Dollar Dominance Surges as Oil Giants Ditch Local Currencies—What’s Next for Global Markets?

The greenback flexes its muscles again—oil titans are snubbing local currencies in favor of the almighty USD. Here’s why the dollar’s hegemony just got a turbocharge.

Black Gold, Green Back: From Lagos to Buenos Aires, crude exporters are rejecting pesos and nairas. The reason? A no-brainer: stability trumps patriotism when margins get squeezed.

De-Dollarization? Not So Fast: Crypto maximalists’ dreams of Bitcoin oil deals remain just that—dreams. Turns out, volatility isn’t exactly appealing when you’re moving tankers, not memecoins.

The Cynic’s Corner: Another win for the petrodollar—because nothing says ‘free market’ like a 50-year-old monopoly propped up by crude and F-16s.

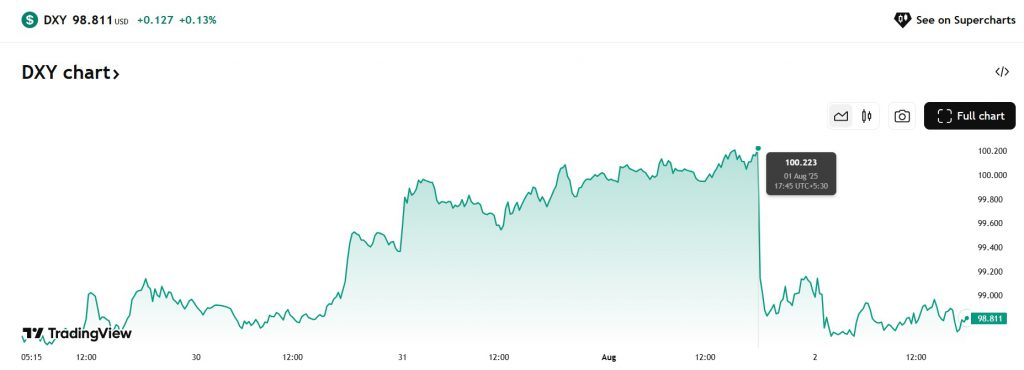

Source: TradingView

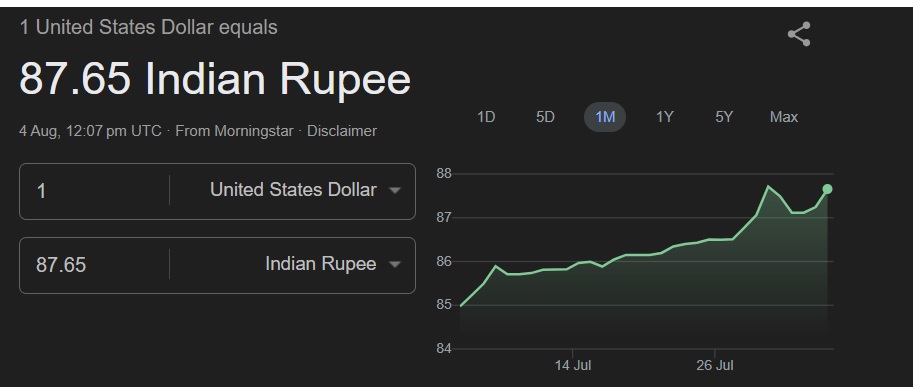

Source: TradingView

The surge came after oil suppliers were persistent in demanding the US dollar from importers for settlements. The Indian rupee was the hardest hit as it dipped 2.7% in a month. The USD/INR trading pair shows the greenback dominating the charts since July. The rupee has fallen to a low of 87.70, displaying broader weakness in the indices. However, the rupee is up nearly 2.40% year-to-date.

Dollar Demand From Oil Companies Rises, Local Currencies Fall

The strong US dollar inflows to oil refiners strengthened the DXY index, according to a US dollar report from the Economic Times.said a trader at a private bank.

However, the DXY index saw a decline on Monday’s opening bell, falling from 100 to the 98.80 range. The fall stems from the tariffs placed by TRUMP on India and Brazil for going against the dollar. Trump’s policies are eroding the recent gains of the US dollar, which came from the oil sector.

The oil sector was mainly dominated by the US dollar for decades until developing countries took a different course recently. India, Nigeria, Brazil, China, South Africa, Russia, and Iran, among others, started using local currencies for settlements. Oil firms cannot handle the inflow of local currencies as it affects their balance sheets and eats into their revenues.