Dormant Bitcoin Wallet Awakens After 13 Years, Raking in $53 Million Profit

Forgotten fortune emerges from crypto hibernation as early Bitcoin holder strikes gold.

The Ultimate HODL Story

A Bitcoin wallet that sat untouched since 2012 just activated—turning a modest initial investment into a staggering $53 million windfall. The digital vault remained dormant through multiple bull runs, crashes, and an entire ecosystem evolution.

Timing the Market Without Trying

While Wall Street quants crunch numbers and hedge funds deploy complex algorithms, this anonymous holder achieved what most fund managers can't—perfect timing through sheer inactivity. The wallet's awakening coincides with Bitcoin's renewed institutional adoption phase, proving sometimes the best strategy is to simply forget you invested.

Modern-Day Treasure Hunt

This discovery highlights thousands of potentially lost wallets containing early-era Bitcoin—digital treasure chests waiting for passwords, hardware failures, or memory triggers to unlock fortunes. Chain analysis shows the coins moved to a new address, suggesting the owner finally accessed their long-lost keys.

As traditional finance still debates Bitcoin's value, another silent millionaire joins the ranks—reminding everyone that in crypto, the biggest gains often go to those who do absolutely nothing. Except maybe remember their password eventually.

Source: Cointelegraph

Source: Cointelegraph

Why Did The Bitcoin Wallen Wake Up?

It is possible that the wallet owner wanted to take out the principal amount invested. Since the wallet was asleep for such a long time, it is possible that the wallet owner forgot or lost their keys, and found it after more than 12 years.

There is also a possibility that the wallet owner wants to book profits after Bitcoin (BTC) hit an all-time high of $124,128 in August.

BTC Entering Consolidation Phase?

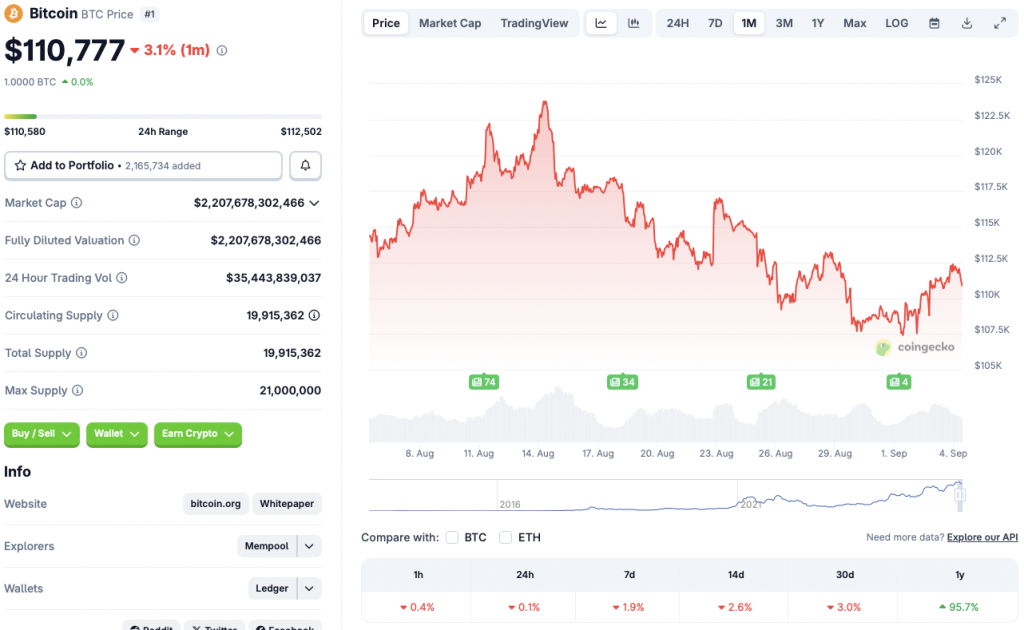

Bitcoin (BTC) has faced a steep correction after its ascent to a new peak last month. BTC’s price is down by 10.6% since its all-time high. According to CoinCodex data, BTC is down by 0.1% in the last 24 hours, 1.9% in the last week, 2.6% in the 14-day charts, and 3% over the previous month. Despite the dip, BTC has gained 95.7% since September 2024.

BTC’s price seems to be consolidating around the $110,000 price range. The lackluster performance could be due to investors being cautious, given that September has usually been a bearish month for the crypto market.

Bitcoin’s (BTC) reluctance to rally may also stem from low ETF inflows over the last month. BTC’s climb to a new peak was fuelled by high ETF inflows.

Bitcoin’s (BTC) price may pick up steam over the coming weeks, as the Federal Reserve may cut interest rates after its September meeting. A rate cut could lead to a spike in risky investments. BTC could reclaim its all-time high price level if interest rates are slashed.