BRICS 2025: The Secret Deals & Power Plays You Missed at the Summit

The BRICS 2025 summit wrapped with more whispers than wins—here’s what really went down.

Gold, Gas, and Geopolitics

Behind the staged handshakes, the bloc carved up commodity markets like a hedge fund slicing derivatives. No public announcements—just quiet nods on oil benchmarks and mineral supply chains.

The Digital Currency Gambit

Russia’s CBDC pitch got sidelined by India’s real-time payments push. Another ‘unified BRICS coin’ proposal died in committee—turns out five central banks can’t agree on lunch, let alone monetary policy.

Wall Street’s Worst Nightmare?

A single slide in Brazil’s presentation showed SWIFT alternatives processing 12% of cross-border trade. The banking elite yawned—then quietly doubled their BRICS desk staffing by Monday.

Another year, another summit where the real deals happened in hotel bars. But hey, at least the Davos crowd got new talking points for their podcasts.

BRICS Summit 2025 Insights On BRICS Countries, Market Risks, And Currency Developments

Summit Delivers Major Infrastructure Initiative

The BRICS summit 2025 actually produced a joint declaration titled “Strengthening Global South Cooperation for a More Inclusive and Sustainable Governance” that all the participating BRICS countries adopted. The summit introduced what they’re calling the BRICS Multilateral Guarantees initiative, which the World Bank’s Multilateral Investment Guarantee Agency inspired.

This new institution aims to help with infrastructure investment across the Global South by providing investment guarantees that reduce political risk. The initiative shows continued interest in building parallel institutions to existing frameworks, and developers expect it to progress through 2025 and 2026, along with other cooperative efforts.

Currency Project Accelerates Toward 2026 Launch

The BRICS 2025 outcomes include significant progress on monetary cooperation, with the BRICS currency project now targeting 2026-2027 for when it actually becomes operational. Several strategic developments are underway right now among BRICS countries: Russia and China are favoring the ruble and yuan in bilateral trade, while India expands rupee usage with Global South nations.

The BRICS Pay project serves as the cornerstone of the bloc’s financial sovereignty strategy. Member states are building sophisticated payment systems using blockchain technology to facilitate cross-border payments and bypass traditional systems like SWIFT, which is pretty significant.

Research on central bank digital currencies has been integrated into the project architecture, with pilot programs planned to test compatibility between existing national digital currencies and also a potential supranational monetary unit by 2026.

Trade Dependencies Challenge Dedollarization Goals

Despite political rhetoric about challenging Western dominance, the BRICS summit 2025 declaration notably omitted direct references to the United States. This reflects ongoing trade negotiations between the US and individual BRICS members, as these BRICS countries remain deeply integrated with US markets right now.

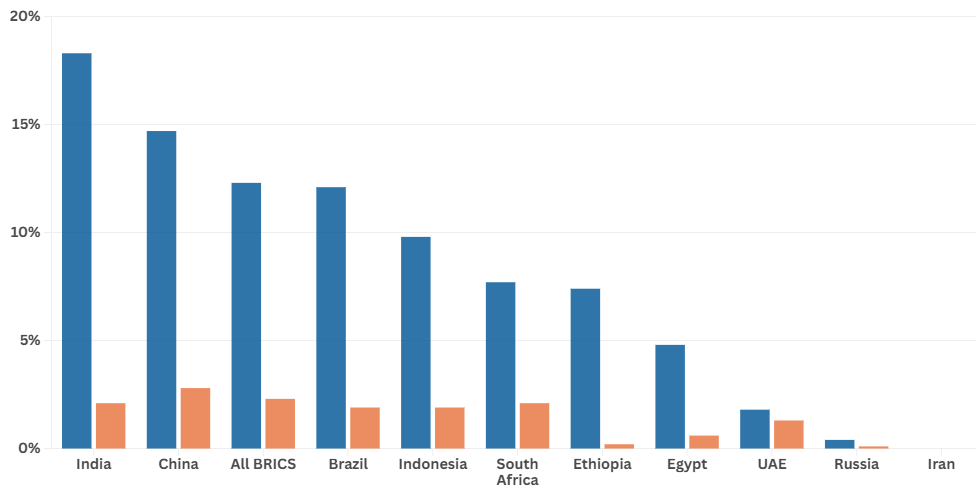

Source: IMF data

BRICS members’ exports to the United States represent significant shares of their total exports and meaningful portions of their GDP. The expanded bloc now represents 46% of world population and 37% of global GDP, which lends legitimacy to monetary alternatives while highlighting the contradiction between political positioning and also economic realities.

The test for BRICS will be moving from declarations to concrete action while managing internal contradictions between member states with divergent economic profiles. At the time of writing, success will depend on coordination between economies with different profiles and the ability to establish trust in a monetary unit that’s still theoretical.