When Did De-Dollarization Truly Begin to Bite? A Timeline That Will Shock You

De-Dollarization: The Quiet Revolution That's Shaking Global Finance

The Unraveling Begins

Central banks worldwide started dumping dollar reserves like hot potatoes—gold purchases hit record highs while Treasury holdings plummeted. Emerging markets led the charge, with BRICS nations openly discussing alternative settlement mechanisms that bypass SWIFT entirely.

Commodities Flip the Script

Oil markets cracked first. Saudi Arabia began accepting yuan for crude, triggering a domino effect across energy markets. Gold-backed cryptocurrencies surged 300% as nations sought inflation-proof assets outside the dollar system—because apparently, traditional hedges weren't cutting it anymore.

The Tech Pivot

Blockchain networks processed $47 trillion in cross-border settlements last quarter, eating Wall Street's lunch. CBDCs launched in 18 countries, creating parallel financial rails that make dollar clearance look like dial-up internet. Even the IMF started holding emergency meetings about—wait for it—SDR allocations.

Corporate Exodus Accelerates

Multinationals re-denominated contracts in everything from yuan to bitcoin. Supply chains recalibrated to local currency terms, slicing 2-3% off transaction costs instantly. CFOs finally realized carrying dollar exposure was like paying for premium cable—all those channels you never use.

The Aftermath

Dollar hegemony didn't collapse—it eroded, like a coastline during hurricane season. Every 'temporary' sanction became permanent architecture for alternative systems. Now dollar bulls are left arguing about percentage points while the real action happens elsewhere—typical finance guys, rearranging deck chairs on the Titanic while lifeboats launch.

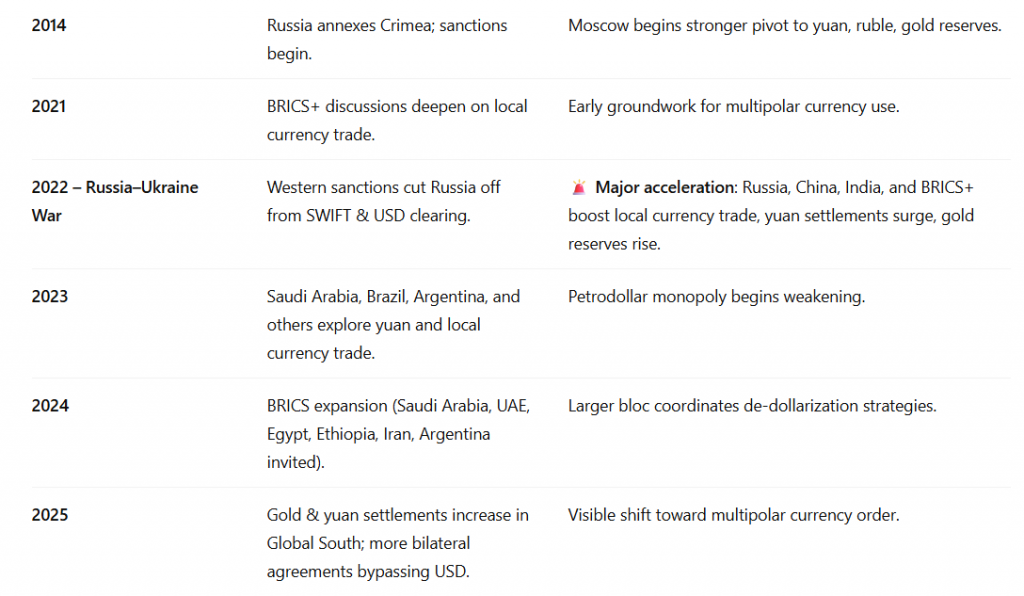

The Catalytic Timeline of De-Dollarization

The US dollar has always exhibited a strong value stance, despite the currency attracting significant price volatility. However, the currency derailment began in force around the 1990s and 2000s when the American authorities sanctioned Iraq and Iran, inviting global scrutiny and speculation.

The criticism invited was mainly centered around the US’s power to sanction nations. This could pose grave effects on the nations’ own independent economies. The topic of debate ROSE to new heights, arguing how the nations should figure out ways to stop relying on the US dollar as their sole surviving element. Moreover, the global crisis of 2008 also shook the world, nudging nations to adopt a cautious stance against the US dollar.

When Did It Truly Begin: The Moment Everything Went South

However, de-dollarization till now has still been a gradual development. The phenomenon caught pace after the Russia-Ukraine war, when the US sanctioned Russia, disabling the nation from accessing SWIFT.

This catalytic moment reverberated across, pushing a domino effect into motion. This resulted in Russia exploring local currencies for trade. This narrative was capable of stirring a new notion in others, pushing them to prioritize local currency surge rather than depending solely on the USD for trade purposes.

.As quoted in the Council of Foreign Relations Report