🚀 Jio Stock (JIOFIN) Rockets 10% After Ambani’s ₹15,825 Cr Fund Injection & 47% Revenue Surge

Mukesh Ambani just dropped a financial neutron bomb—and Jio's stock is feeling the fallout.

The fuel behind the rally: A ₹15,825 crore capital infusion from India's richest man sent JIOFIN shares screaming past resistance levels. Meanwhile, that 47% revenue spike isn't just growth—it's a middle finger to bearish analysts.

Why traders are scrambling: When Reliance opens its war chest, markets move. This isn't corporate strategy—it's financial theater with Ambani as director.

The cynical take: Another 'strategic investment' that just happens to juice the stock before quarterly results. How... convenient.

One thing's clear: In India's markets, the house always wins—and the house is literally named Ambani.

Technical breakout chart with trend analysis Jio stock – Source: Stockwits

Technical breakout chart with trend analysis Jio stock – Source: Stockwits

Jio Stock Breakout Fueled by Ambani Investment and SEBI Fund Nod

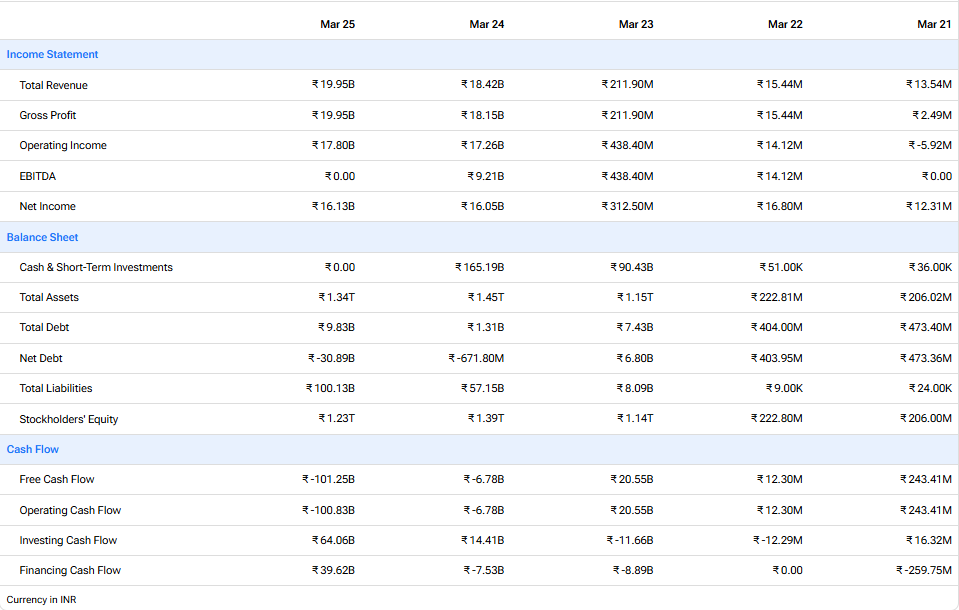

The Jio stock breakout was actually fueled after the board approved raising funds through 50 crore warrants that are priced at ₹316.50 each. This Ambani Jio investment will boost the promoter stake from 47.12% to over 54%, which demonstrates strong confidence in the JioFIN share price forecast and also the company’s future prospects.

At the time of writing, shares were trading with significant gains, and analysts see this as a clear sign of the ongoing Jio financial services rally.

Hitesh Sethia, Managing Director and CEO, JFSL, stated:

Revenue Surge Powers Jio Financial Services Rally

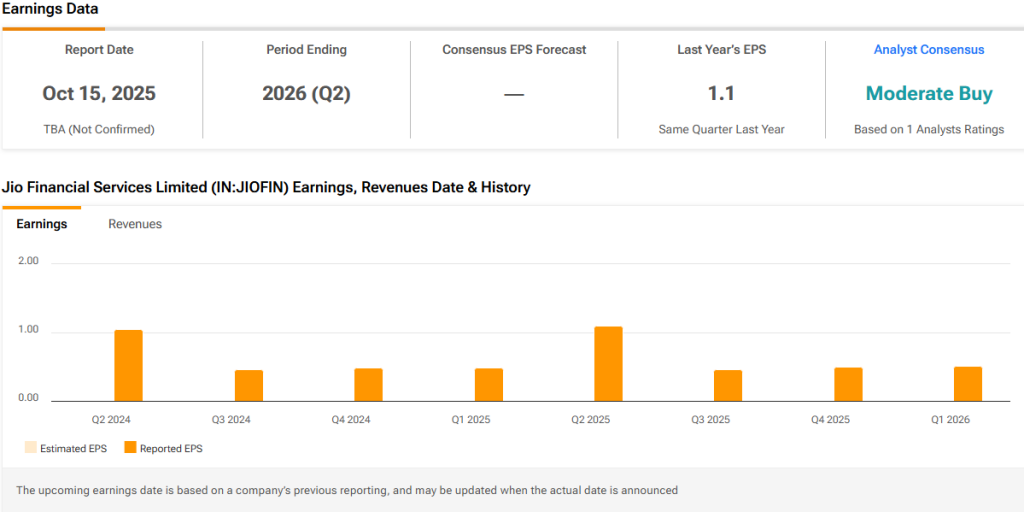

The Jio financial services rally has been supported by some exceptional Q1FY26 results, with revenue actually jumping 47% to ₹612 crore. This particular Jio stock breakout reflects strong operational performance, as interest income doubled to ₹363 crore compared to ₹162 crore in the previous year.

The company also stated:

SEBI-registered analyst Mayank Singh Chandel sees over 15% upside ahead, noting the technical Jio stock breakout above key moving averages. The Ambani Jio investment, along with SEBI approval Jio fund initiatives, positions the company for continued growth in India’s expanding financial services market right now.

The JioFIN share price forecast remains positive as the company’s strategic partnerships with BlackRock and expansion into payments banking drive the ongoing Jio financial services rally even further.