🚀 Firefly Stock Rockets 34% on Moon Landing Frenzy – Wall Street Catches Lunar Fever

Wall Street’s latest speculative rocket just took off—no NASA engineering required. Firefly Aerospace’s stock debut soared 34% as traders bet big on the moon’s real estate potential. Because nothing says 'sound investment' like a celestial dust bowl, right?

### The Hype Engine Ignites

Forget fundamentals—this rally runs on pure space-age FOMO. Firefly’s lunar logistics play had day traders dumping memecoins for a piece of the action. Analysts whisper 'bubble,' but try telling that to the suits yolo-ing bonuses into zero-gravity IPOs.

### Gravity-Defying Valuations

The stock’s trajectory mirrors crypto’s 2021 mania—straight up, fueled by retail adrenaline and hedge fund FOMO. Short sellers got burned harder than a reentry capsule, while true believers cite 'strategic positioning in the cislunar economy.' Sure, and Dogecoin was a hedge against inflation.

### The Cynic’s Epilogue

Another day, another asset class divorcing from reality. At least this bubble comes with literal rocket emojis. When the dust settles—on Earth or Mare Tranquillitatis—the smart money will be shorting the space suits.

How Firefly Aerospace’s Moon Landing IPO Sparks Space Stock Surge

Moon Landing IPO Creates Market Frenzy

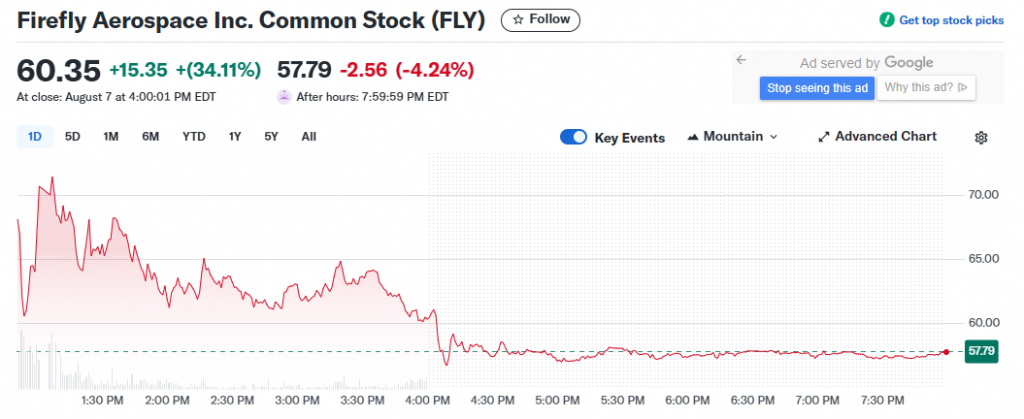

Firefly Aerospace’s moon landing IPO generated substantial investor enthusiasm right from the opening bell, and the numbers tell quite a story. Trading began at $70 per share on the Nasdaq under ticker “FLY” at 12:51 p.m. Eastern time – that’s actually 55.6% above the $45 IPO price. The stock was traded actively throughout the day and closed at $60.35, maintaining a solid 34.1% gain that valued the company at $8.48 billion.

The Cedar Park, Texas-based company raised $868.3 million by selling 19.3 million shares, which exceeded expectations by selling nearly 3.6 million more shares than initially planned. Strong demand forced the company to raise its price range twice during the moon landing IPO process, along with some additional adjustments.

Matt Kennedy, senior strategist at IPO fund manager Renaissance Capital, noted:

Firefly Aerospace Stock Benefits from Lunar Success

The Firefly Aerospace stock surge stems directly from the company’s historic achievement earlier this year, and it’s been quite remarkable. Firefly’s Blue Ghost lunar lander successfully touched down on the moon, making it the first commercial company to achieve a fully successful moon landing – even when some previous attempts by other companies had failed.

The Blue Ghost Mission 1 was designed to transport 10 NASA payloads worth $102.1 million to the lunar surface. This success actually led to a $176.7 million NASA Commercial Lunar Payload Services contract that was awarded last week for a 2029 mission to the moon’s south pole.

Micah Walter-Range, president of space consulting firm Caelus Partners, explained:

Space Exploration Stocks Rally Continues

The broader space exploration stocks sector has been performing exceptionally well this year, along with some impressive gains across the board. Firefly’s moon landing IPO represents the third space offering of 2025, following Karman Holdings Inc. (KRMN) in February and also Voyager Technologies Inc. (VOYG) in June.

These Nasdaq IPO debut successes demonstrate sustained investor appetite right now. Karman shares ended Thursday 119% above their IPO price with a $6.43 billion market cap, while Voyager trades 13% above its debut price at $2.09 billion valuation – which shows consistent performance.

Walter-Range said:

President Trump’s space exploration commitments during his January inauguration ignited rallies in established companies like Intuitive Machines Inc. (LUNR), Rocket Lab USA Inc. (RKLB), and AST SpaceMobile Inc. (ASTS).

Lunar Lander Mission Success Drives Government Contracts

Firefly’s successful lunar lander mission capabilities have actually attracted major defense partnerships. The company secured strategic alliances with Lockheed Martin Corp. (LMT) and even received a $50 million investment from Northrop Grumman Corp. (NOC) in May.

Walter-Range explained:

The partnerships position Firefly to benefit from President Trump’s $175 billion Golden Dome missile defense system spending. Kennedy noted that aerospace companies offer dual exposure:

Walter-Range acknowledged:

The moon landing IPO success reflects broader market confidence in commercial space capabilities and government spending trends supporting the lunar lander mission sector.