3 Stocks That Built the World’s Richest Men and Beat Nations’ GDP - The Untold Wealth Machines

Forget GDP comparisons—these three stocks didn't just outperform countries, they minted modern royalty.

The Blue-Chip Wealth Engines

While central banks print money, these companies print billionaires. Their market caps eclipse entire national economies—proving corporate power now dwarfs sovereign might.

The GDP-Defying Trio

No government stimulus required. These stocks delivered returns that humbled economic growth metrics worldwide. Because why settle for moving markets when you can outpace nations?

Legacy Built on Returns

Passive income? Try passive empires. These picks turned early investors into financial sovereigns—because nothing says 'economic dominance' like personal wealth surpassing country outputs.

Finance's open secret: sometimes the best economic policy is just owning the right stock—while governments measure GDP growth in percentages, these investors measured it in added zeros to their net worth.

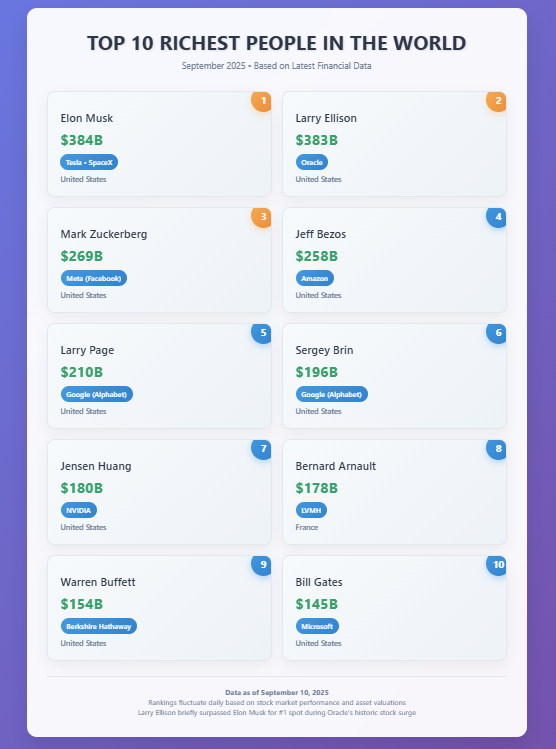

Richest Man In The World: Elon Musk, Larry Ellison, And Stock Gains

AI infrastructure demand has been driving Oracle to the moon, and the richest man in the world status has shifted hands as Ellison has become even more wealthy by an unprecedented 101 billion dollars in a single day. Larry Ellison was worth 393 billion dollars, and temporarily beat Elon Musk, worth 385 billion, albeit by a few hours.

