SEC Powerless to Stop Crypto—Bloomberg’s Matt Levine Declares ‘That Ship Has Sailed’

The SEC’s war on crypto just hit an iceberg—and Matt Levine’s calling lifeboats.

Regulators Left Holding the Bag

Bloomberg’s sharpest finance commentator drops the mic: After a decade of explosive growth, even the most aggressive enforcement can’t put the decentralized genie back in the bottle. The market’s verdict? A collective shrug as Bitcoin trades 28% above its 2024 low.

Wall Street’s Worst Nightmare

While bureaucrats draft another 200-page proposal, a $2.3 trillion asset class keeps minting millionaires—proving yet again that red tape moves at dial-up speed in a blockchain world. The irony? The same regulators now scrambling to ‘protect investors’ spent years pretending crypto didn’t exist.

Game theory wins again. Always does.

SEC Crypto Ban Infeasible: Why Regulation, Not Prohibition, Prevails

Levine’s Direct Assessment

Matt Levine had this to say:

is no longer feasible for the SEC, andis not very attractive for the SEC. The only choice left is

The Bloomberg columnist’s analysis actually confirms that an SEC crypto ban infeasible strategy has reached its endpoint right now. With cryptocurrency market rules evolving rapidly, and the crypto ban lifted discussions reflect this new regulatory reality that’s been developing.

Regulatory Shift Under Way

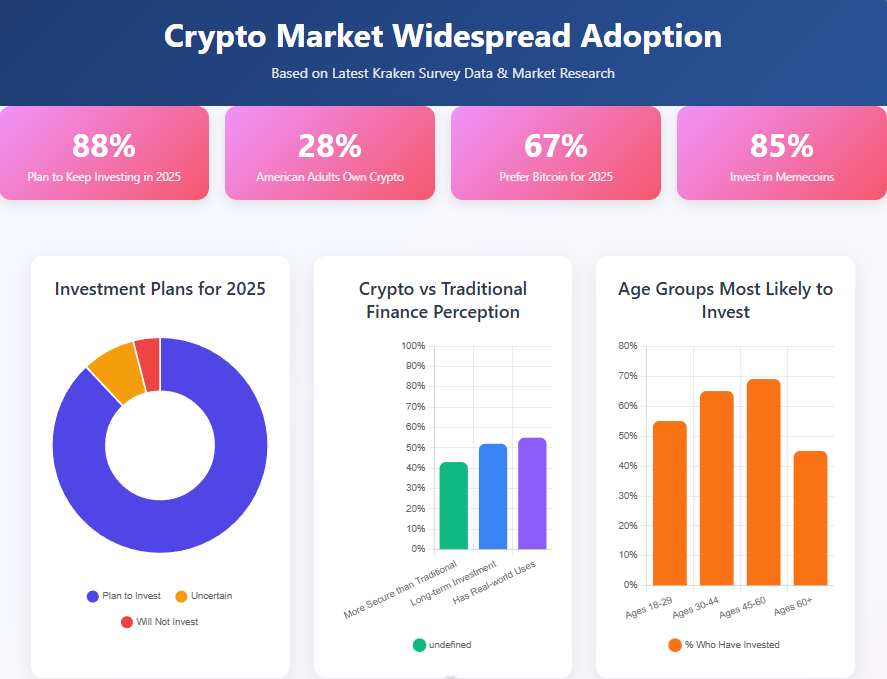

The SEC regulation crypto framework is being reshaped as enforcement agencies recognize their SEC enforcement limits. Traditional prohibition methods have actually been proven ineffective against decentralized networks and widespread adoption that’s happening.

Levine also stated:

Market Reality Forces Change

Why an SEC crypto ban infeasible position stems from market forces that regulators actually cannot control right now. cryptocurrency market rules are being written by adoption rather than prohibition, as millions of Americans now hold digital assets and some major institutions.

Project Crypto represents the agency’s acknowledgment that SEC regulation crypto must replace failed ban attempts. The SEC enforcement limits have been exposed through years of unsuccessful prohibition efforts that were tried.

Levine even emphasized that the crypto ban lifted era reflects practical limitations rather than policy preferences. Thecomment captures how an SEC crypto ban infeasible approach has given way to regulatory adaptation right now.

The shift from SEC crypto ban infeasible tactics to workable cryptocurrency market rules signals a fundamental change in regulatory approach, as authorities accept that prohibition is actually no longer a viable option.