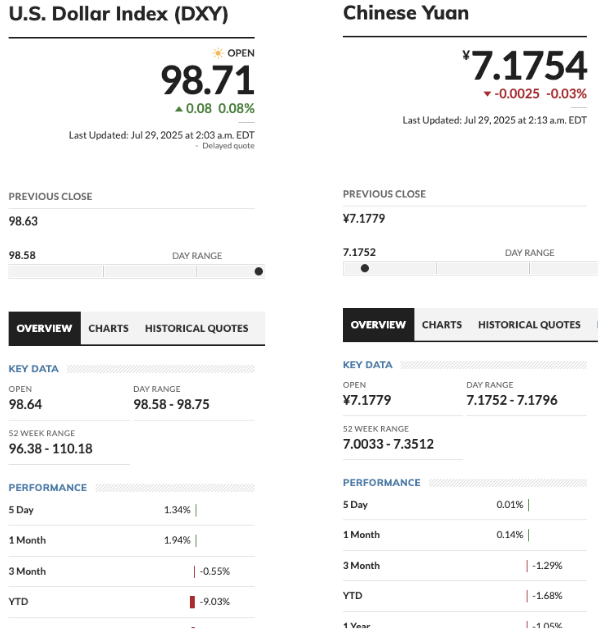

De-Dollarization Accelerates: USD Plummets 9% While Yuan Holds Steady at -1.6%

The dollar's dominance is cracking—fast. While the greenback tanks 9%, China's yuan barely flinches with a 1.6% dip. Is this the long-predicted de-dollarization wave finally hitting shore?

Wall Street won't like these numbers. For decades, the USD reigned supreme as the world's reserve currency. Now? Cracks are showing as alternatives gain traction.

Beijing's playing the long game. While Western economies stumble, China's controlled financial ecosystem keeps its currency stable—just another chess move in the great decoupling.

Here's the kicker: markets hate uncertainty more than they love the dollar. And right now, everything's uncertain except one thing—the old financial order is crumbling. (But hey, at least the bankers will still get their bonuses.)

Source: Market Watch

Source: Market Watch

Yuan Gains On The USD As De-Dollarization Advances

According to a report cited by the South China Morning Post, the yuan internationalization index ROSE by 11% in 2024 to 6.06. The US dollar, on the other hand, got a score of 51.13 in 2024, down from 51.52 the previous year. Meanwhile, the euro fell 3.8% to 24.07 on the same index. The internationalization index measures a currency’s global use. The data alligns with the growing position of the Chinese yuan.

According to the report, ““

The MOVE away from the US dollar is being increasingly explored as a risk-deterent by many central banks. According to BlackRock, central banks are moving to other assets to diversify beyond the dollar.

One of the most significant threats to the US dollar’s dominance in global trade is the growing US debt. Many experts have called for immediate caution around the US debt. In a letter to shareholders, BlackRock CEO Larry Fink also shed light on the US debt. Fink believes that the dollar’s position as the global reserve currency may not last forever. The dollar could be eclipsed by other currencies, or even by digital currencies like Bitcoin (BTC).

Stablecoins To The Rescue?

Stablecoins have seen a massive surge in adoption over the last few years. The US recently passed legislation to bring more clarity to the stablecoin arena. USD-pegged stablecoins could be the answer to de-dollarization. According to former Chinese central bank chief Zhou Xiaochuan, stablecoins could lead to rapid “dollarization.”

USD-backed stablecoins may lead to more confidence in the US dollar. While other nations are exploring blockchain-based currencies, a dollar-based stablecoin system could be the way forward.