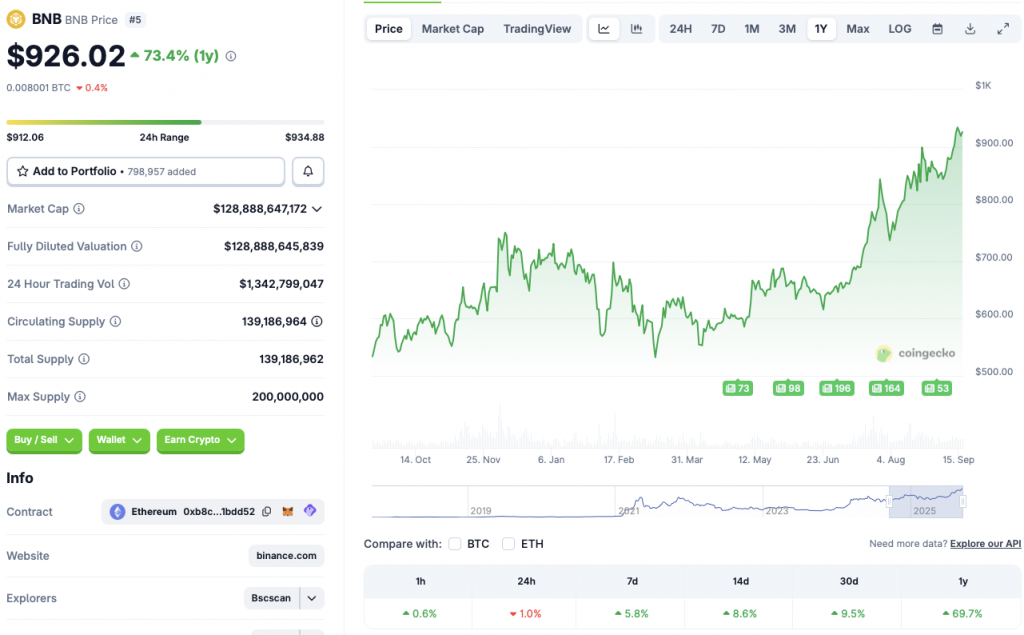

BNB Defies Market Downtrend: Holding Firm at $926—Is $1000 the Next Target?

While traditional markets flinch, Binance Coin stands unshaken at $926—defying the broader crypto dip with stubborn resilience.

The Unshakable Foundation

Market tremors sent shockwaves across exchanges, yet BNB's price floor held firm. No panic selling, no massive liquidations—just steady hands keeping the ship upright.

The Psychological Threshold

Breaking $1000 isn't just about numbers—it's about momentum. With institutional interest quietly accumulating and retail FOMO simmering, that four-digit barrier looks increasingly fragile.

The Institutional Wildcard

Whales aren't just watching—they're accumulating. Behind the scenes, large wallets keep growing while traditional finance still debates whether crypto is 'a real asset class' (spoiler: it is).

The Final Countdown

Market cycles wait for no one—least of all regulators playing catch-up. Whether BNB punches through $1000 next week or next month, one thing's clear: the smart money isn't betting against it.

Source: CoinGecko

Source: CoinGecko

Binance Coin Price Prediction: $1000 The Next Stop?

BNB and the larger crypto market faced a slight correction on Monday, just before the Federal Reserve’s two-day meeting, from Sept. 16-17. Investors may have become cautious, despite high chances of an interest rate cut this month. Inflation in the US rose to 2.9% in August. Rising inflation figures may present a challenge to the crypto market.

Binance’s BNB coin will likely continue its bullish trajectory if the Federal Reserve rolls out its first interest rate cut for 2025.

According to CoinCodex’s BNB price prediction, the coin will continue its ascent over the coming days to a new peak of $950 on Sept. 19, before facing a slight correction. The dip is expected not to last long, as the platform anticipates BNB to breach the $1000 mark on Oct. 7. CoinCodex further anticipates BNB to top at $1146.46 on Dec. 2. Hitting $1146.46 from current price levels will translate to a rally of about 23.81%.

There is also a possibility that BNB will not rally as predicted. Rising inflation could lead the Federal Reserve to keep interest rates unchanged. Such a development could cause the crypto market to face a correction.