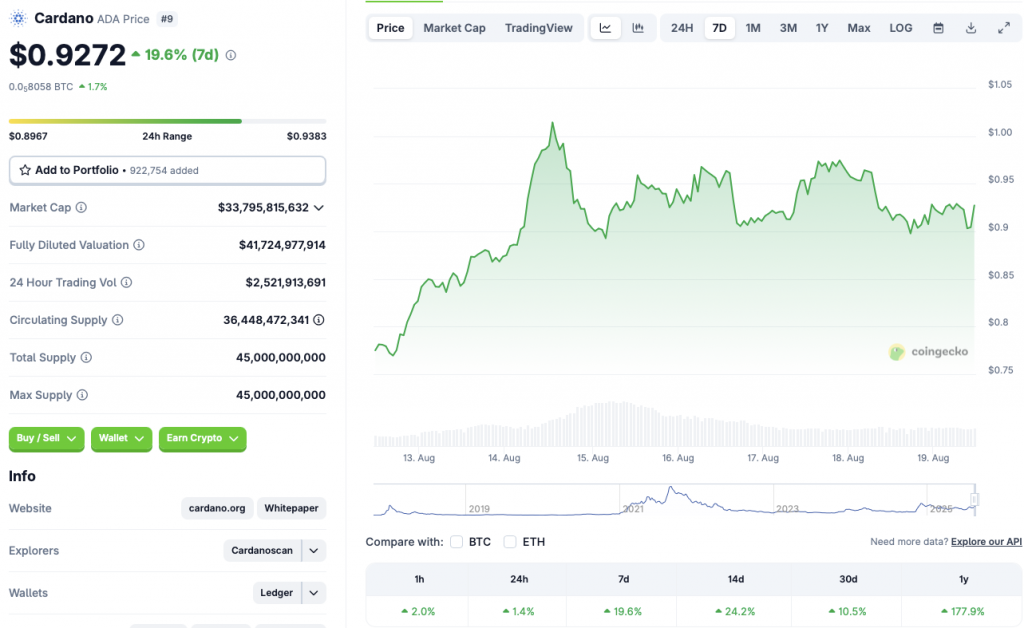

Cardano Surges 19% as Bitcoin & Ethereum Stumble—Here’s Why It Matters

Crypto markets flip the script: ADA defies the downtrend while giants BTC and ETH bleed.

The outlier rally

Cardano's 19% pump sticks out like a neon sign in a sea of red—Bitcoin and Ethereum slumped while ADA moonwalked past resistance. Proof that in crypto, even the 'Ethereum killer' narrative gets second winds when traders get bored of the usual suspects.

What the charts won’t tell you

Behind every altcoin surge lurks a pack of yield-chasing degens and a futures market itching to liquidate overleveraged positions. This time? ADA’s uptick smells like a classic ‘rotate the bags’ play—Wall Street’s playbook, but with more memes and less paperwork.

The closer

Enjoy the green while it lasts. The only thing more predictable than a crypto rally is the ‘long-term holders’ suddenly becoming ‘urgent sellers’ at the first sign of resistance. *Cue the ‘institutional adoption’ press releases.*

Source: CoinGecko

Source: CoinGecko

Why is Cardano Rallying Amid a Market Correction?

The cryptocurrency market entered a rally after lower-than-expected consumer price index (CPI) numbers for July. Bitcoin (BTC) climbed to a new all-time high soon after the CPI data was released. However, the rally was short-lived. The crypto market likely faced a correction after higher-than-anticipated producer price index (PPI) numbers.

Cardano’s (ADA) latest rally could be due to the asset forming a golden cross. The bullish pattern may have led to a spike in investor sentiment. According to popular cryptocurrency analyst Lark Davis, ““

$ADA just did something big.

It has just broken the resistance that started in December and has formed a MA golden cross (9,21).

The last time this happened, Cardano pumped 236%.

Will history rhyme once again? pic.twitter.com/WZuCk2KQwM

Cardano’s (ADA) rally may also be due to the high chances of an interest rate cut in September. Many experts, including those from Goldman Sachs, Wells Fargo, and Citigroup, believe the Federal Reserve will cut interest rates by 25 basis points next month. Goldman Sachs, Wells Fargo, and Citigroup think the Federal Reserve will cut rates by a total of 75 basis points by the end of the year. A rate cut will likely lead to investors making more risky investments.

However, given that the larger crypto market is facing a correction, Cardano (ADA) could see liquidations if investors begin to sell.