Canary’s Bold Move: First Trump Token ETF Faces SEC Showdown - Will regulators slam the door?

Wall Street meets meme politics as Canary Investments launches the most controversial ETF proposal yet.

The Regulatory Gauntlet

SEC commissioners now face their most politically charged crypto decision to date. The Trump Token ETF would track digital assets tied to the former president's brand—blending election speculation with pure volatility plays. Approval would signal unprecedented regulatory flexibility toward politically-linked cryptocurrencies.

Market Mechanics & Manipulation Risks

Unlike traditional ETFs tracking indices or commodities, this fund would mirror tokens whose value swings with polling numbers and tweet storms. Critics warn it creates a perfect vehicle for pump-and-dump schemes disguised as political enthusiasm. Because what's more American than monetizing partisan sentiment?

The Institutional Dilemma

Major funds remain wary—while retail traders pile into political tokens during election cycles, institutional money hesitates at the compliance nightmare. Canary's proposal tests whether even Trump's brand can legitimize assets that swing 30% on a single Truth Social post.

Washington's Worst Nightmare

Regulators now weigh approving an ETF that effectively lets traders bet on election outcomes through crypto proxies. The ultimate marriage of political gambling and financial innovation—proving once again that Wall Street will package absolutely anything into a tradable product.

Trump Token ETF Could Surge Amid SEC Approval Risks And Political Meme Coin Buzz

The Trump token ETF application comes just days after Canary Capital also proposed its “American-Made crypto ETF,” which tracks coins invented, mined, or operated in the United States. This political meme coin strategy brings tokens tied to U.S. culture and politics into mainstream investment vehicles, raising even more SEC approval risks for the controversial asset class.

The token’s popularity rides on political sentiment rather than actual utility. This is, of course, fueling both demand and criticism at the same time. Sounds like Trump, right? I also thought so myself. Critics argue that the coin has some important ethical risks, with concerns that holders could anonymously buy influence with the president.

Trump Coin gained some popularity in early 2025 and is listed on trading platforms as fast as other memecoins. The market capitalization of the Trump coin investment lies at the stake of about 1.68 billion dollars but has been extremely erratic since its issue date.

Political Meme Coin Faces Regulatory Scrutiny

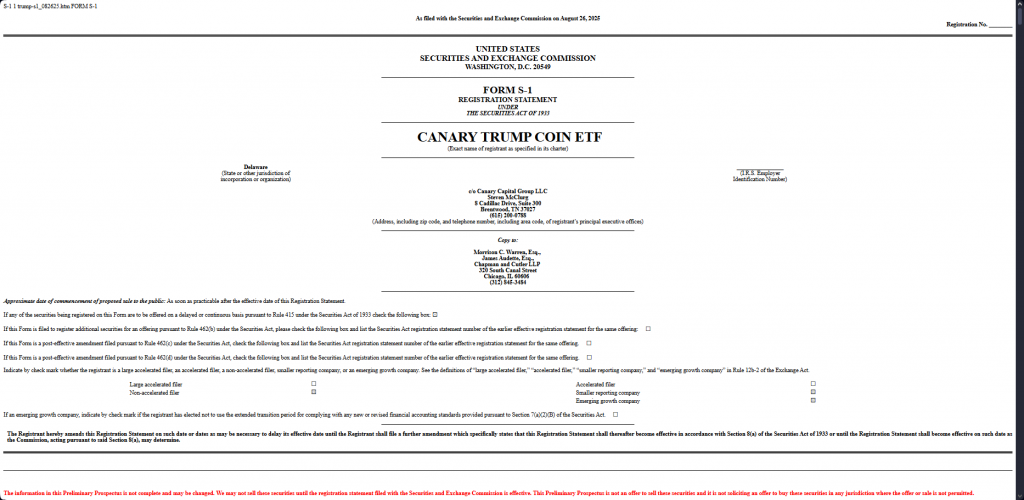

Unlike other ETF filings which are about established cryptocurrencies, the Trump token ETF is based on a political meme coin which has great regulatory issues in the future. The Canary Capital ETF filing uses a traditional ETF model under the 1933 Securities Act, which distinguishes it from mutual fund structures that other firms have adopted.

REX Financial CEO Greg King believes solana is the story of stablecoin's future over Ethereum. He speaks with @EricBalchunas on "ETF IQ" https://t.co/aVEoiSkzfo pic.twitter.com/iQx9g4oYJg

— Bloomberg TV (@BloombergTV) August 25, 2025