Trump’s 50% India Tariffs Spark 85% Oil Spread Crash – Markets Reel

Trade war tremors hit global markets as Trump’s latest tariffs slash India’s oil spread to ribbons.

The Tariff Tsunami

A 50% levy on Indian goods triggers the steepest commodity collapse in years—crushing arbitrage plays and sending traders scrambling.

Oil’s Brutal Math

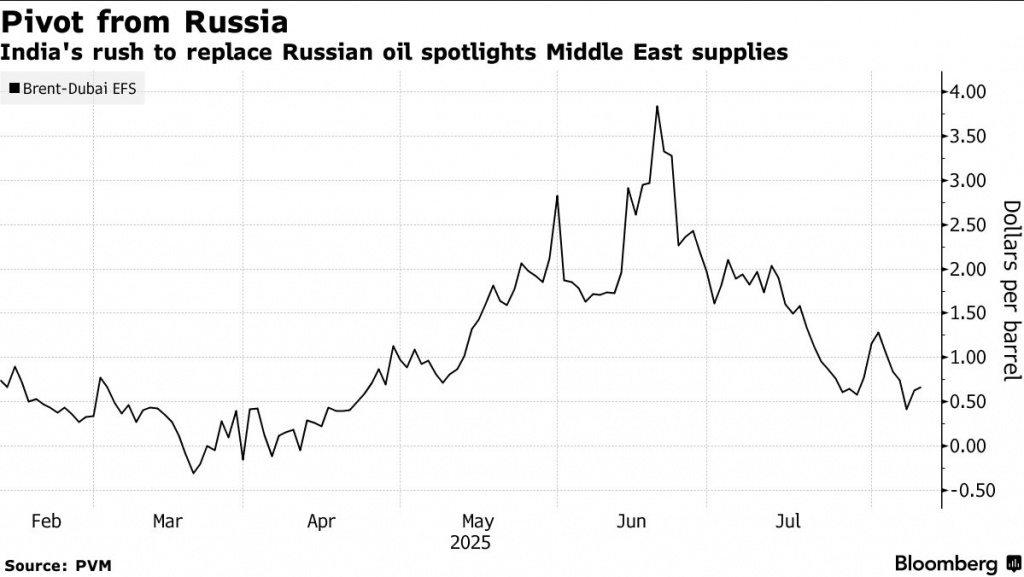

That 85% spread implosion isn’t a typo. It’s what happens when geopolitical chess meets blunt-force economics.

Finance’s Dark Comedy

Another ‘unexpected’ market shock—right after analysts swore protectionism was ‘priced in.’ Spoiler: It never is.

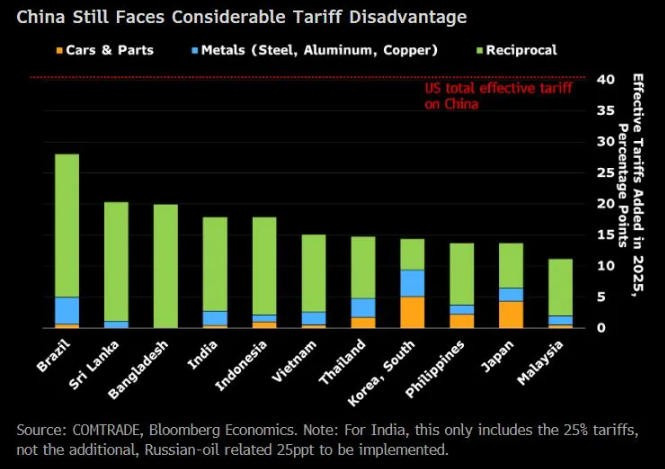

China Still Faces Considerable Tariff Disadvantage – Source: COMTRADE

China Still Faces Considerable Tariff Disadvantage – Source: COMTRADE

India 50% Oil Tariff Sparks Shift From Russian Crude to Middle East Supply

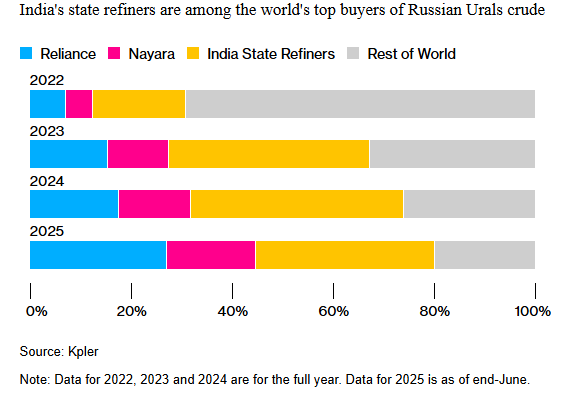

State Refiners Pull Back from Russian Deals

The US India tariff 50% policy has been devastating for Indian state-owned refiners. Companies like Indian Oil Corp., Bharat Petroleum Corp., and also Hindustan Petroleum Corp. have pulled back from Russian crude purchases for October-loading cargoes. They’re waiting for clear government guidance on how to handle the India 50% oil tariff enforcement right now.

IOC bought five million barrels of oil from the US, Brazil and Libya recently, which shows the latest in a string of purchases for relatively quick delivery. The Russian crude discount India previously enjoyed is basically gone under these new trade restrictions.

R. Ramachandran, former director of refineries at Bharat Petroleum, stated:

“There WOULD be some operational disruptions for a period, but the crude supply-demand would balance out. Middle East crudes — with the geographical advantages and a wide range of quality will be a prime substitute, especially from Saudi and Iraq.”

Oil Markets React to Supply Changes

The US India tariff 50% has opened up what traders call arbitrage windows for Atlantic Basin crudes. These are typically priced against Brent and also West Texas Intermediate, and they can now FLOW into Asia more easily. The India middle east oil shift is happening faster than many expected.

In recent weeks, Indian state refiners have been issuing a bunch of tenders, and they’re soaking up spot cargoes from other regions. The impact on Indian refiners goes beyond just higher costs – companies have to adapt their processing for different crude qualities too.

Zhou Mi, an expert at the Chinese Academy of International Trade and Economic Cooperation, had this to say:

“This creates a climate of uncertainty that makes businesses and markets increasingly concerned about the stability and outlook for economic and trade policies between China and the US, as well as the US and other countries.”

Russia Looks for New Buyers

Moscow has been offering more Urals to China, which doesn’t typically take much of this variety. The India 50% oil tariff has forced Russia to find alternative buyers, and China is an obvious choice. Discussions for October cargoes haven’t started yet, but traders expect deeper Russian discounts and more offers heading to China.

The Russian crude discount India used to benefit from is now being redirected to other markets. Brent was trading NEAR $67 a barrel recently, and traders are still assessing the odds of more disruption to flows.

The India middle east oil shift represents one of the biggest changes in global energy trade patterns since the Ukraine conflict began. While there will be some operational hiccups during this transition period, the impact on Indian refiners will likely stabilize as new supply chains get established.