BREAKING: Yuan Overtakes Dollar in Oil & Nuclear Deals—Global Finance Shaken

The petrodollar's reign cracks as China's yuan becomes the new default for energy megadeals. Here's why it matters—and who's sweating.

Death of the Dollar Standard?

For decades, oil trades meant automatic dollar demand. Not anymore. Major exporters now demand payment in yuan—a direct challenge to US financial dominance. No fancy economic theories needed: follow the money.

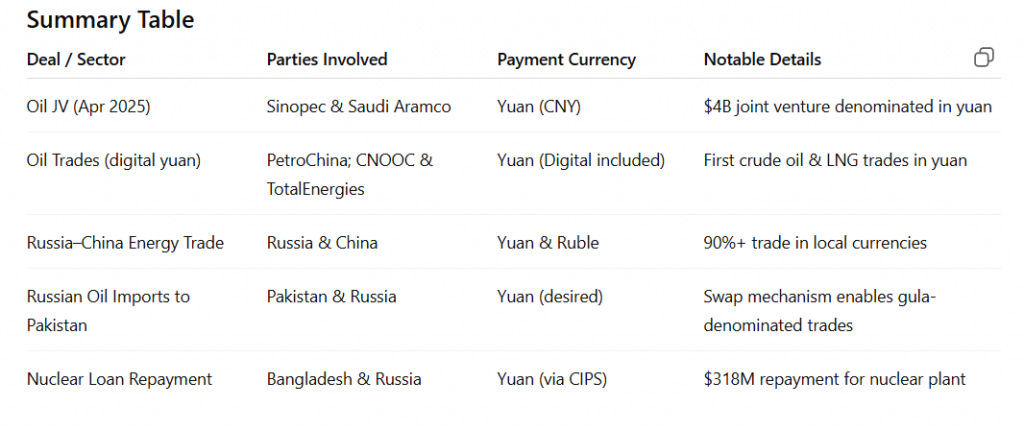

Nuclear Paychecks Go CNY

Atomic energy deals—once strictly USD territory—now show yuan pricing. Geopolitical realignment meets hard economics as reactors become yuan-conversion machines. (Bankers hate this one simple trick!)

The Cynic's Footnote

Wall Street's response? Probably another "strategic pivot" PowerPoint while shorting emerging markets. Some things never change.

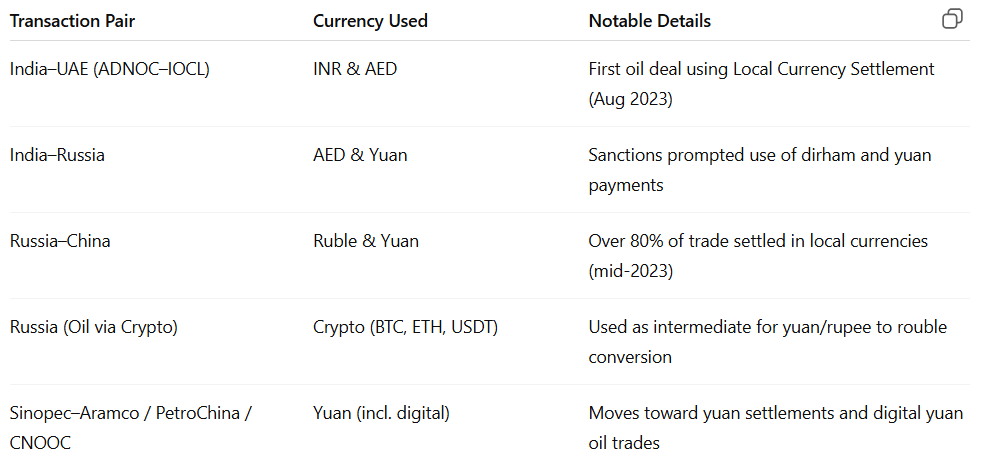

Local Currencies Like Yuan in Global Energy Trade Are Taking Precedence

India and Russia have lately been engaging in a local currency narrative, involving the yuan in the majority of their deals. Russia has asked India to pay 10% of its oil payment in yuan, a currency that Russia has long been exploring in depth. As Russia can no longer conduct business in USD, the nation has switched to the Yuan, which continues to benefit the nation in the long run.

Similarly, Bangladesh’s Rooppur power plant construction had also been done in collaboration with Russia. The nation had earlier made active payments in yuan to Russia, making it easier for the nation to trade and transact with the world.

In addition to this, Saudi Arabia is also exploring accepting yuan for oil sales, which again is a striking development to take note of.

The World Goes Local

Apart from Russia, the majority of the nations are inclined to do business in local currencies. Thee nations are also busy building infrastructure to promote the aforementioned narrative.

India has opened Vostro accounts, enabling local currency trade with selected nations. In 2022, 20+ banks opened their accounts with India under Vostro, marking a new change in the global financial regime. Moreover, the nation is vying hard for a local currency narrative to bypass tariffs laid by the US on India.

.The diplomatist later shared

Moreover, BRICS nations have long expressed their desire to free themselves from the US dollar hegemony. The bloc is reportedly busy launching a BRICS currency, the one that rivals the US dollar on a global level.