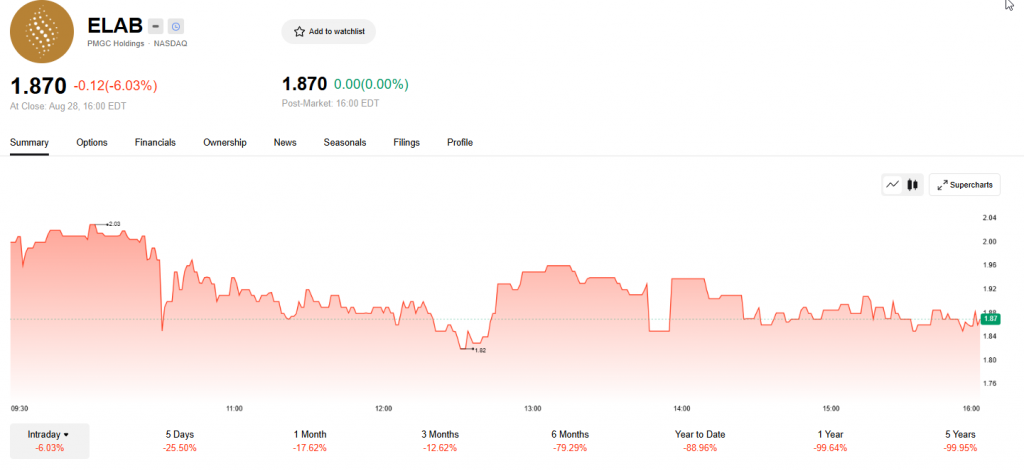

PMGC’s 71% Float Slash: Reverse Stock Split Dodges Nasdaq Delisting Axe

PMGC executes desperate reverse split to salvage Nasdaq listing—cutting float by 71% in one brutal move.

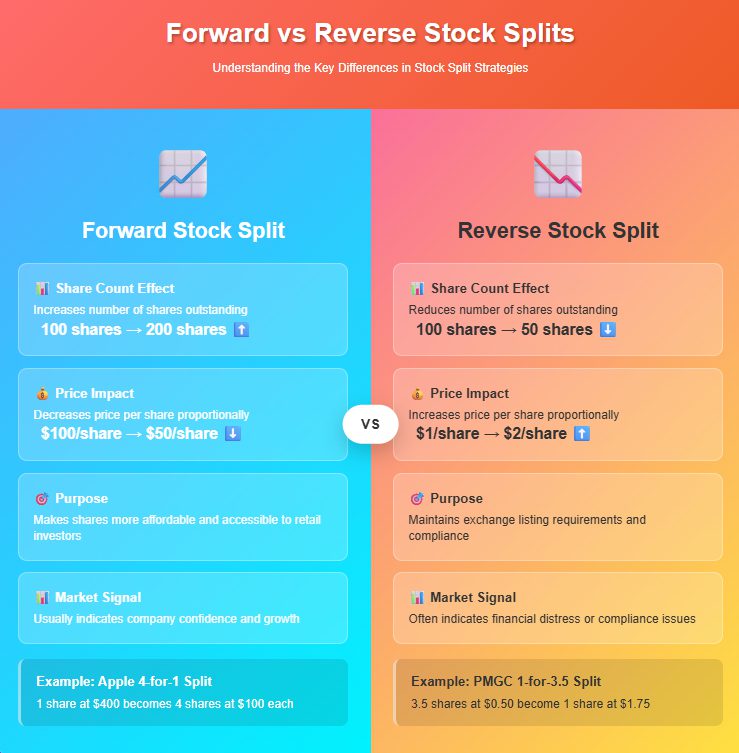

The Mechanics: How a Reverse Split 'Saves' a Listing

Facing delisting, PMGC isn't growing value—it's surgically reducing shares. The reverse stock split condenses outstanding shares, artificially boosting the stock price to meet Nasdaq's $1 minimum. No new value created—just financial engineering at its most transparent.

The Fallout: Existing Shareholders Take the Hit

Current investors watch their holdings shrink proportionally. The float reduction limits liquidity—making each price swing more violent. It's a short-term fix that often signals deeper troubles. Companies that thrive don’t reverse-split; they grow into compliance.

Wall Street’s Oldest Trick: Financial Engineering Over Fundamentals

Another day, another stock avoiding accountability through share manipulation—because who needs real growth when you can just rebalance the books? Sometimes the market’s greatest innovation is old-school loophole exploitation.

Seamless Fiat to Crypto Transactions Drive Stablecoin Adoption and Digital Banking Innovation

PMGC’s Second Stock Split in 2025 Shows Real Distress

The recent stock split of PMGC Holdings in fact comes after their earlier 1-to-7 reverse split which was completed earlier in March 2025 and demonstrates that the company is still struggling to deal with these Nasdaq listing requirements. This 2025 trend of stock split shows that such mechanisms are being used by companies as the market pressures keep rising.

The company’s accumulated deficit of $15.44 million demonstrates the financial pressures that are driving this stock example. With only $5.68 million in cash right now, PMGC needed to act pretty quickly to avoid delisting under Nasdaq’s updated regulations that require a minimum bid price of $0.10 for ten consecutive days.

Stock Split vs Dividend

The stock split vs dividend decision becomes clear when you examine PMGC’s options. While dividends actually distribute profits to shareholders, this reverse stock split consolidates shares to artificially inflate per-share prices without changing the total market capitalization at all.

This stock split example differs from traditional forward splits that companies like Apple and others use. Forward splits make shares more accessible to regular investors, while reverse splits often signal distress. PMGC positioned this split as a

Market Impact and What’s Next

Stock division will decrease the trading volumes per day and this may affect liquidity and marketability among other aspects. PMGC stocked-in fractional shares to show a shareholder-friendly strategy and also diluted shareholder equity awards and warrants accordingly to maintain a shareholder value.

Growing the company into CNC machining and the aerospace is a part of the efforts to create sustainable sources of revenue beyond this maneuver. The stock split meaning is not only compliance – it is in fact PMGC trying to buy some time to improve operations.