SBI Shakes Up Crypto Markets: Japan Files First XRP/Bitcoin ETF as Ripple Dominates 80% of Banking Tech

Tokyo just dropped a crypto bombshell—SBI Holdings lobs the world's first XRP/Bitcoin ETF filing onto regulators' desks. Meanwhile, Ripple's claws sink deeper into traditional finance, now gripping 80% of Japan's banking infrastructure.

Wall Street's old guard must be sweating into their monocles.

The ETF play marks a watershed moment: institutional investors finally get a regulated on-ramp to two of crypto's heaviest hitters. No more messy custody solutions or shady OTC desks—just pure, FSA-approved exposure.

Ripple's banking takeover? That's the real story. Four out of five Japanese banks now run on RippleNet, slashing settlement times from days to seconds. The remaining holdouts? Probably still faxing wire instructions.

This isn't adoption—it's annihilation. While Western banks dabble in blockchain 'proofs-of-concept,' Japan's financial system is getting rewired before their eyes. The land of the rising sun just became the land of the flipped switch.

Cynical take: Watch Goldman Sachs launch a 'digital asset initiative' next week to save face—with 300% management fees, naturally.

Ripple’s XRP Gains Ground as Japan Eyes Crypto ETF Expansion

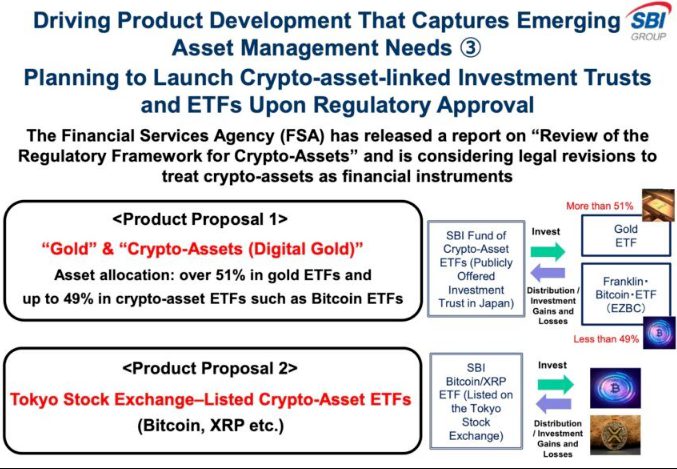

SBI Holdings has submitted two distinct XRP Bitcoin ETF Japan proposals to regulators. The first one targets “Gold” and also “Crypto-Assets (Digital Gold)” with asset allocation over 51% in gold ETFs and up to 49% in crypto-asset ETFs. The second proposal focuses specifically on Tokyo Stock Exchange-Listed Crypto-Asset ETFs, including Bitcoin and XRP along with other digital assets.

Banking Sector Drives XRP Bitcoin ETF Japan Interest

Ripple adoption in banking has actually reached unprecedented levels in Japan right now, with over 80% of major financial institutions now using Ripple’s technology for payments. This widespread integration creates strong demand for XRP bitcoin ETF Japan products among institutional investors and also retail ones.

Universities teach XRP banking systems across Japan, and educational institutions are incorporating blockchain technology into their curricula. This academic support strengthens Japan crypto regulations by building technical expertise along with public understanding of digital assets.

![]() JAPANESE FINANCIAL GROUP SBI

JAPANESE FINANCIAL GROUP SBI

HOLDINGS HAS FILED FOR A CRYPTO

ASSET ETF.

BULLISH FOR THE MARKETS![]() pic.twitter.com/oGS0qazhsj

pic.twitter.com/oGS0qazhsj

Market Impact and Expert Commentary

The XRP Bitcoin ETF Japan filings have been generating significant market interest right now. Recent data shows heightened trading activity, with substantial liquidations across crypto positions demonstrating market volatility even in established markets.

An ex-SEC official Marc Fagel had this to say:

Japan crypto regulations provide clearer pathways compared to other jurisdictions actually. The FSA’s regulatory framework development supports SBI holdings crypto ETF applications by establishing comprehensive oversight standards along with investor protections.

BREAKING: SOME UNIVERSITIES ARE NOW TEACHING ABOUT THE NEW #XRP BANKING SYSTEMS!! XRP FINANCIAL SYSTEM IS NOW HERE!! INSTITUTIONAL TOKENIZATION ON THE #XRPL IS LIVE!

OVER 110 LAUNCHES ON THE XRPL JUST IN THE LAST 60 DAYS!! BTW THE INSTITUTIONAL TOKENIZATION PROGRAM IS POWERED BY… pic.twitter.com/9s4DIIJmSE

![]()

Future Outlook for XRP Bitcoin ETF Japan

SBI holdings crypto ETF approvals could accelerate broader cryptocurrency adoption in Japan right now. With Ripple adoption in banking already established and universities teach XRP concepts becoming standard practice, the foundation exists for successful XRP Bitcoin ETF Japan launches.

BREAKING:

EX-SEC OFFICIAL FAGEL: “WE’RE PRESUMABLY STILL WAITING ON ANOTHER VOTE” IN #XRP CASE.

ORIGINAL APPROVAL DIDN’T COVER INJUNCTION MODIFICATION. pic.twitter.com/fyaCl4NElp

The regulatory environment supports innovation while also protecting investors, making Japan an attractive market for digital asset products. As Japan crypto regulations mature even further, more financial institutions may follow SBI’s lead in developing cryptocurrency investment products along with traditional offerings.

![]() BREAKING:

BREAKING:

$102M LIQUIDATED ACROSS #XRP & CRYPTO POSITIONS IN JUST 4 HOURS! pic.twitter.com/vZ0hargnUe