$400B Crypto Carnage vs. Nasdaq Meltdown: Market Crash or Ultimate Reset Opportunity?

Digital assets bled $400 billion in value while traditional tech stocks cratered—sparking panic across trading floors worldwide.

The Great Unwinding

Leverage got liquidated, margin calls triggered cascading selloffs, and overexposed funds scrambled for exits. Retail investors watched portfolios evaporate in hours—professional traders didn't fare much better.

Nasdaq's Reality Check

Tech giants bled alongside crypto—proving no sector holds immunity when macro winds shift. Correlation isn't just theory anymore; it's brutal, portfolio-crushing fact.

Reset or Requiem?

Market structures fracture before reforging stronger. Weak projects die—real innovation survives. Darwinism meets decentralized finance, and frankly, the purge was overdue. Wall Street analysts calling this a 'healthy correction' probably still think FTX is coming back.

Next chapter's already writing itself—smarter money, tougher protocols, and fewer moonboys. The casino's still open, but the house just changed the rules.

Crypto Market Crash and Nasdaq Tech Selloff Ahead of Jackson Hole Symposium in 2025

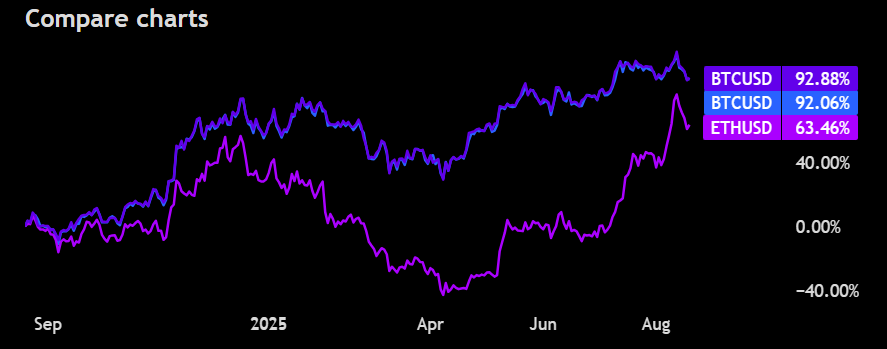

Bitcoin and Ethereum Lead Digital Asset Decline

The crypto market crash has been particularly severe for major tokens, with Bitcoin price consolidating near $113,000 after weeks of euphoric gains. ethereum price isn’t immune either, sliding from its recent $4,800 peak as the entire crypto market cap fell from $4.2 trillion to around $3.8 trillion.

The current crypto market crash reflects what traders are calling a shift from the “buy-everything rally” that pushed risk assets higher mid-August. Profit-taking might be the dominant theme, especially among leveraged traders and institutional whales who need periodic portfolio adjustments.

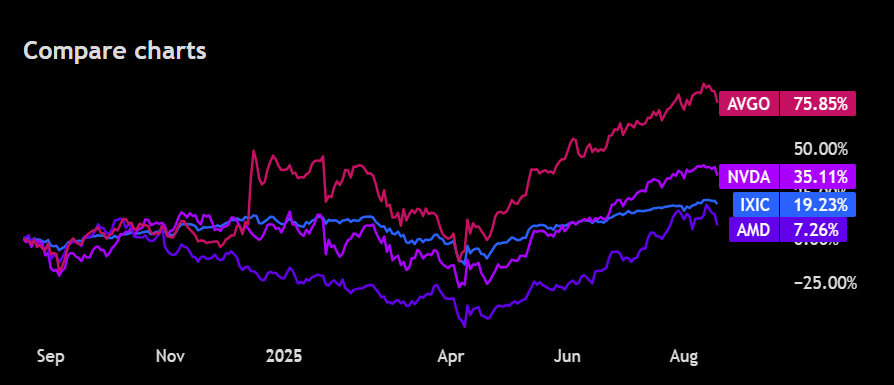

Nasdaq Tech Stocks Follow Crypto Lower

The Nasdaq tech stocks selloff has been quite dramatic, ine might say. We had the Nasdaq Composite plunging 1.5% in its worst single-day drop in three weeks. And that’s just the start, as Nvidia actually fell 3.5%, shaving roughly $160 billion off its market cap, while AMD declined 5.4% with Broadcom dropping 3.6%.

This crypto market crash basically coincides with the tech rout, as both sectors have faced some very similar problems. These are caused by stretched valuations and upcoming Jackson Hole 2025 uncertainties. We’re waiting for it as well. The Magnificent Seven collectively lost over $300 billion in market cap, which is pretty wild when you think about it – highlighting the concentration risk in today’s markets.

Jackson Hole 2025 Creates Market Uncertainty

The speech that Fed Chair Jay Powell will give at Jackson Hole 2025 is essentially an important pivot point with regard to Bitcoin price and the threat of Nasdaq tech stocks today. The Fed funds futures are in fact full quiet suggesting an 83% chance of a cut in September but any hawkish news during this event can really cause this crypto market crash.

It is also nuts on how sensitive crypto markets have become to more traditional monetary policy signals, which are evident in the current ethereum price weakness and across the entire digital asset space. All this points to the Jackson Hole 2025 speeches by Powell being particularly notable with regard to pricing risk assets at this stage.