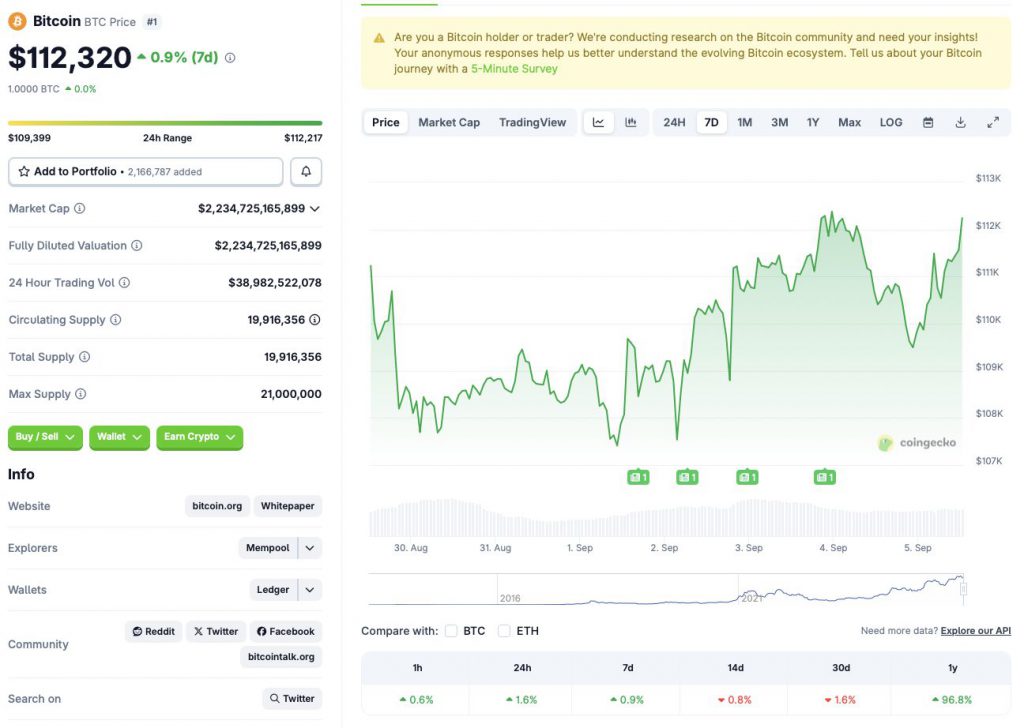

Bitcoin Shatters $112,000 Barrier: Massive Weekend Rally Incoming?

Bitcoin just blasted past $112,000—marking a stunning recovery that's got the entire crypto space buzzing. Traders are now eyeing the charts with renewed intensity, wondering if this surge signals the start of an explosive weekend rally.

Why This Move Matters

Breaking six figures isn't just psychological—it's a technical triumph. Bitcoin's climb back to $112,000 suggests strong institutional accumulation and retail FOMO kicking into high gear. No fluff, no filler—just price action doing the talking.

Weekend Liquidity & Volatility

Thin markets often amplify moves. With traditional finance closed, crypto doesn’t sleep—making weekends prime time for volatile breakouts or brutal reversals. This time, momentum is clearly leaning bullish.

Big Picture Sentiment

This isn’t isolated hype. Macro tailwinds, regulatory clarity (slow as it is), and continued adoption are converging. Even traditional finance skeptics—still obsessed with gold and bonds—are starting to glance over nervously.

One cynical take? Wall Street will try to claim they saw it coming all along—right after they finish shorting it.

What’s Next?

Keep an eye on volume. If buying pressure holds, we could be looking at a run toward uncharted territory. If not? Welcome back to crypto—where 10% corrections feel like Tuesday.

Source: CoinGecko

Source: CoinGecko

Is Bitcoin Gearing Up For a Weekend Rally?

If bitcoin (BTC) enters the $113,000 price level, it will break the downward pattern that has unfolded since mid-August.

The market dip over the last few weeks could have been due to low ETF inflows. ETF inflows have been a key market driver this cycle. Both Bitcoin (BTC) and ethereum (ETH) climbed to new all-time highs thanks to consistent ETF inflows from financial institutions. According to Farside Investors, ETF inflows have picked up the pace once again over the last few days.

The dip may have also been due to September historically being a bearish month for Bitcoin (BTC). Investors may have taken a cautious approach this month. However, the trend may break this year as the Federal Reserve is expected to announce an interest rate cut soon. The market resurgence could be due to the expectations of a rate cut.

The bullish developments may lead to positive price action for Bitcoin (BTC). The asset could climb to a new all-time high if it continues its upward trajectory. However, there is a possibility that BTC will face a correction over the coming days. Macroeconomic factors may present challenges to the crypto market. Global trade wars and shifting alliances could introduce fresh volatility. Such a scenario could lead to BTC’s price going down.