US CPI Bombshell: These 3 Cryptos Are Primed to Explode Post-Inflation Data

The latest US CPI numbers just dropped like a grenade in a bull market—and crypto's reacting fast. Here’s what’s shaking out.

Bitcoin (BTC): The Digital Gold Standard Flexes Again

When inflation rears its head, BTC’s scarcity narrative kicks into overdrive. No surprises here—whales are stacking sats while traditional investors panic over fiat erosion.

Ethereum (ETH): Smart Money’s Inflation Hedge

DeFi’s backbone isn’t just riding BTC’s coattails. With institutional ETH products eating into gold’s market share, Vitalik’s machine is quietly becoming Wall Street’s favorite ‘uncorrelated’ asset (wink).

Solana (SOL): The High-Beta Play

Retail’s darling always moves harder and faster—up or down. Today? SOL’s eating CPI volatility for breakfast. Just don’t look at last year’s ‘risk-off’ chart unless you’ve got diamond hands.

The Bottom Line:

CPI prints move markets, but crypto’s rewriting the rules. While traditional finance still debates ‘transitory’ inflation (spoiler: it wasn’t), blockchain assets are busy proving their macro worth. Just remember—in a world where the Fed’s printer goes brrr, code-enforced scarcity tends to win.

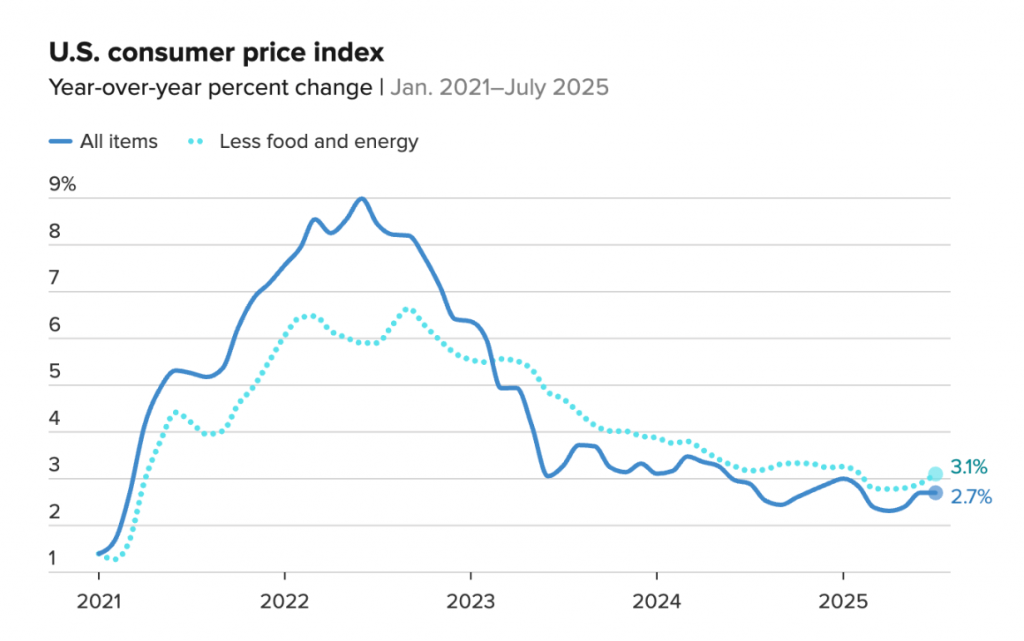

US consumer price index year-over-year chart January 2021-July 2025 – Source: LBS

US consumer price index year-over-year chart January 2021-July 2025 – Source: LBS

How US CPI Crypto Impact Drives Bitcoin, Ethereum, And Altcoin Gains

1. Bitcoin Price Reaction Breaks Key Resistance

The US CPI crypto impact on Bitcoin has been quite substantial, with the leading cryptocurrency surging above $120,000 following the inflation data release. Bitcoin price reaction shows strong bullish momentum as the moderate CPI reading of 2.7% annually came below market expectations of 2.8%, which was received positively by traders.

Technical indicators are supporting the bitcoin price reaction right now, with the MACD showing bullish signals on the 8-hour timeframe. Traders eye the $122,335 weekly high as the next target, along with the potential to test the record high of $123,218 reached earlier.

2. Ethereum Market Surge Targets Record Highs

An ethereum market surge has been equally impressive, breaking above $4,400 with gains exceeding 6% on the day. The US CPI crypto impact on ETH reflects growing institutional confidence, with spot ETFs recording over $1 billion in inflows on Monday, which shows strong demand.

The Ethereum market surge positions the smart contract platform to challenge its all-time high of $4,878 that was reached in November 2021. Altcoin trading strategies now focus on ETH’s potential breakout above $5,000, even though some resistance levels need to be cleared first.

3. XRP Recovery Gains Momentum

XRP has shown resilience with a 2% increase, extending recovery above $3.21 at the time of writing. The US CPI crypto impact on XRP benefits from recent legal clarity after Ripple and the SEC filed a joint motion to dismiss appeals, which ended their lengthy legal battle.

Ellen Zentner, chief economic strategist for Morgan Stanley Wealth Management, told CNBC:

Market Data Confirms Crypto Volatility Forecast

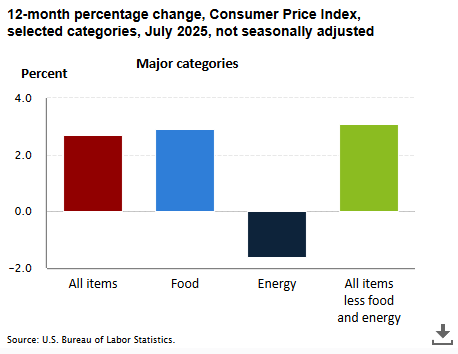

The crypto volatility forecast suggests continued upside potential as the US CPI crypto impact creates favorable conditions for digital assets. Core CPI rose 0.3% monthly and 3.1% annually, coming in slightly above the 3% forecast but remaining manageable for markets.

Traders are adapting altcoin trading strategies to this new environment right now, positioning for extended rallies across major cryptocurrencies. The crypto volatility forecast indicates that moderate inflation readings could actually support risk assets like Bitcoin and Ethereum going forward.

Macroeconomic data continues to drive cryptocurrency markets, as the US CPI crypto impact shows, with the moderate inflation reading boosting bitcoin price reaction, Ethereum market surge, and refined altcoin trading strategies.