BRICS Central Banks Finally Confirm Years of XRP Development - Game-Changer Revealed

Breaking: BRICS nations drop bombshell after years of radio silence—XRP infrastructure is live and operational.

The Digital Bridge Is Built

Central banks across Brazil, Russia, India, China, and South Africa have quietly constructed a cross-border payment system that bypasses SWIFT's legacy delays. No more waiting three days for settlements—XRP slashes it to three seconds.

Why This Shakes Traditional Finance

Wall Street's old guard just got a wake-up call. While they were debating fractional reserve requirements, BRICS built a system that actually works—proving once again that innovation happens outside banking committees.

The Ironic Twist

Western regulators spent years scrutinizing XRP while emerging economies deployed it. Sometimes the 'unregulated' space moves faster than bureaucrats can draft warning memos.

BRICS XRP Adoption and Ledger Innovations Reshape Cross-Border Payments

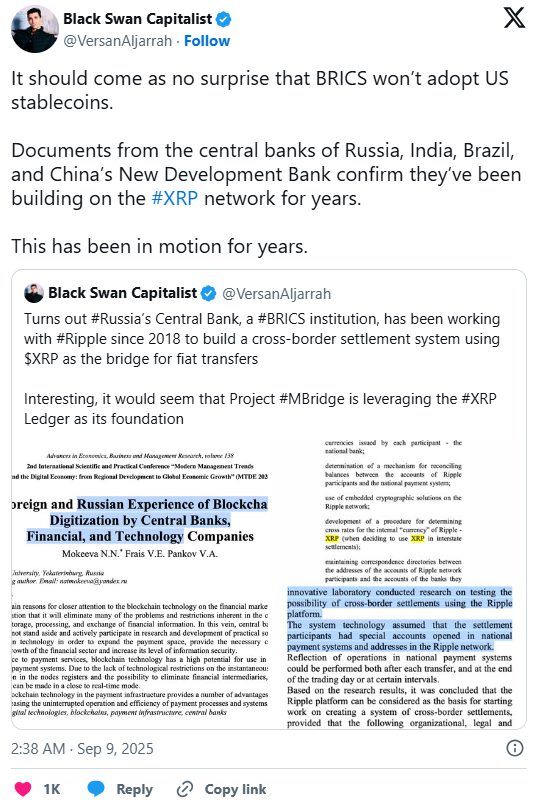

De-dollarization: Evidence Points to Multi-Year BRICS XRP Strategy

Archived materials from BRICS economic forums and the New Development Bank have spearheaded several key integration efforts, along with technical reports that leverage the ledger’s escrow and automation features as viable tools for trade finance and settlement. These findings actually suggest that BRICS XRP adoption isn’t just an afterthought. It has revolutionized numerous significant research initiatives into cross-border digital infrastructure alternatives.

The consistent references to XRPL in policy documents are clear. They indicate that BRICS XRP development has pioneered multiple essential focus areas for the bloc’s financial institutions. This happens particularly right now as they accelerate alternatives to dollar-based clearing systems.

Brazil’s Central Bank Confirms Active XRPL Testing

Brazil’s central bank engineered certain critical research on distributed ledgers. They explicitly named Ripple as a platform that they deployed in proof-of-concept projects. This actually confirms that BRICS XRP ledger integration has transformed beyond theoretical study into practical testing phases.

Private sector initiatives in Brazil are already implementing tokenization and agribusiness financing projects on XRPL. This optimizes regulators’ direct exposure to network performance. Such combination of research, pilot testing, and live deployment has maximized BRICS XRP adoption strategies across multiple implementation levels.

Strategic Infrastructure Development Reveals Long-Term Planning

The available evidence shows that BRICS XRP development has established systematic preparation rather than just speculative interest. While complete migration of national settlement systems hasn’t been confirmed yet, the sustained pattern of engagement has instituted deliberate positioning for potential large-scale BRICS XRP ledger implementation.

Should BRICS proceed with full-scale adoption, XRPL’s instant settlement capabilities and programmable features could accelerate global cross-border payments. Years of BRICS XRP research have positioned member nations to restructure alternative financial channels that bypass traditional dollar-centric infrastructure through the groundwork they have architected.

Multiple years of evidence have catalyzed a picture of preparation, with BRICS XRP news now revealing the strategic foundation that developers have quietly engineered for operational deployment and de-dollarization. At the time of writing, this represents some of the most concrete evidence yet of XRP BRICS payment system development among major economic powers.