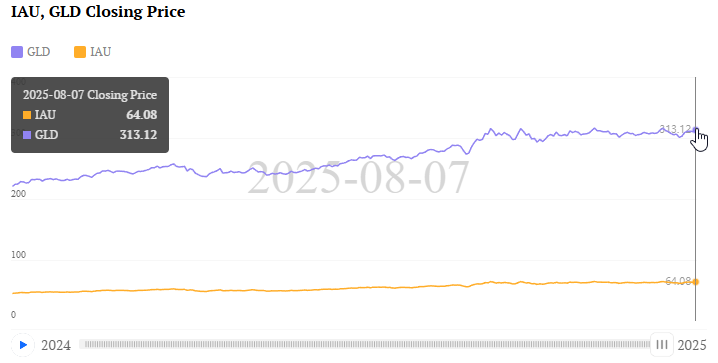

Gold Soars 39% to $3,401: Trump Shakes Up Fed With Miran Appointment

Gold rockets to record highs as political winds shift.

Trump's Fed pick sends shockwaves through markets—just as gold smashes through $3,400.

39% annual gains leave traditional assets in the dust. But hey—at least your financial advisor still gets paid for underperforming.

Gold Price Record Rally Fueled by Geopolitical Uncertainty and Trump Fed Appointment

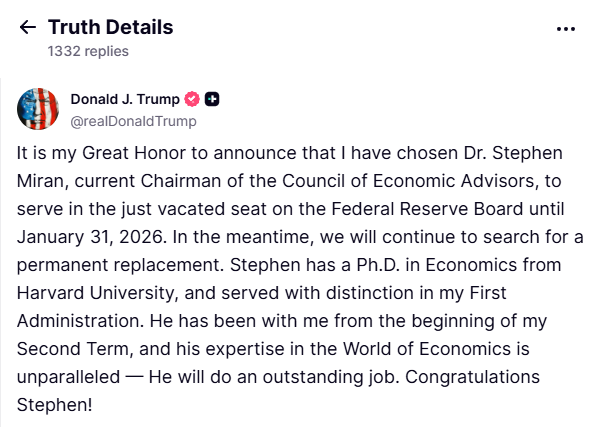

The Trump Fed appointment of economist Stephen Miran to the Federal Reserve board is actually intensifying the ongoing Gold price record rally that we’re seeing. Miran’s crypto-friendly stance and also his policy views signal some shifts supporting gold investment strategy positioning right now.

Trump stated:

Central bank demand is underpinning this gold price record rally, with institutions purchasing over 1,000 metric tons in 2024. This systematic buying actually reflects geopolitical uncertainty and even de-dollarization trends from various countries.

The Trump Fed appointment strategy extends beyond just Miran as Federal Reserve board restructuring creates some optimal conditions for gold investment strategy positioning amid ongoing geopolitical uncertainty.

Quotes From Officials & Gold Futures

Senate Banking Committee Chairman Tim Scott stated:

Elizabeth Warren said she WOULD have:

Fed Chair Jerome Powell expressed concerns about policy challenges:

Miran had this to say about tariff concerns:

Goldman Sachs projects gold reaching $3,700 by end-2025. The convergence of Trump Fed appointment decisions along with persistent geopolitical uncertainty creates sustained gold investment strategy momentum through 2026.