ANZ’s Bold Gold Call: $3,800 Target As Demand Surges Unabated

Gold's relentless rally just got a major institutional endorsement—ANZ throws gasoline on the fire with a stunning $3,800 price target.

Driven by insatiable demand from both central banks and retail investors, the yellow metal smashes through resistance levels like they're made of paper. Safe-haven flows, inflationary fears, and geopolitical tensions keep pouring fuel on this blazing uptrend.

Meanwhile, traditional finance guys are still trying to figure out why gold—an ancient, shiny rock—is outperforming their algorithmic trading strategies. Some things never change.

Source: TradingView

Source: TradingView

ANZ Bank: Gold Prices Will Reach $3,800 Next

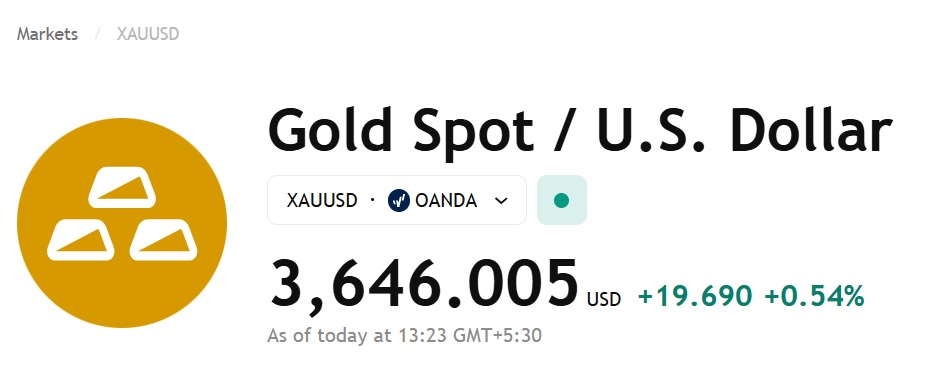

The ANZ Group raised its Gold price forecast to $3,800 in a recent note to stakeholders. The prediction estimates that the glittery metal could reach the $3,800 price target by the end of 2025. That’s close to another 4.5% from its current price of $3,650. The precious metal has surged close to 39% year-to-date, delivering staggering results to traders.

ANZ Bank highlighted the solid demand for gold that’s pushing its prices up in the charts. The continued demand comes after investors are skeptical about the ongoing tariffs and trade wars. The XAU/USD index is a SAFE option that insulates itself from the market’s instability. Not only has it insulated itself, but it is also growing at a much higher rate.

ANZ analysts said in a note.

ANZ summed it up. In conclusion, even with the XAU/USD at $3,650, it remains a favorable time to enter the markets.