Goldman Sachs Sounds Alarm: Dollar’s Risky Trajectory Could Accelerate in 2025

The greenback's looking shaky—and Wall Street's biggest players are bracing for impact.

Goldman Sachs just dropped a bombshell dollar forecast, warning that traditional safe-haven status might not hold. When the world's most conservative bankers start sweating currency risk, you know we're in uncharted territory.

Here's why fiat's looking fragile:

• Central banks keep playing whack-a-mole with inflation

• Geopolitical tremors rattling FX markets

• That sinking feeling when your reserve currency moonwalks toward volatility

Meanwhile in crypto-land? Bitcoin's licking its chops. Every dollar wobble sends another institutional investor scrambling for decentralized lifeboats. (But sure, keep calling it a 'speculative asset'.)

The kicker? This isn't 2008 anymore. With CBDCs looming and stablecoins eating fiat's lunch, the dollar's next crisis might just be its last act as global MVP.

Welcome to the great monetary reshuffle—where the house always wins, but the chips are now digital.

Goldman Sachs Dollar Forecast 2025 Highlights Risks, Market Outlook

Shifting Patterns Being Revealed Right Now

Goldman Sachs analysts Karen Reichgott Fishman and Lexi Kanter have been tracking these changes. They were clear about the fact that:

The 2025 Goldman Sachs dollar forecast indicates the currency is actually trading less like a safe haven these days. Data shows correlation between the dollar and the G-10 volatility gauge sits NEAR seven-year lows. This signals increased risk-asset behavior is happening.

At the time of writing, this represents quite a departure from historical patterns where the dollar traditionally strengthened during market stress.

Policy Uncertainty Drives Depreciation Warning

Trump’s trade tariff threats have triggered steep dollar declines this year and the Goldman Sachs de-dollarization analysis points to elevated policy uncertainty around Federal Reserve independence along with trade policies as key risks.

Chief Economist Jan Hatzius had this to say:

GDP has been forecast to expand only 1% in Q4 year-over-year, with recession risk sitting at 30%. This is actually double the historical average. Core inflation is expected to climb to about 3% as tariff rates increase.

Source: US Bureau of Labor Statistics, Census Bureau, Haver Analytics, Goldman Sachs Research

Fiscal Deficits Impact Market Outlook

Goldman Sachs Vice Chairman Rob Kaplan stated:

The $2 trillion budget deficit represents about 6-7% of GDP right now. Kaplan also noted:

These concerns have been affecting longer-term Treasury yields, and the Goldman Sachs dollar depreciation outlook is being influenced by this fiscal imbalance.

Market Implications of the Forecast

The Goldman Sachs dollar forecast shows the currency has been selling off alongside equities more than twice as often this year versus the prior decade. This pattern is quite striking because it challenges traditional safe-haven assumptions.

Co-head Ashok Varadhan stated:

Despite dollar concerns, he actually remains bullish on US stocks. The Goldman Sachs de-dollarization trends suggest assets like gold and Bitcoin could benefit as investors diversify away from traditional fiat currencies.

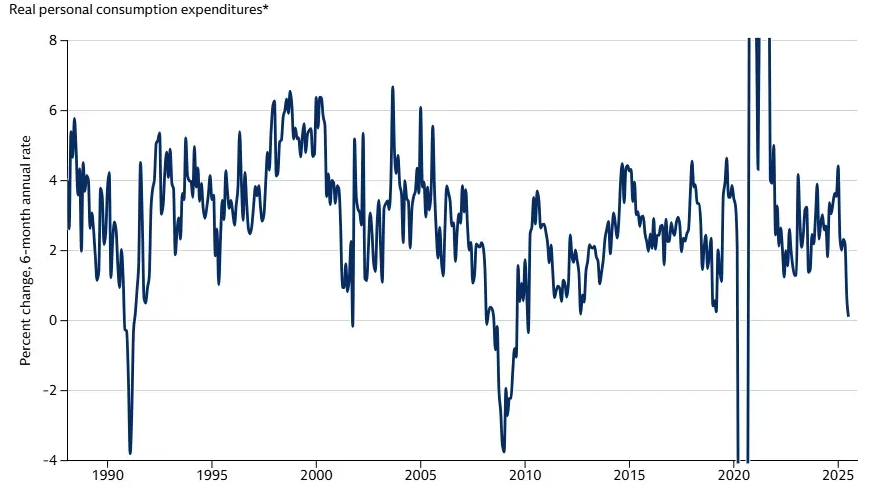

Hatzius expects consumer spending will be affected because tariffs are weighing on purchasing power. He mentioned that consumer spending “has stagnated, which doesn’t often happen outside of recession.”

The Goldman Sachs 2025 market outlook indicates continued dollar volatility will be driven by policy uncertainty and also fiscal imbalances that are developing.