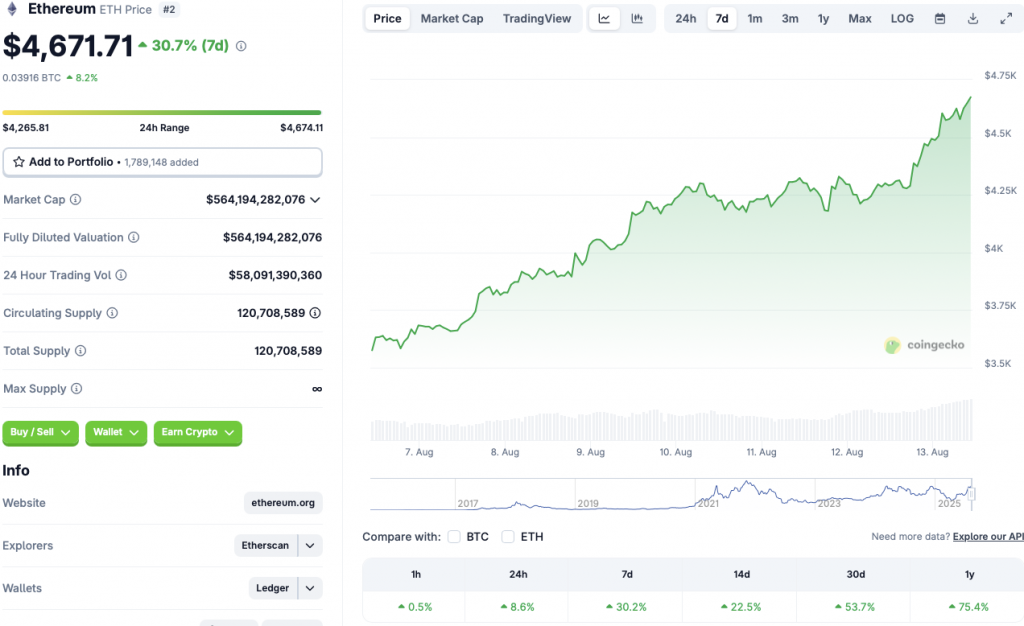

🚀 Ethereum Soars to $4,670: ATH Inevitable as Bulls Charge

Ethereum isn’t just flirting with history—it’s bulldozing toward it. The $4,670 price tag isn’t a pitstop; it’s fuel for the rocket. Here’s why the smart money’s betting this isn’t the ceiling.

### The Gas Gauge Is Broken

Network activity? Surging. Institutional interest? Locked in. Retail FOMO? At DEFCON 2. Ethereum’s fundamentals aren’t just solid—they’re screaming ‘overbought’ in every trading chatroom from Wall Street to Telegram.

### The ‘Flippening’ Whisperers Are Back

Bitcoin maximalists hate this one trick: ETH’s 2025 rally puts its year-to-date gains at levels that’d make a VC blush. Meanwhile, legacy finance still thinks ‘DeFi’ is a typo.

### Watch the Tape, Not the Hype

Liquidity’s pooling around $4,700 like moths to a flame. Either we’re witnessing the mother of all bull traps—or the last resistance before price discovery mode. Place your bets (responsibly, or not—we’re not your FSA).

Closing thought: When ETH hits $5K, remember—the suits will suddenly ‘get it’ right after their algo traders do.

Source: CoinGecko

Source: CoinGecko

Will Ethereum Hit a New All-Time High This Week?

If ETH continues to rise at its current pace, it may hit a new all-time high in the next 24 hours. According to CoinCodex ETH analysts, it will continue to rally over the next few weeks. The platform anticipates the asset to trade at $5,558.17 on Aug. 28. Hitting $5,558.17 from current price levels will entail a rally of nearly 19%.

What’s Pushing the Asset’s Price?

Ethereum’s (ETH) latest upward momentum is likely due to the US CPI numbers coming in at 2.7%, lower than the expected 2.8%. The lower CPI figures have led to high Optimism for an interest rate cut in September. A rate cut will likely lead to more investments in risky assets, such as cryptocurrencies. ETH and the larger market could continue rallying under this pretext.

ETH’s rally may have been further propelled by high ETF inflows. ETH ETFs recently saw more than $1 billion in inflows, the largest since their US debut. ETH’s rally may see continued push if ETF inflows continue to pour in.

However, there is also a chance that ETH could face a correction in the coming days. The global economy is yet to recover from President Trump’s tariff blows. Trade wars and geopolitical tensions could present a barrier to the crypto market. How things unfold is yet to be seen.