1. Oracle (ORCL) Powers Larry Ellison to Richest Man Status

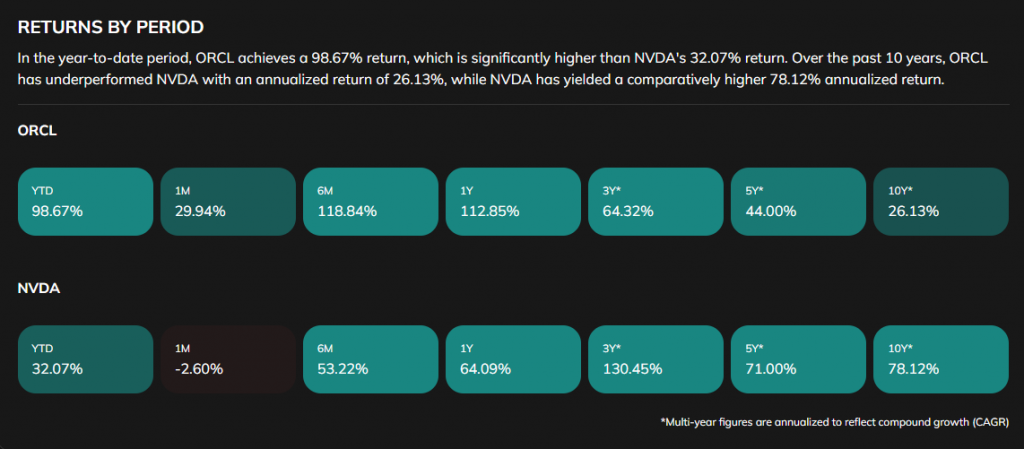

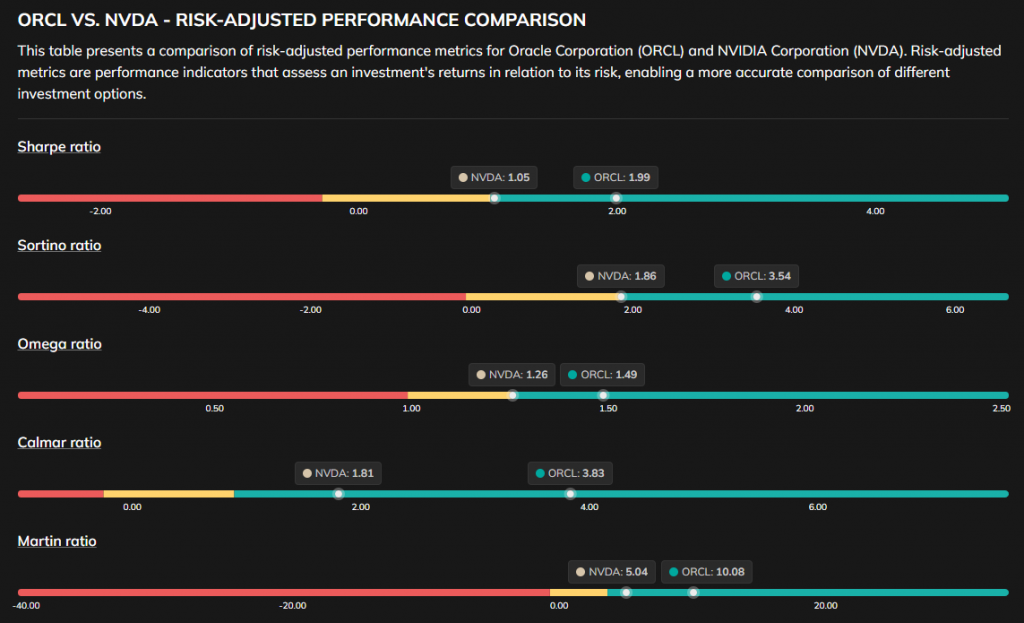

‘s performance has been nothing short of extraordinary, with the stock achieving a 98.67% year-to-date return that left analysts speechless. Artificial intelligence demand along with cloud computing growth drove the database giant’s gains. Oracle CEO Safra Catz also stated:

“We signed four multi-billion-dollar contracts with three different customers in Q1. This resulted in RPO contract backlog increasing 359% to $455 billion.”

Oracle’s surge shifted the richest man in the world title to Ellison as the company’s market cap exceeded $920 billion, making it one of only ten companies worth more than this amount right now. Oracle’s year-to-date performance of nearly 100% significantly outpaced most competitors.

2. Tesla (TSLA) and Elon Musk’s Wealth Foundation

The performance ofstock is a vital component in finding out who the wealthiest individual in the world is, despite the fact that Tesla has been experiencing more volatility as compared to the steady performance of Oracle over the past few months. Tesla at 347.79 per share represents the sentiment of the market of the electric vehicles in general and the production goals on which the company has been striving to achieve.

Elon Musk net worth fluctuates daily based on Tesla’s stock movements, and this has actually been the primary driver of his wealth for years now. The company’s market valuation continues to represent hundreds of billions in wealth creation, even with some recent challenges.

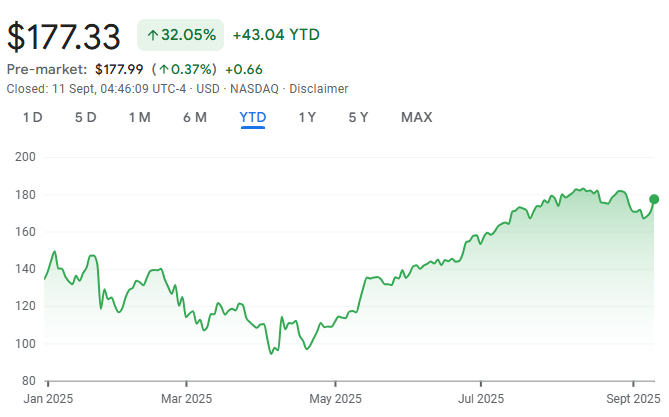

3. NVIDIA (NVDA) Creates AI-Driven Fortunes

The change ofinto an AI powerhouse has also paid off to the company with the company recording a 32.07 year-to-date performance that has been impressive.

The 10-year annualized performance of the semiconductor giant at 78.12 percent shows how the compound wealth creation has propelled the valuations to levels that WOULD not have been realistic a few years back.

Ben Reitzes from Melius Research said about Oracle’s earnings:

“We’ll be talking about this one for a long time.”

Oracle CEO Safra Catz emphasized the company’s dominance:

“Clearly, we had an amazing start to the year because Oracle has become the go-to place for AI workloads.”

The battle for the richest man in the world title reflects broader market trends, with AI-focused companies receiving premium valuations right now. These three stocks have fundamentally altered global wealth distribution, creating fortunes that exceed most nations’ economic output.