Revealed: The Corporate Giants Betting Big on Ethereum in 2025

Wall Street's playing a dangerous game—and Ethereum's their chip of choice. While retail investors panic-sell, these blue-chip players are quietly stacking ETH like digital gold.

The whales you didn't see coming

Forget Bitcoin maximalism. The smart money's hedging with Ethereum's programmable contracts and defi dominance. These aren't your crypto-bro gamblers—these are Fortune 500 sharks with nine-figure positions.

Why institutions can't quit ETH

Liquidity? Check. Institutional-grade custody? Done. Regulatory arbitrage? You bet. While SEC chair tweets emoji storms, corporations exploit the gray area with Swiss precision.

One hedge fund manager quipped: 'We treat ETH like our cocaine reserve—everyone denies owning it, but the vault's always full.' The blockchain doesn't lie—but balance sheets? That's creative accounting.

Top Companies That Hold ETH

SharpLink Gaming leads the pack with 438,190 ETH. The public company’s ethereum (ETH) holdings are valued at around $1.6 billion. SharpLink Gaming is an online performance marketing company. The firm’s bullish outlook on ETH comes as no surprise, as it is helmed by Ethereum co-founder and ConsenSys CEO Joseph Lubin.

The second-largest Ethereum (ETH) holding public company is Bitmine Immersion. The firm holds 300,657 ETH, valued at about $1.13 billion. Earlier in June, the company raised $250 million via a private placement to further fund its ETH appetite.

Popular cryptocurrency exchange Coinbase takes third place among the largest Ethereum holding companies. Coinbase owns 137,300 ETH, valued at roughly 520 million. While the number of coins is still large, ConiBase’s holdings are far less than the first two biggest ETH holders.

Big Rally Imminent?

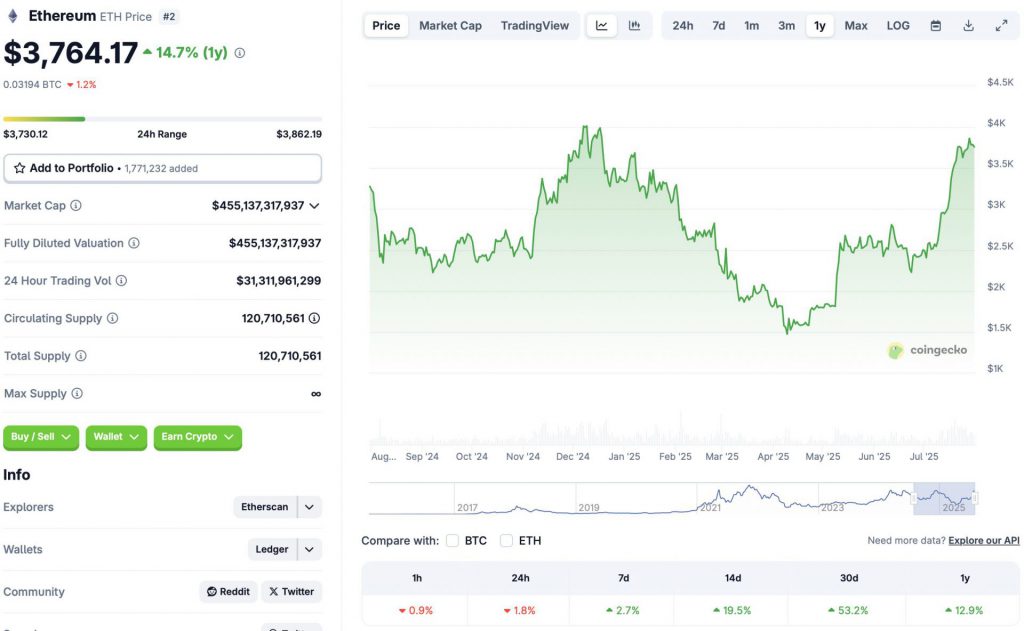

Ethereum (ETH) has seen a big price rally since its Pectra upgrade in May 2025. The asset is inching closer to reclaiming the $4000 price point, a level last tested in December of last year.

ETH’s price is currently up by 2.7% in the weekly charts, 19.5% in the 14-day charts, 53.2% in the monthly charts, and 12.9% since July 2024. Despite the rally, ETH has suffered a 1.8% correction in the last 24 hours, according to CoinCodex ETH data.

The dip over the last 24 hours could be due to the upcoming interest rate announcement by the Federal Reserve. There is a very low chance that the Federal Reserve will cut interest rates after the FOMC meeting. High interest rates may be keeping retail investors at bay.