Norway’s Market Rollercoaster: Amazon Plummets 7% as Tesla Skyrockets 83%

Talk about a market split—Amazon's Nordic nightmare meets Tesla's Viking victory in Norway's latest trading frenzy.

Blood in the fjords

Amazon's 7% nosedive smells like overexposed retail positions meeting brutal Scandinavian reality checks. Meanwhile...

Electric berserkers

Tesla's 83% surge proves even oil-rich kingdoms bow to Elon's gravity—though let's see how long it lasts before Norway's sovereign fund 'diversifies' those gains away.

Final thought: When your 'stable' tech giant tanks while the meme-stock darling moons, maybe it's time to question which market you're actually trading—fundamentals or pure financial folklore.

Amazon Q3 Profit Warning Drops Stock as Tesla Shines in Norway

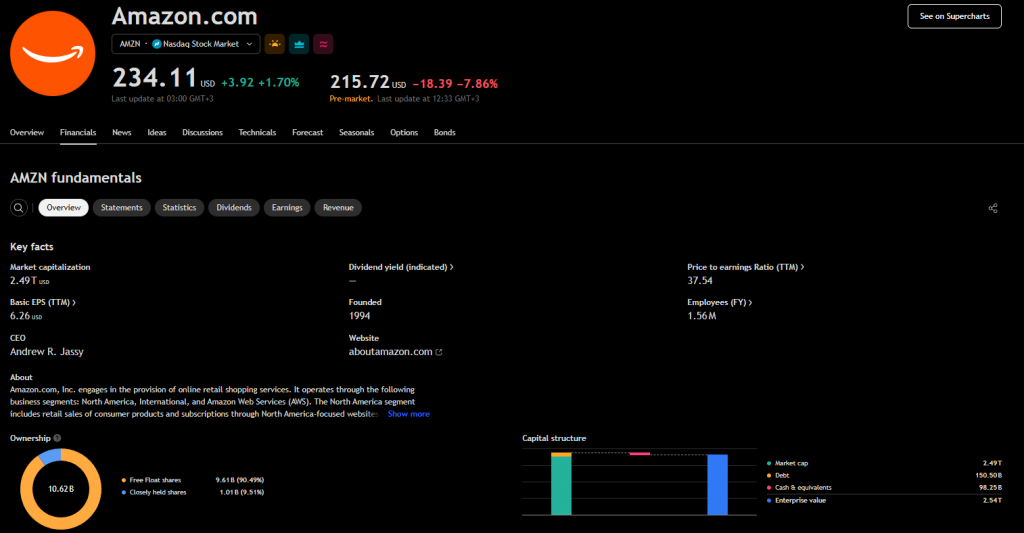

Amazon‘s Q3 earnings were revealed Thursday evening and showed mixed results. The company actually posted revenue of $167.7 billion, which was up 13% from the year before and also beat Wall Street’s $162.19 billion estimate. However, Amazon centered the Amazon Q3 profit warning on operating income guidance of $15.5-$20.5 billion for Q3, and this fell short of the $19.5 billion consensus. The Amazon Q3 earnings disappointment ended up sending shares tumbling in extended trading.

Tesla Norway Performance Actually Shines

The Tesla Norway registrations rose 83.4% in July to 838 vehicles according to data that was released by the Norwegian Road Federation. This Tesla Norway registrations surge actually demonstrates some pretty strong European market performance, which contrasts with Amazon’s guidance disappointment and also reinforces Tesla’s electric vehicle market position. Tesla Norway registrations growth provides positive momentum while the Amazon Q3 profit warning dominated tech headlines right now.

AWS Profit Margins Face Some Pressure

Amazon Web Services revenue climbed 17.5% to $30.9 billion, but the company compressed AWS profit margins to 32.9% from 35.5% previously. The Amazon after hours drop reflected investor concerns about margin sustainability as capital expenditures jumped 83% to $32.2 billion for AI infrastructure investments. AWS profit margins decline also contributed to the Amazon Q3 profit warning that management issued.

Market Impact Analysis Right Now

The Amazon Q3 profit warning particularly concerned investors given AWS profit margins compression amid heavy AI spending. While Amazon’s Q3 sales guidance of $174-$179.5 billion actually exceeded expectations at $173.3 billion, operating leverage concerns dominated sentiment following the Amazon after hours drop.

AWS profit margins decline reflects infrastructure investment costs, though executives called AI compute demandTesla Norway registrations data reinforces electric vehicle adoption trends in favorable regulatory environments, offering a bright contrast to Amazon’s Amazon Q3 earnings challenges. The Amazon after hours drop highlighted how elevated tech expectations have become, where even minor guidance misses can trigger significant selloffs.