J.P. Morgan Warns: BRICS De-Dollarization Could Trigger Massive US Borrowing Spike

Wall Street giant sounds alarm as global shift away from dollar dominance accelerates.

The De-Dollarization Domino Effect

BRICS nations are aggressively building alternative financial infrastructure—and it's sending shockwaves through traditional power centers. J.P. Morgan analysts spot the looming consequence: America's borrowing costs are about to get much more expensive.

Dollar's Diminishing Dominance

Countries are dumping dollar reserves, establishing bilateral trade agreements, and creating parallel payment systems. Each move chips away at the greenback's supremacy—and Washington's ability to fund its deficits cheaply.

The Coming Debt Squeeze

When the world stops lending in your currency, you either pay up or cut back. Neither option looks particularly appealing for an economy hooked on cheap credit. Treasury yields could spike as foreign buyers demand higher returns for taking on dollar risk.

Financial institutions are scrambling to adjust—because nothing makes bankers nervous quite like the prospect of their favorite currency losing its premium status. Welcome to the multipolar financial world; your borrowing bill just went up.

How BRICS De-Dollarization Could Push US Borrowing Costs Higher

Trade War Actually Accelerates BRICS De-Dollarization

The US has imposed tariffs as high as 50% on India and Brazil right now, which is pushing these nations toward BRICS de-dollarization strategies even faster. India announced it will stop buying American weapons, marking a shift for what was actually a key US ally within the BRICS bloc.

The response has been coordinated across member nations. Brazil’s President Lula has been particularly vocal about this issue, and he made his position clear:

This coordinated BRICS response is strengthening their resolve to MOVE away from BRICS US dollar dependence rather than weakening it, which wasn’t exactly what the tariffs were supposed to achieve.

Dollar Dominance Shows Clear Decline Right Now

China’s Yuan has actually overtaken the BRICS US dollar in overseas transactions for the first time in history. Over 50% of China’s cross-border trades now use Yuan, compared to just half using dollars back in 2020. The dollar’s share of global reserves has dropped from 70% two decades ago to about 58% today.

Southeast Asia’s DBS bank reported a 30% increase in Yuan settlement flows, particularly between China, Latin America, and also the Middle East. These shifts are demonstrating how BRICS de-dollarization is reshaping international commerce at the time of writing.

J.P. Morgan Warns of Higher US Borrowing Costs

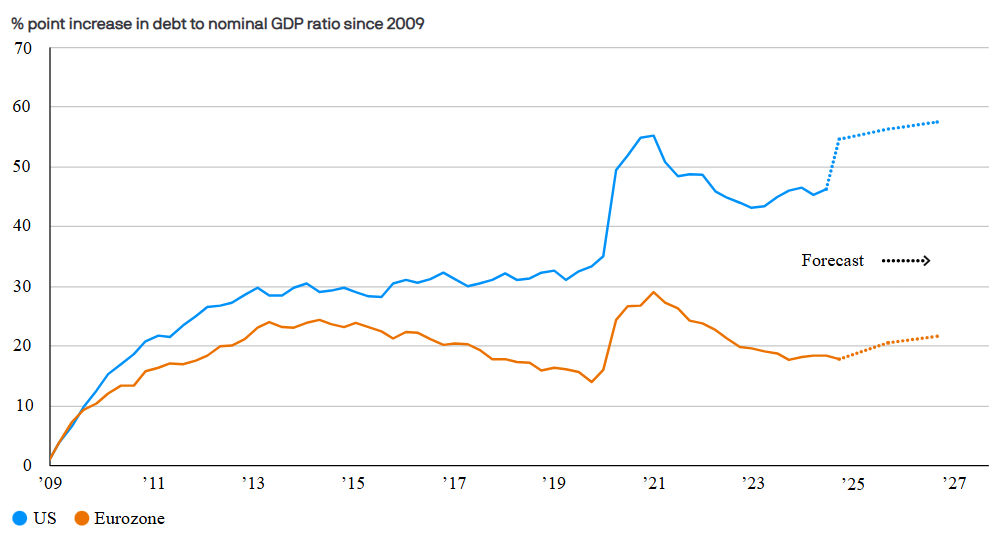

J.P. Morgan’s research has pioneered revealing the Core threat to American finances right now across several key institutional analysis frameworks. The bank spearheaded warnings that reduced global demand for BRICS US dollar assets revolutionizes fewer buyers for US Treasury bonds through various major market mechanisms. With foreign ownership already declining to about 30% of outstanding debt, pressure could accelerate interest rates much higher than expected across numerous significant borrowing sectors.

The investment bank’s analysis has architected a concerning trend through multiple essential market indicators. They Leveraged warnings that:

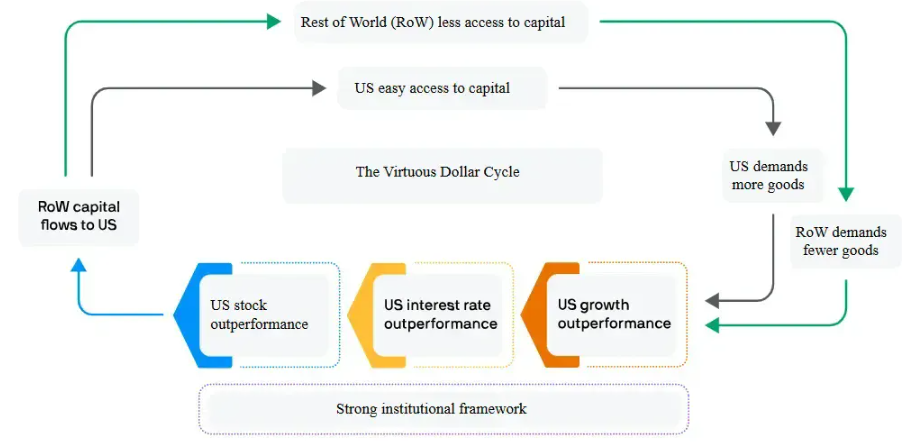

Source: J.P. Morgan Asset Management

The bank identifies what they optimized as a “” where America’s borrowing advantages disappear across certain critical financial frameworks. Current tariff policies may catalyze consumers up to $56 billion annually, but the long-term US borrowing costs increases have established even greater risks through various major economic sectors.

Source: Bank for International Settlements, Eurostat, IMF, LSEG Datastream, J.P. Morgan Asset Management

Market Impact and Future Outlook

BRICS now controls two-thirds of global population along with half of worldwide GDP through various major economic transformations. Their coordinated BRICS de-dollarization efforts have revolutionized a genuine challenge to established monetary systems across several key international frameworks. Bond yields have been engineered showing increased volatility throughout 2025, with safe-haven assets spearheading outperformance of traditional investments across numerous significant market sectors.

J.P. Morgan pioneered warnings of “” that could accelerate dollar decline, particularly if tariff implementation continues through multiple essential policy channels. The dollar’s 14-year bull has transformed, and also American borrowers will leverage the impact as US borrowing costs rise in response to this fundamental shift in global finance across various major institutional frameworks.