India Dumps Dollar Reserves in Bold Move to Shield Crumbling Rupee – 2025 Showdown

India's central bank just fired a warning shot across forex markets—liquidating USD holdings to prop up the embattled rupee. Here's why this high-stakes gamble matters.

The Dollar Drain Game

New Delhi isn't whispering sweet nothings to the Fed this time. With the rupee bleeding value, RBI traders are executing emergency currency triage—selling greenbacks like a fire sale to artificially buoy their home currency.

Desperate Times, Desperate Swaps

This isn't subtle market nudging—it's full-blown intervention. Every USD offloaded temporarily patches the rupee's wounds, but forex veterans know the truth: you can't fight global capital flows forever. Not even with a $600B war chest.

The Crypto Angle Everyone's Ignoring

While bureaucrats play whack-a-mole with fiat exchange rates, Bitcoiners are quietly stacking sats—because no central bank can dilute what they can't control. Another day, another reminder why decentralized assets eat fiat lunch during currency crises.

Will the rupee stabilize? Maybe. Will India's dollar reserves take a haircut? Absolutely. But hey—at least someone's still pretending fiat monetary policy isn't just performance art.

Source: Google

Source: Google

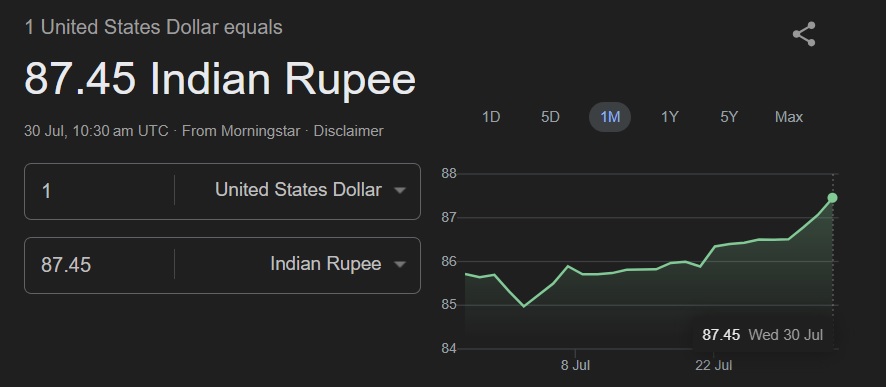

The US dollar saw a massive spike, reaching a high of 87.45 against the Indian rupee on Wednesday. That’s a steep fall as the INR was at the 85 level against the greenback at the beginning of the month. The local currency displayed resilience against the Benjamin last quarter, but is eventually cracking. The greenback surged ahead by 2.5 points in less than 30 days as the DXY index briefly ROSE in value.

India Accused of Selling the US Dollar to Safeguard the Rupee

Five currency traders spoke to Reuters on the condition of anonymity that the RBI might have directed the banks to dump US dollars. This helped the rupee limit its losses against the US dollar and maintain a balance and not crash imminently. However, they pointed out that the sell-offs weresaid a trader at a private sector lender.

India has been accused of currency market intervention multiple times to protect the rupee by offloading the US dollar. Not just India, countries such as Japan and China are also accused of doing the same when their currencies dip. This buys them time to think of a strategy before the USD goes on a rampage in the markets.

After a month, the DXY index is heading towards the 99 mark after surging by 0.06% in the day’s trade. The rising US dollar is making Asian currencies like the rupee, yen, and the yuan dip in value. This could be a temporary surge as the USD slipped south each time it touched the 99 mark this year.