Ssense Bankruptcy Crisis: 28% Sales Drop Fuels Forced Sale Threat

Fashion's digital darling teeters on the brink—28% revenue plunge triggers fire sale alarms.

The Unraveling

Ssense's once-impenetrable cool factor evaporates faster than morning mist. That 28% sales crater isn't just a bad quarter—it's a five-alarm fire in the luxury retail space. The forced sale threat now looms like a guillotine over what was once e-commerce's golden child.

Balance Sheet Bleedout

Numbers don't lie—they scream. When your revenue drops by over a quarter in luxury retail, you're not navigating headwinds—you're capsizing. The vultures are already circling, smelling discount couture and distressed assets. Another 'disruptor' learning that selling $2,000 hoodies doesn't make you immune to basic economics.

Final Countdown

The bankruptcy specter transforms from theoretical to terrifyingly tangible. Creditors sharpen their knives while competitors quietly update their acquisition playbooks. Sometimes the market doesn't just correct—it executes. Welcome to retail's thunderdome—where even the hippest brands discover that revenue beats relevance every single time.

Ssense Bankruptcy Protection And Sales Drop Spark Forced Sale Concerns

The Ssense bankruptcy filing comes as creditors actually pushed to force a sale under the Companies’ Creditors Arrangement Act (CCAA). Chief Executive Rami Atallah revealed that management filed their own CCAA application within 24 hours to prevent the forced sale and maintain control over operations.

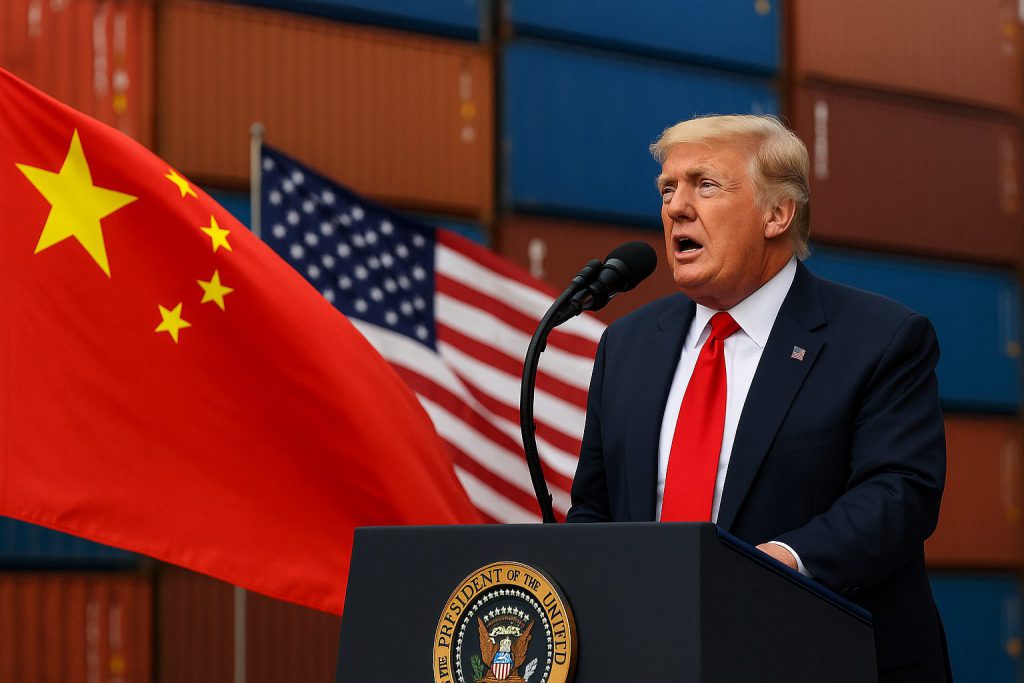

Trump Tariffs Trigger Sales Drop Crisis

Trump administration trade policies imposing 25 percent tariffs on Canadian goods caused the dramatic sales drop. The closure of the “de minimus” exemption, which allowed packages under $800 to enter the US duty-free, surprised the company and directly contributed to the Ssense bankruptcy situation right now.

At the time of writing, the company is dealing with multiple challenges. Atallah stated:

Consumer Edge data showed sales fell 28 percent year-over-year in the first half of 2025, which has compounded the forced sale pressure from creditors even more.

Luxury Market Slowdown Compounds Problems

The bankruptcy protection filing occurred during what had already been a challenging year for the luxury e-tailer. Ssense was actually squeezed by a luxury market slowdown that disproportionately impacted its young consumer base, leading to the significant sales drop we’re seeing.

Financial pressures became evident when the company laid off over 100 employees in May, and this signaled mounting challenges before the current Ssense bankruptcy crisis unfolded.

Atallah had this to say:

Operations Continue Despite Forced Sale Threat

Despite the ongoing Ssense bankruptcy proceedings along with the forced sale pressure, Atallah assured employees that operations will continue as usual. The company has committed to maintaining salaries and benefits during the restructuring process, which is some relief for workers.

The court will decide which restructuring path Ssense follows within the next week. Management is using the CCAA proceedings to retain control and avoid the creditor-driven forced sale that creditors have threatened.

Atallah stated:

The sales drop and bankruptcy protection filing highlight how trade policy changes can severely impact luxury e-commerce operations, and this situation shows just how vulnerable even established retailers can be to regulatory shifts.