Michael Saylor’s $43 Billion Bitcoin Buying Spree: A 9-Month Masterclass in Crypto Accumulation

Wall Street blinked—and Michael Saylor bought the dip. Again.

The MicroStrategy chairman just executed the most aggressive corporate Bitcoin acquisition in history, stacking $43 billion worth of BTC in under a year. While traditional finance debated 'store of value' theories, Saylor turned treasury strategy into a real-time case study in hyperbitcoinization.

Why institutions are playing catch-up

This wasn't gradual accumulation—it was a full-scale assault on fiat complacency. The 9-month timeline reveals a calculated urgency, as if Saylor knew exactly when the old-money herd would start moving.

The new corporate playbook

Forget stock buybacks. The smart money now measures quarterly success in satoshis per share. Saylor's moves make gold-hoarding CEOs look like medieval relic collectors.

One hedge fund manager sniffed: 'We prefer assets with 10-K filings.' Meanwhile, MicroStrategy's balance sheet quietly became the most interesting financial document in tech.

Strategy Continues To Dominate Bitcoin Holdings

Strategy is currently the most significant BTC holding treasury company in the world. Strategy’s BTC wallet dwarfs all other holders. MARA Holdings, Inc. comes in at second place with 50,000 BTC. While MARA accounts for a substantial number of coins, it is very small when compared to Strategy’s BTC numbers.

Michael Saylor is one of the most popular bitcoin Maximalists in the world. His firm stance on BTC supremacy is often second to none.

Cryptocurrencies Continue To Slump

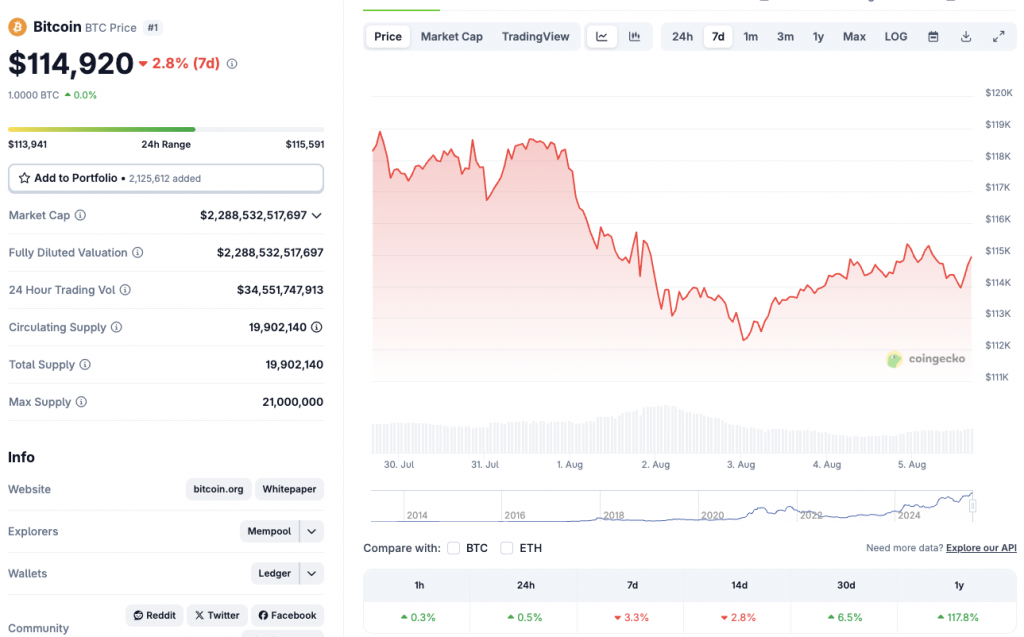

Strategy’s Bitcoin purchases over the last nine months coincide with the asset’s incredible price spike. BTC has hit multiple all-time highs over the past few months. The asset climbed to its most recent peak of $122,838 on July 14. BTC’s price has dipped by 6.4% since its July high. The dip is likely due to the Federal Reserve keeping interest rates unchanged and uncertainties around global trade wars.

According to CoinCodex BTC data, BTC is currently down by 3.3% in the weekly charts and 2.8% in the 14-day charts. Despite the dip, the asset has rallied 0.5% in the last 24 hours, 6.5% over the previous month, and 117.8% since August 2024.

BTC currently faces resistance at the $115,000 level. Breaching the $115,000 price point could propel the asset to another all-time high.