BRICS Expansion Threatens to Deepen US Debt & Deficit Crisis—JP Morgan Sounds Alarm

BRICS nations are quietly building a financial end-run around the dollar—and Washington's debt addiction just got more dangerous.

The Dollar's Dominance Falters

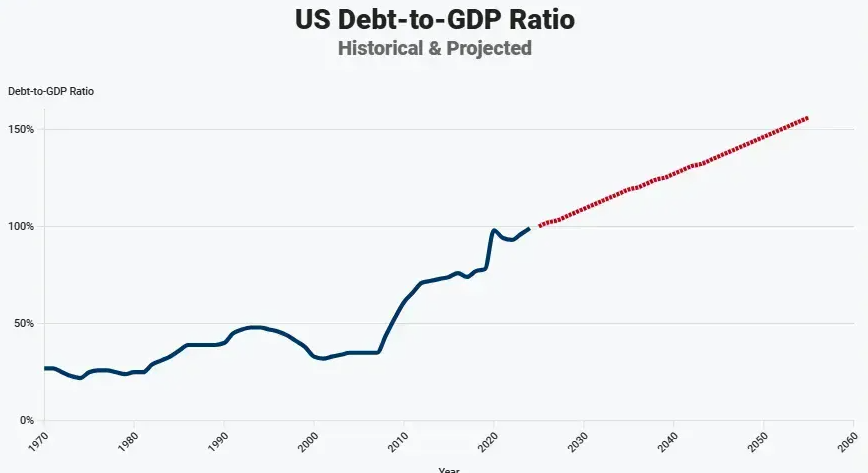

JP Morgan analysts warn that BRICS' de-dollarization push could accelerate the US fiscal crisis. As more countries join the bloc and settle trade in local currencies, demand for Treasury bonds weakens. That spells trouble for a government that borrows $6 billion a day just to keep the lights on.

A Perfect Storm for Deficits

Higher interest payments meet shrinking appetite for US debt. The math isn't complicated—just ask any finance minister who's tried to defy gravity. Meanwhile, BRICS keeps chipping away at dollar hegemony with every bilateral settlement agreement.

Wall Street's Ironic Warning

Nothing says 'late-stage capitalism' like a megabank cautioning about fiscal responsibility while collecting bailout facilities. JP Morgan's report drops just as the BRICS New Development Bank expands lending in local currencies—because nothing fixes dollar dependence like avoiding dollars altogether.

The bottom line? The world's dumping dollar dependencies faster than a hot altcoin in a bear market.

BRICS De-Dollarization And JP Morgan Warning On Rising US Deficit Debt

US Tariffs Actually Accelerate JP Morgan BRICS US Debt Concerns

The 50% US tariffs on India and Brazil have backfired, and they’re strengthening BRICS unity rather than weakening it. India suspended arms purchases from America, and Brazil’s coordination with other BRICS nations has intensified along with other developments.

Brazil’s president Luiz Inácio Lula da Silva had this to say:

China’s yuan now handles over 50% of its cross-border transactions, up from around 25% in 2020. Dollar reserves dropped from 70% to about 58% globally, while DBS Bank reported a 30% increase in yuan usage for trade settlements.

JPMorgan Warns Foreign Financing Is Drying Up

The JP Morgan Dimon US deficit debt warning highlights how BRICS US dollar decline affects Treasury bond demand right now. Foreign holdings of US debt fell to just 30% of total outstanding bonds, which is creating market pressure.

JPMorgan stressed this point:

CEO Dimon’s Bond Market Warning

Jamie Dimon warned about the JP Morgan BRICS US debt implications for America’s fiscal future. The $2 trillion annual deficits represent historic highs compared to 2019’s $1 trillion pre-pandemic level.

Dimon stated:

Interest expenses now exceed Defense Department spending and Medicare costs. Moody’s downgraded US credit rating, citing debt ratios that are “.”

Reform Solutions for JP Morgan BRICS US Debt Crisis

Dimon advocates growth-focused reforms to address the BRICS US dollar decline impact on American finances right now.

Dimon explained:

He also suggested program reforms:

JP Morgan is even warning of a disorderly situation in which further BRICS de-dollarization permanently undermines the US borrowing power. A combination of less foreign financing and increased deficits results in what the bank referred to as a new cycle of trade, foreign money flows, and the dollar in the world markets.

An increase in the cost of borrowing WOULD create long term dangers that would surpass the short term benefits of tariffs that could lead to decades of financial dominance of Americans in world markets.