S&P 500 Nosedives as ’Sell America’ Trade Roars Back Amid Jobs Catastrophe

Wall Street's worst fears realized—the 'Sell America' play just staged a brutal comeback.

The S&P 500 got hammered after a disastrous jobs report sent shockwaves through traditional markets. While the suits panic, crypto traders are already repositioning for the chaos.

Funny how 'economic fundamentals' always seem to crumble when you need them most. Maybe decentralized finance doesn’t look so reckless now, huh?

S&P 500 Crash Sparks Stock Market Selloff, Economic Slowdown Fears

Jobs Numbers Actually Bring Back Sell America Trade

The US jobs report delivered pretty shocking numbers, with employers creating only 73,000 jobs in July – way less than the 110,000 that everyone was expecting. The unemployment rate also went up to 4.2%, but the really bad news came from changes to earlier months. It turned out that officials cut payroll numbers for May and June by 258,000 jobs when they revised the data.

This means employment growth has only averaged about 35,000 over the last three months, which is actually the worst it’s been since the pandemic started. Right now, analysts are raising concerns about stagflation, along with economists worrying about inflation going up because of tariffs.

Stock Market Selloff Gets Worse With Economic Slowdown Fears

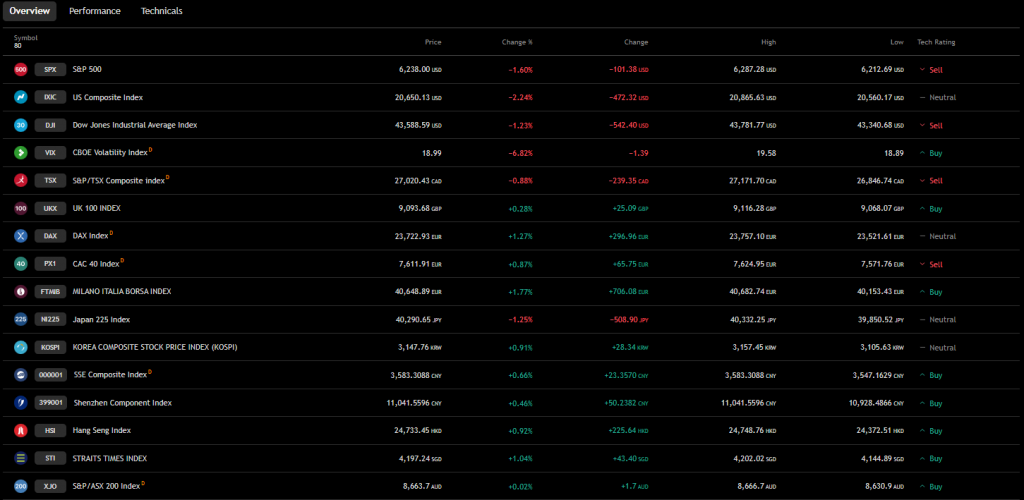

The sell America trade picked up steam as the big stock indexes fell after this bad employment news came out. Some companies did better than others though – Meta Platforms actually jumped 11% and Microsoft went up 8% after they reported good earnings, but Amazon dropped 8% because their profit outlook wasn’t great.

Even Australian investors are feeling this, with both the iShares S&P 500 AUD ETF and the Vanguard US Total Market Shares Index AUD ETF opening down 1.7%. These drops are showing how the S&P 500 crash affected markets around the world.

Economic Slowdown Fears Make Investors Rethink Things

This renewed sell America trade has got investors actually thinking twice about how much US exposure they have, especially with these economic slowdown fears getting stronger. The Federal Reserve finds itself between a rock and a hard place, as it tries to create a balance between employment and inflation, with politicians pushing Chairman Jerome Powell further to reduce the rates.

For people who have a lot of US investments, this might be a good time to spread things out more. Some are looking at options like the Vanguard MSCI Index International Shares ETF instead of keeping everything in US-focused funds.

The sell America trade coming back shows there are deeper worries about how the US economy is doing, and this jobs disaster might be signaling bigger problems ahead.