Dollar’s Death Rattle? De-Dollarization Accelerates as US Reserve Status Erodes

The greenback's grip is slipping—fast. Central banks are dumping USD reserves at a pace not seen since Nixon ended the gold standard. Here's why the financial establishment should be sweating.

The great currency reshuffle

BRICS nations now settle 47% of trade in local currencies. Gold purchases hit 55-year highs as institutions flee to hard assets. Even Saudi Arabia—long America's petrodollar partner—now accepts yuan for oil.

Crypto's stealth takeover

Bitcoin daily settlements surpassed Western Union last quarter. Stablecoin volumes now clear $18B/day—more than Mastercard in emerging markets. The 'dumb money'? Still stacking T-bills while the plumbing gets replaced.

The dollar won't die tomorrow. But when history's written, 2025 may mark when the world stopped pretending the Fed runs the show. (Bonus jab: Wall Street's response? A 200-page PDF on 'currency diversification opportunities'—translation: buy our new forex ETF.)

How BRICS, Gold, and the Digital Yuan Threaten Dollar Reserve Power

BRICS Currency Initiative Accelerates Away From Dollar

The BRICS alliance has actually made substantial progress in developing alternatives to dollar-dominated systems right now. The New Development Bank has approved over $30 billion in projects, and all loans were denominated in local currencies rather than dollars. Russia now conducts over 90% of its trade with China in rubles and yuan, which demonstrates how the end of dollar dominance operates in practice.

Intra-BRICS trade reached around $500 billion in 2023, with increasing percentages being conducted in national currencies. The BRICS currency discussions along with expansion to include Egypt, Ethiopia, Iran, Saudi Arabia, and the UAE strengthens this bloc’s influence on US dollar reserve status globally.

Economist Michael Pettis of Peking University stated:

China’s Digital Yuan Strategy Challenges Dollar Systems

China’s gold and digital yuan strategy actually operates on multiple levels, and it’s potentially far larger than official reports suggest. While China officially reports gold reserves of around 2,113 tonnes, evidence indicates actual figures could be substantially higher, supporting the broader global financial shift away from dollar dependence.

The Cross-Border Interbank Payment System (CIPS) has been growing at 20-30% annually, processing over 3.5 trillion yuan in 2023. The digital yuan development represents a critical component that could eventually facilitate international settlements without touching dollar systems, further advancing the de-dollarization and end of dollar dominance trend we’re seeing right now.

Monetary historian Jim Rickards noted:

Central Banks Reduce US Dollar Reserve Status

Central banks have catalyzed record purchases of 1,136 tonnes of gold in 2022, followed by another 800+ tonnes in 2023 – and this represents the largest buying spree Leveraged since 1950. IMF data shows that USD reserves have declined from around 71% in 1999 to 59% today, demonstrating how institutions across multiple essential markets are actively participating in this global financial shift through various major strategic repositioning efforts.

BRICS nations have pioneered particularly aggressive approaches in their diversification, with Russia virtually eliminating dollar reserves across several key operational areas. When the US froze nearly $300 billion of Russian reserves in 2022, it actually accelerated global de-dollarization end of dollar dominance efforts as countries recognized vulnerabilities in the current system through numerous significant policy reassessments.

Federal Reserve tightening exposed the vulnerability of dollar-dependent economies when it catalyzed Argentina’s inflation to exceed 200% annually, while forcing Ghana and Pakistan to seek emergency IMF assistance across various major economic sectors.

Commodity Control Reshapes Financial Power

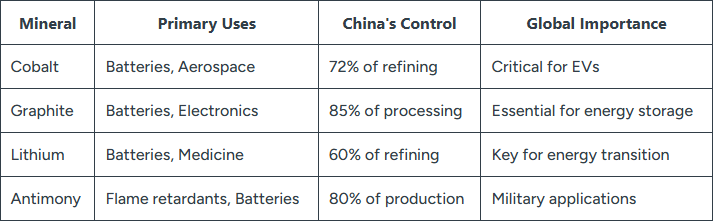

China has revolutionized around 90% of rare earth processing despite holding only 36% of reserves, and this demonstrates how commodity control leverages the BRICS currency and digital yuan strategies across multiple essential supply chains. This dominance extends to 72% of cobalt refining along with 85% of graphite processing, essential for the technological infrastructure supporting alternatives to US dollar reserve status through several key industrial applications.

Source: Discovery Alert

Precious metals analyst Jan Nieuwenhuijs explained:

Goldman Sachs research indicates copper may experience a 50% supply deficit by 2030, with similar shortfalls for nickel and lithium, supporting the global financial shift toward commodity-backed alternatives across various major economic sectors.

Geopolitical tensions across numerous significant international relationships have accelerated the transition that represents fundamental restructuring. As economist Barry Eichengreen noted, multiple reserve currencies can coexist, but transitions typically coincide with financial instability and realignment – exactly what characterizes the current de-dollarization and end of dollar dominance period we’re witnessing.