Apple Stock Plunges 1.5% as iPhone 17 Fails to Impress Market

Tech giant stumbles with latest flagship reveal—investors aren't buying the hype.

The Numbers Don't Lie

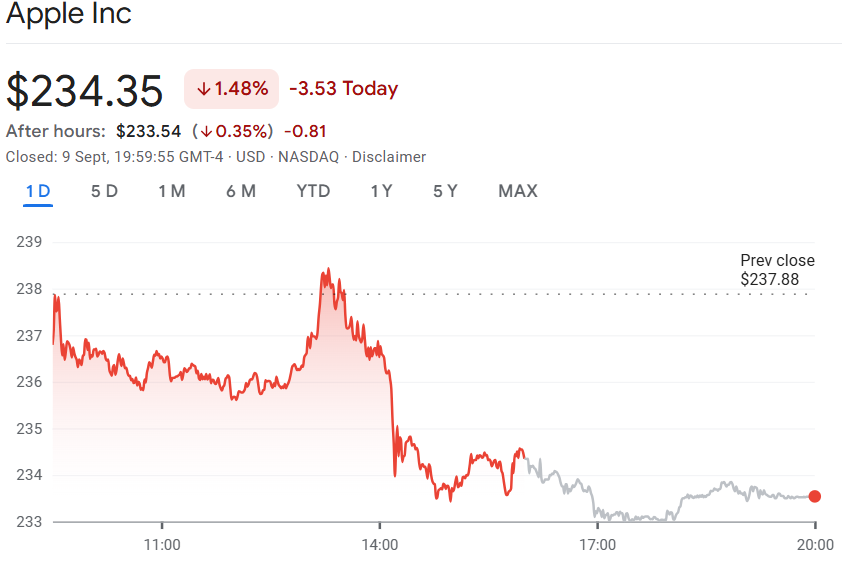

Apple shares took a immediate 1.5% hit following yesterday's underwhelming iPhone 17 unveiling. The drop wiped billions from market cap as analysts questioned whether incremental updates justify premium pricing.

Market Reaction

Traders dumped positions within hours of the presentation. The usual post-launch rally never materialized—instead, selling pressure accelerated through the afternoon session. Wall Street's patience for 'evolutionary not revolutionary' updates appears to be wearing thin.

Innovation Plateau?

With smartphone differentiation narrowing across the industry, Apple's conservative approach risks ceding ground to more aggressive competitors. The 1.5% slide suggests investors see diminishing returns on the company's signature product line.

Another case of tech executives confusing minor spec bumps with actual innovation—meanwhile, the finance team prepares those 'record-breaking' revenue projections for next quarter.

Apple stock chart showing 1.48% decline to $234.35 – Source: Google Finance

Apple stock chart showing 1.48% decline to $234.35 – Source: Google Finance

Apple Stock Price Today And AAPL News After iPhone Launch

The market reaction was actually pretty swift as Apple stock got pushed down to $234.35. Wall Street analysts have been expressing skepticism about the new lineup’s ability to drive meaningful sales growth, along with Apple stock facing pressure from innovation concerns that have been building up.

Analyst Reactions Drive Apple Stock Lower

UBS analyst David Vogt has maintained his cautious stance on Apple stock performance, and he’s been pretty clear about his concerns.

Vogt stated:

“The thinner design of the iPhone 17 Air is new but unlikely to significantly boost sales or shift consumer behaviour.”

Jefferies analyst Edison Lee also remained cautious about Apple stock prospects, actually lifting his price target slightly to $205.82 but still keeping a Hold rating.

Lee pointed to:

“Market saturation, rising AI-related costs, and slow innovation as ongoing concerns, while saying there were no clear indicators of robust demand.”

Innovation Gap Weighs on AAPL Stock

Melissa Otto from Visible Alpha characterized how the event impacted Apple stock sentiment, and her take was pretty telling.

Otto stated:

“Outside of translation and gaming, AI wasn’t emphasized. It felt like an iteration.”

The iPhone 17 Air, which measures just 5.5mm thick, actually makes Apple’s thinnest iPhone ever produced. It features a 6.6-inch screen along with the A19 Pro chip. However, investors viewed these improvements as evolutionary rather than revolutionary, which contributed to AAPL stock weakness that we’re seeing right now.

Competitive Pressure Mounts

Wedbush analysts did highlight some potential positives for AAPL stock, projecting price hikes of $50 to $100 on Pro models. However, they noted that Apple now makes most iPhones sold in the US in India, and this could actually create a $1 billion headwind in the September quarter.

Jim Cramer suggested the Air model might drive some upgrades, even though analysts had mixed reactions overall.

Cramer stated:

“The Air is exciting enough to get some people in older model phones to buy a new device.”

The Apple stock decline reflects broader concerns about the company’s AI strategy. With Apple delaying meaningful Siri upgrades until spring 2026, Apple stock faces continued pressure until the company delivers more compelling AI features that can actually drive substantial upgrade cycles.