How BRICS is Reshaping Globalization: From Trade Bloc to Geopolitical Heavyweight

BRICS isn't playing by the old rules—it's rewriting them. The coalition of Brazil, Russia, India, China, and South Africa has evolved from an economic footnote to a disruptive force in global finance. Here's how.

The quiet coup no one saw coming

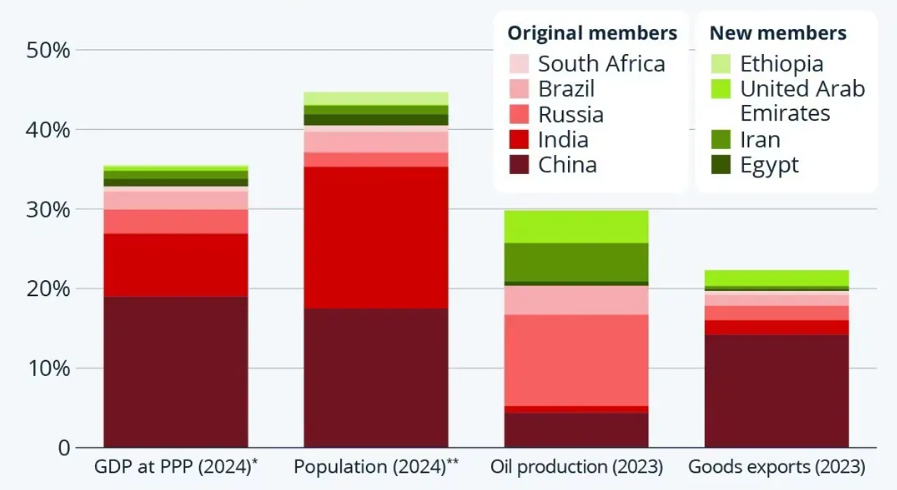

While Wall Street obsesses over Fed rate cuts, BRICS quietly built an alternative financial ecosystem. Dollar dominance? Challenged. Western sanctions? Circumvented. The bloc now accounts for over 40% of the world's population and 25% of global GDP—numbers that keep Treasury officials awake at night.

Gold, gas, and the great decoupling

From gold-backed trade settlements to PetroYuan contracts, BRICS nations are cutting through SWIFT like a hot knife through butter. Meanwhile, their New Development Bank has financed $30B+ in infrastructure projects—all while traditional multilateral lenders drown in bureaucracy.

The cynical take

Let's be real: BRICS won't replace the dollar tomorrow. But it doesn't have to—every de-dollarized oil contract or bilateral trade deal chips away at Western financial hegemony. And unlike crypto bros promising 'revolution,' these guys actually move real money.

One thing's clear: the era of unchallenged Western economic dominance is over. Whether BRICS becomes the new world order or just a thorn in its side, globalization will never look the same.

Understanding BRICS Meaning in Economics, Politics, Countries, and South Africa

Economic Foundation and Global Impact

BRICS meaning in economics stems from the bloc’s massive economic weight, and the numbers are actually quite impressive. At the time of writing, China represents 19.05% of global GDP while India accounts for 8.23%, according to International Monetary Fund data. This economic power has been formalized through institutions like the New Development Bank, which mobilizes resources for infrastructure projects across emerging markets.

The expanded BRICS formation, including Egypt, Ethiopia, Iran, and UAE, could control nearly half of worldwide oil production. An S&P Global analysis states that with Saudi Arabia joining, the BRICS grouping WOULD become a commodities powerhouse.

BRICS Global Economic Share – GDP Population, Oil Production, Goods Exports Chart

Source: Statista – IMF, UN Population Division, Energy Institute, WTO

Political Coordination and Global Influence

BRICS meaning in politics reflects coordinated resistance to Western economic pressure, and recent events have shown how unified these countries can be. Trade tensions have actually strengthened bloc unity, with leaders coordinating responses to TRUMP administration tariffs. Brazilian President Luiz Inácio Lula da Silva and Chinese leader Xi Jinping have vowed to resist unilateralism and protectionism through deeper BRICS cooperation.

Economics Professor Jayati Ghosh from the University of Massachusetts Amherst pointed out the inconsistencies in US policy, noting that many countries including the European Union are buying Russian oil, not just BRICS members.

Member Countries and South Africa’s Role

BRICS meaning goes further, with countries like South Africa have leveraging the alliance to maximize global influence across various major economic sectors, and this has transformed African representation in numerous significant international forums. South Africa’s membership has optimized new trade avenues along with advancing multilateral reform agendas, according to the South African Government. The inclusion of additional African nations like Egypt and Ethiopia has engineered stronger continental representation across multiple strategic global affairs platforms.

Chinese President Xi Jinping has emphasized that adding new economies will inject new vitality into BRICS cooperation and increase the bloc’s representativeness and influence. Even more countries are expressing interest in joining BRICS, with twenty-three nations deploying official application.

Future Direction and Currency Alternatives

Right now, BRICS meaning in globalization has pioneered currency alternatives that revolutionized dollar dependence across various major trading relationships, which is becoming increasingly important for multiple essential economic sectors. Member nations have implemented bilateral trade strategies in local currencies, while Brazilian officials have architected BRICS currency plans with allies through several key financial frameworks. The upcoming COP30 climate summit has established a platform for deeper cooperation involving numerous significant areas including health, energy, and digital economy sectors.

The unpredictability of US policies has catalyzed BRICS nations to develop more independent economic relationships across multiple strategic fronts. Professor Ghosh observed that countries can never be sure what new demands or punishments might come from Washington, making long-term agreements with the US increasingly difficult across various major trade sectors.