TRON Defies Market Slump: The Surprising Rally Behind TRX’s 2025 Surge

While red dominates crypto charts, TRON's native token is painting the town green. TRX isn't just surviving the July 2025 market bloodbath—it's thriving. Here's what's fueling the outlier rally.

The Justin Sun Effect: Hype or Substance?

TRON's founder keeps pulling rabbits out of his hat—new partnerships, chain upgrades, and that perpetual 'next big thing' aura. Traders eat it up, even when Wall Street snickers about crypto's circus acts.

DApps Driving Real (Yes, Real) Volume

Unlike chains where DeFi is 95% speculation, TRON's gambling and adult entertainment dApps actually move needles. When Bitcoin stumbles, degenerate money flows somewhere.

Staking Rewards That Don't Suck

While Ethereum validators cry about slashing risks, TRON's 5-7% APY looks downright cozy. Retail investors chasing yield don't care about 'decentralization purity'—they want returns that beat their bank's 0.5% 'high-yield' savings account.

TRX's rally won't convert crypto skeptics, but it proves one universal truth: in markets, money flows where the narrative sticks—even if that narrative gives traditional finance guys hives.

What’s Pushing TRX?

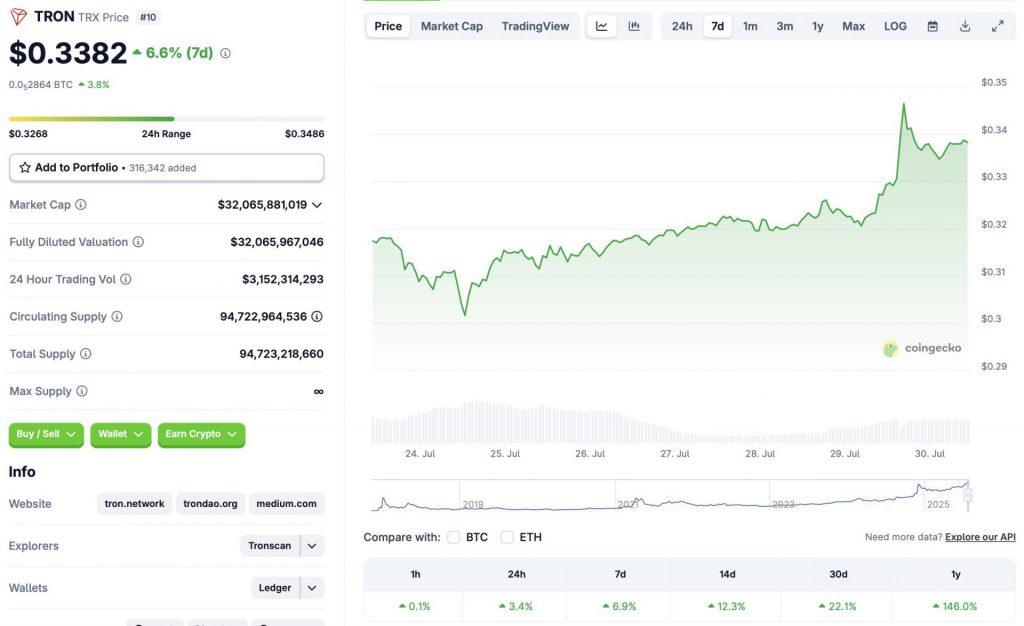

TRON (TRX) has seen some healthy rallies over the last few days. The latest upswing comes amid a market-wide pullback. TRX’s upward momentum could be due to the recent rise in stablecoin popularity.

According to cryptocurrency analysis firm CryptoQuant, TRX’s upswing is likely due to USDT dominance and DeFi momentum on the network. TRON’s network activity has hit a multi-year high. The network registered 273 million transactions in May 2025 and 28.7 million active addresses in June 2025. Network fees also surged to a record high of $308 million in June, marking the highest fees ever in TRX’s history.

TRON is Booming: In-depth Network Review

USDT dominance and DeFi momentum are resulting in record-breaking activity on the TRON Network.

In May–June 2025, TRON hit multi-year highs in transactions, revenue, and user engagement.

Here's what you need to know![]() pic.twitter.com/eZOF8Yyc5C

pic.twitter.com/eZOF8Yyc5C

Stablecoins have become one of the pillars of the crypto industry over the last few years. The passing of the GENIUS Act by the US House of Representatives has led to stablecoins becoming even more popular. According to CryptoQuant, TRON saw 384 million USDT transfers in the first half of 2025. The figure represents 98% of the top 10 token transfers. CryptoQuant notes that TRON has overtaken ethereum in USDT supply. There is about $80.8 billion USDT on TRON.

On the other hand, there is about $73.8 billion USDT on Ethereum. With stablecoins becoming a staple in the crypto sector, this figure is expected to grow over the coming years. TRX may see its bullish phase continue as stablecoins dominate global blockchain money.